Want to start your own construction or contracting business in Florida, but not sure how to get your contractor’s license?

You’re not alone. The process of getting a contractor’s license in the Sunshine State can be particularly complicated, as it takes a different approach from other states (you’ll see why in a bit).

Plus, finding the information you need on various government sites can take up time you might not have, especially if you’re already working smaller contracting jobs.

That’s why I did the research for you! Check out my step-by-step guide on everything you need to do to get your contractor’s license in Florida.

How to Get a Contractor License in Florida: 5 Requirements

There's a lot of information to sift through before getting your contractors license in Florida. We'll review topics like what is required to get your contractor's license in Florida, why business insurance is important to the process, how to apply for your contractors licensing exam, and more.

Do You Need a General Contractor License in Florida?

If you want to run a contractor business in Florida, the state requires you to have a contractors license. This license is granted by the Florida Department of Business and Regulation.

We'll go more in depth on the process of getting your contractors license in Florida works further on.

What is Required to Get a Contractors License in Florida?

Unfortunately, getting your contractors license in Florida isn't as simple as taking a test and paying a fee. There are a lot of steps to take before you're ready to call yourself a licensed Florida contractor.

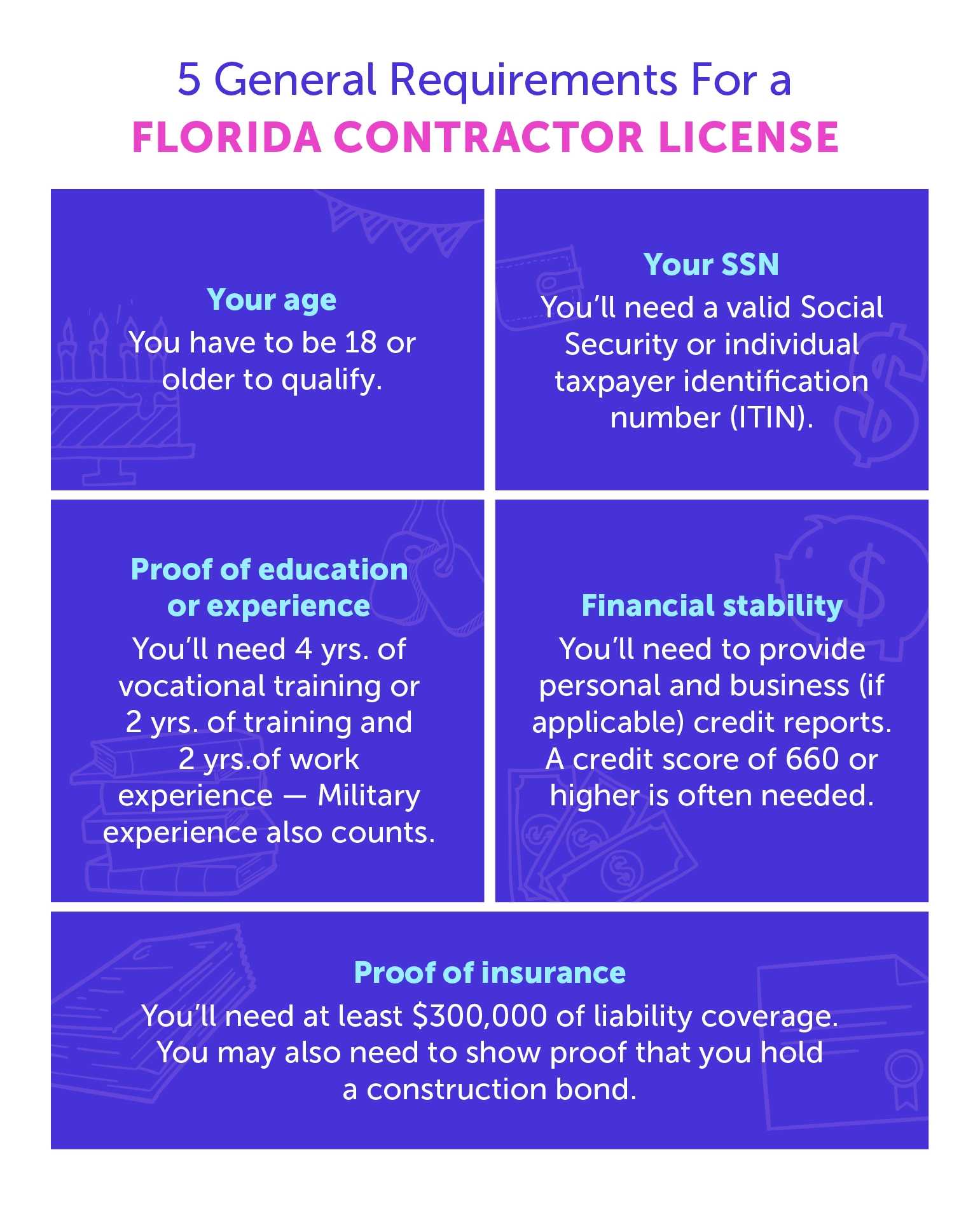

Check off these five general requirements.

In order to qualify for a certified contractor’s license in Florida, there are a few basics you need to check off, like:

1. Your age.

You have to be 18 or older to qualify.

2. Your SNN.

You’ll need a valid Social Security number or individual taxpayer identification (ITIN).

3. Proof of education/experience.

You should be able to show that you’ve completed four years of education in a vocational school, training program, or have completed work experience. If you only have two years of vocational training but two or more years of work experience, that still meets this requirement.

Good news for veterans: Military experience also counts towards this requirement, so if you’re a veteran, download Florida’s Military Fee Waiver and Military Service Verification form. Based on your experience, your application may be expedited.

And yes, you read that right - as a veteran, you won’t have to pay a fee to get your Florida contractor’s license!

4. Demonstrate financial stability.

When applying for your license, you’ll be asked to submit personal credit reports, as well as a credit report for your business (if applicable). In general, a credit score of 660 or higher is needed to show your business is financially stable. If your credit score is lower, you may need a surety bond.

The Contractor’s Licensing Board only accepts certain credit reports, so check out this list of approved vendors who can provide you with what you need.

