Prepare Your Business for Storms - Important Information You Need to Know

9-minute read

Artists have painted them. Poets have written about them. Meteorologists have predicted them. Storms are fascinating forces of nature — and they can be a huge hassle.

Whether your business is faced with an impending hurricane or a major snowstorm, it’s important to be prepared for the worst. A significant weather event may force you to shut down your operations. And even a small storm can cause big problems such as flooding, fallen trees, or frozen pipes.

That’s why it’s best to stay one step ahead of the forecast. The measures you take today can help protect your business in the event of an unexpected or lingering storm.

No matter where you live, there’s a chance you’re in for stormy weather. So batten down the hatches. We have tips to help keep your business safe.

Tips for Protecting Your Business During Winter Weather

When the weather outside is frightful, it can lead to major disruptions for your business. Winter storms can produce any combination of heavy snowfall, ice, high winds, and freezing temperatures.

Blizzards can create dangerous conditions for your workplace and even force you to close. From power outages to icy walkways, the effects of winter weather can linger for days — leaving your business exposed to risk, long after the storm has passed.

Preparedness is a key to managing the impact of a winter storm. As a small business owner, you’re responsible for protecting your business and ensuring that your employees are safe.

Whether you run your business from an office, a storefront, or your home, there are ways you can prepare for severe winter weather.

1. Watch the forecast.

While it’s true that some storms fall short of their predicted intensity, many will amp up in the days and hours before the event. You never know when a forecast may quickly change from a few flurries to a bombogenesis snowstorm.

That’s why you should stay abreast of your local weather forecast. Download a weather app and sign up for local weather alerts. Pay attention to the Wireless Emergency Alerts (WEA) that are sent to your smartphone.

The National Weather Service issues weather alerts based on three-tiered levels:

- Winter Weather Warning: Take action!

A winter storm will likely impact your area. Be prepared for heavy snow or ice, strong winds, and freezing temperatures that will make travel and outdoor exposure dangerous.

- Winter Weather Watch: Be prepared!

Conditions are favorable for a winter storm, and there is the potential for severe winter weather. If a winter storm hits, be prepared for heavy snow or ice, strong winds, and freezing temperatures that may make travel and outdoor exposure dangerous.

- Winter Weather Advisory: Be aware!

Winter weather conditions should be expected but not severe enough to meet warning levels. Exercise caution when traveling and avoid prolonged exposure to the outdoors.

Helpful tip: Check out the National Weather Service’s Winter Weather pages to learn more about winter weather safety.

2. Inspect your location.

Assess your business property to determine if any areas need your attention. It’s best to do this in the fall, so you have time to address issues before winter.

Pay attention to common problem areas or issues, such as:

- Trees

Fallen tree limbs can damage roofs, cars, and windows. Check the trees around your property and consider removing any branches that could break off from heavy snow or high winds.

- Doors and Windows

Winterizing can be as simple as caulking and weather-stripping your doors and windows to keep them insulated.

- Roof

Contact a professional to have your roof inspected before storm season approaches. This will give you time to make repairs before the first snowfall.

- Water Pipes

Subzero temperatures can cause a pipe to burst, leading to flooding and water damage. When the temperatures plummet, you should know how to prevent your pipes from bursting.

Helpful tip: Check your battery-powered smoke and carbon monoxide detectors to make sure they’re working so they will operate properly if the power goes out.

3. Gather tools and supplies.

When a storm hits, you don’t want to be running around trying to find an ice chipper. Gather — or purchase — the supplies you’ll likely need and store them in a place that’s easily accessible.

The most useful tools for winter weather are typically:

- Snow shovel, ice chipper, and a roof rake

- Snow brushes and window scrapers

- Road salt and ice melt

- Flashlights and batteries

- Jumper cables

- An electric generator

- Blankets

- Food and water

Helpful tip: Consolidate important contact information into one document, including your snowplow company, local fire department, police department, insurance agent, heating contractor, plumber, and electrician. Keep the list with your emergency tools.

4. Have a winter weather plan.

Snow days are thrilling for kids, but they can be stressful for your employees. As a business owner, it’s a good idea to have a plan for how the business will operate during a storm.

If you don’t already offer a remote work option to your employees, you should strongly consider it during the winter season. Snowy commutes can be treacherous, and you don’t want your employees to get stranded at the office. Plus, commuting in poor conditions takes twice as long (sometimes longer), which means your employees could lose valuable work time navigating the roads.

Take stock of what resources your employees will need to work from home. With some preparation, you can set them up for success, and your business will continue to be productive. Putting a weather safety plan in motion also shows your employees that you care about their well-being.

And don’t forget to notify your customers of any changes. If your operating hours change or your business is closed, send an email and post a message to your social media channels.

Helpful tip: If you close your business due to weather, think of creative ways to continue serving and supporting your customers.

5. Check your insurance.

Some insurance policies may cover damage from snowstorms and cold fronts. You should call your insurance provider or check your policy to see if it protects against winter hazards.

If it does, have your insurance policy number and claim number readily available. If you don’t have snowstorm coverage, you may want to consider adding it to your policy.

While you’re at it, check if you have business interruption coverage. A major storm could have enough impact to shut down your office for a few days or weeks — maybe longer. Even if your business is closed for just a few days, it can take a toll on your finances — and that’s where business interruption coverage can help.

How to Prepare for Hurricanes and Other Major Storms

As a business owner, there’s nothing worse than dealing with something that’s entirely out of your control. Enter Mother Nature.

Hurricanes, tornadoes, and floods. Oh my. You never want to hear that one of these natural disasters is heading your way.

You also may wonder how they differ from one another.

A tropical cyclone becomes classified as a hurricane when it reaches maximum sustained winds of 74 miles per hour or higher. The Saffir-Simpson Hurricane Wind Scale rates a hurricane's severity from 1 to 5, based on wind speed.

A tornado is a mobile, destructive vortex of violently rotating winds having the appearance of a funnel-shaped cloud and advancing beneath a large storm system.

These storms are dangerous events that often cause massive destruction. There’s no way to stop a hurricane or tornado, but you can prepare your small business by arming yourself with information.

Follow these tips to help keep your employees, facility, and business assets safe:

1. Create a disaster preparedness plan.

Storms are a serious threat to your small business, so be proactive and prepared. With a comprehensive plan in place, your employees will know what to do if a natural disaster strikes.

- Train employees on safety-related procedures, building evacuation, general disaster preparedness, and first-aid.

- When your business is in the path of a hurricane, tornado, or flood, consider declaring emergency status sooner rather than later so your employees stay safe.

- Provide details on who your employees should contact for information during and after the storm.

- Maintain an updated emergency contact list, including the local authorities (fire department and police department), FEMA, insurance providers, local hospitals, and emergency shelters.

- Communicate particulars regarding essential employees and remote-work options. Be flexible with your policies, and let your employees know that their safety is your top priority.

2. Safeguard your property and possessions.

Hurricanes and tornadoes are known for exceptionally high winds, heavy rainfall, and storm surges, which can cause devastating damage.

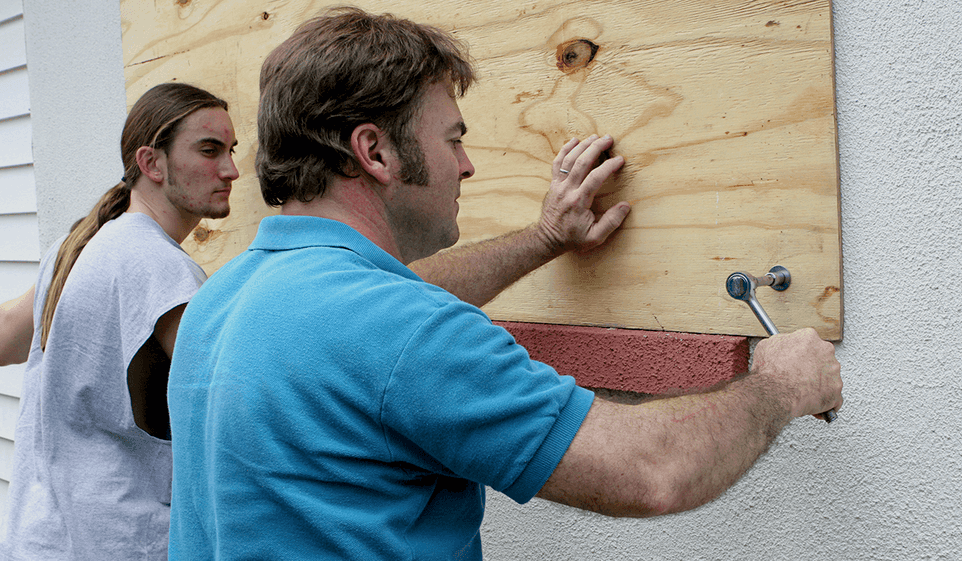

- Storm-prepping could protect your property from the dangers presented by tropical storms, tornadoes, and derechos. Board windows and doors with plywood, and consider investing in storm shutters.

- Consider removing branches or trees that could fall on your building or be blown toward your windows during high winds.

- Use sandbags in areas that are prone to flooding.

- Relocate valuable items to a second level if possible. Or move them off the floor to protect them from water damage.

3. Have an emergency supply kit.

An emergency kit ensures you have what you need to care for your employees in a disaster. Here are some essential items you’d like to have in your kit:

- A minimum three-day supply of bottled water for each employee.

- A minimum three-day supply of nonperishable food that doesn’t require cooking.

- A workplace first-aid kit. You also may suggest that every employee keep a few days' worth of prescription medications on hand.

- Sanitation and hygiene supplies such as hand soap, paper towels, toilet paper, disinfectants, antibacterial wipes, gloves, and face masks.

- Emergency supplies such as fire extinguishers, flashlights, batteries, whistles, portable chargers, and thermal blankets.

- Basic tools such as Swiss Army Knives, wrenches, pliers, hammers, screwdrivers, and duct tape.

- Your emergency contacts list, spare keys, and spare cash.

4. Protect your business-critical documents.

When preparing for the worst, consider having a plan for safeguarding important documents, files, and other information that your business will need to move forward in the wake of a disaster. This plan could include:

- Maintaining copies of important company documents such as bank statements, tax returns, insurance policies, and documents related to employees, suppliers, and customers. Store your onsite records in a water-tight container, and keep your extra copies off-site.

- Asking employees to back up their digital files to an external hard drive so they are easily accessible in the event people are still working remotely. Keep the hard drives somewhere safe so they won’t be damaged from the storm.

- Using a cloud system to back up all your data. You never know when a storm may knock out your power, and data loss could have significant financial implications. Ninety-three percent of companies without disaster recovery who suffer a major data disaster are out of business within one year.

5. Have a business continuity plan.

A severe weather emergency can be incredibly stressful for a small business owner. But you don’t have to ride out the storm alone. Ready.gov/Business is a government-run program that helps businesses navigate various hazards, including natural disasters.

Their toolkits offer business owners a step-by-step preparedness guide that includes information on developing a business continuity plan. If a weather event suddenly disrupts your small business, it can lead to lost revenue, unforeseen expenses, and employee absences. You need a continuity plan to ensure that your business can recover quickly.

Make Sure You Have the Right Insurance Coverage

You’ve heard about the calm before the storm. But what happens when it’s over?

Major weather events can quickly send a small business owner into crisis mode. Significant damage from a storm can disrupt your operations and create safety risks. But the right business insurance can help your small business recover.

There are three types of coverage you may want to consider: general liability insurance, business personal property insurance, and inland marine insurance.

General liability insurance provides coverage against costs associated with certain third-party accidents, third-party property damage, and bodily injury (up to your policy limit).

Let’s say one of your customers slips and falls on your icy steps. With general liability insurance, you could be covered for their medical expenses and other types of claims, up to the limits of your policy.

Here are some examples of GL coverage:

- Third-party bodily injury to another person

- Third-party property damage

- Personal and advertising injury

- Medical expenses

- And more

At Simply Business, we can find GL coverage from leading insurers, and it usually takes just under 10 minutes. Give us a call at 844-654-7272, Monday through Friday, 8 a.m. to 8 p.m. (ET).

Get Insured in Under 10 Minutes

Get an affordable & customized policy in just minutes. So you can get back to what matters: Your business.

Start Here>During a storm, anything can happen. Furniture, equipment, tools, fixtures, or inventory can be damaged, leaving you with unexpected replacement costs. With business personal property or inland marine insurance, you may be covered, up to the limits of your policy.

A business personal property policy can cover financial claims involving:

- Theft of business property

- Damage to the business property

- Loss of business property

- And more

Inland marine coverage can help financially protect the tools and equipment you use while in transport or on a job site. This may include damage that occurs during a storm.

Inland marine insurance typically covers:

- Damage to business property

- Theft of business property

- And more

At Simply Business, you can see what business insurance could look like for your small business. Use our free quote comparison tool to explore policies.

Still unsure about the insurance you need? Our licensed insurance agents are available to answer questions. Just call 844-654-7272, Monday through Friday, 8 a.m. to 8 p.m.

Weathering the Storm

It takes only one storm to uproot your small business. Extreme weather can cause property damage, power outages, safety hazards, and other disruptions that can last for days, if not weeks. That’s why storm preparedness is so important.

As a small business owner, it’s your responsibility to keep your employees and customers safe and informed during a severe weather event. When you’re prepared, you’re viewed as credible, caring, and professional. And your small business is able to weather any storm.

Written by

Susan Hamilton

I've always loved to write and have been lucky enough to make a career out of it. After many years in the corporate advertising world, I'm now a freelance writer—running my own show and contributing to Simply Business. Fun fact: I have three desks in my house, but I still do my best thinking walking in the woods.

Susan writes on a number of topics such as workplace safety, customer sales, and workers' compensation insurance.

This content is for general, informational purposes only and is not intended to provide legal, tax, accounting, or financial advice. Please obtain expert advice from industry specific professionals who may better understand your business’s needs. Read our full disclaimer

INSURANCE

Business InsuranceGeneral Liability InsuranceWorkers Compensation InsuranceProfessional Liability InsuranceErrors & Omissions InsuranceSole Proprietors Workers CompensationCyber InsuranceSelf-Employed InsuranceBUSINESSES

Contractors InsuranceCleaners InsuranceE-commerce InsuranceHandyman InsuranceHome Improvement Contractor InsuranceLandscaping InsuranceLawn Care InsurancePhotographers InsuranceABOUT

About usContact UsCareersSite MapInsurance ProvidersSIMPLY U

General BusinessProtect Your BusinessStart Your BusinessADDRESS

Simply Business1 Beacon Street, 15th FloorBoston, MA02108

LEGAL

Terms & ConditionsPrivacy PolicyPrivacy Notice for CA ResidentsResponsible Disclosure PolicyDo Not Sell or Share My Personal Information (CA Residents)*Harborway Insurance policies are underwritten by Spinnaker Insurance Company and reinsured by Munich Re, an A+ (Superior) rated insurance carrier by AM Best. Harborway Insurance is a brand name of Harborway Insurance Agency, LLC, a licensed insurance producer in all 50 states and the District of Columbia. California license #6004217.

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business, LLC is a licensed insurance producer in all U.S. States and the District of Columbia. Simply Business has its registered office at Simply Business, 1 Beacon Street, 15th Floor, Boston, MA, 02108. In California, we operate under the name Simply Business Insurance Agency, LLC, License #0M20593. In Colorado, we operate under the name Simply Business, LLC DBA Simply Business Insurance Agency. In New York, we operate under the name Simply Business Insurance Agency. In Pennsylvania, we operate under the name Simply Business Insurance Agency, LLC. In Texas, we operate under the name, U.S. Simply Business, LLC. For more information, please refer to our Privacy Policy and Terms & Conditions.