Learn more about your business's credit score here.

5. Proof of insurance coverage

To get your Florida contractor’s license, you’ll need to provide proof of insurance (including workers compensation insurance in Florida, if you have employees).

By law, Florida contractors must have at least $300,000 of liability coverage. You may also need to show proof that you hold a construction bond.

Get Business Insurance for Your Contractor Business

Business insurance may seem like a small detail in your journey to get a contractor's license in Florida. But in reality, it's a big decision. That's because it can determine how much financial protection your business has in the event of certain occurrences, like if property gets damaged or someone gets injured.

Below are three steps you can take to make sure you choose the insurance coverage in Florida for your contractor business.

1. Know your risks.

Understand all of the potential risks you face when working. You may want to talk to a seasoned contractor to learn about what they've experienced in their career. Take time to list them out, even if they may seem unlikely.

Knowing about which risks your business faces can help prepare you to get the right coverage.

2. Understand your financial situation.

Your insurance premium will likely be paid on a monthly or annual basis. Estimate how much money you expect to spend and earn before deciding which payment schedule works best for you.

3. Compare your options.

You compare the options of produce at the grocery store, so why wouldn't you compare business insurance options?

With Simply Business, we help make it easy to compare your options. It's a fast, easy, and affordable process.

Use our free quote comparison tool here. Then choose the best contractor insurance coverage for you.

Applying for a FL Contractor’s License?

You may need to show proof of business insurance to get your license.

That’s where we come in. Compare insurance quotes.

Start Here >Know if you need additional contractor’s licenses.

Florida offers multiple types of contractor’s licenses, some of which may impact how many exams you need to take (more on this in a bit). While this article is geared towards the general certified contractor’s license, Florida offers separate requirements for:

- HVAC technicians

- Swimming pool technicians

- Plumbing

- Roofing

- Sheet metal

- And more

Depending on your specialty areas, you may need to apply for more than one license. For example, if you’re a contractor who wants to work on roofing projects, you’ll need to apply for both the general certified contractor license (which we’re exploring here) and the contractor’s license for roofers.

You can find the entire list of special licenses here.

Apply to take your Florida contractor license exam.

So here’s the deal: You actually can’t apply for your contractor’s license until you take the Florida Exam for Contractors.

Don’t worry, it shouldn’t be difficult to take; it’s just designed to test your knowledge of basic safety, business finances, building, and other related topics. The exam is typically held every other month for one week and in various cities.

You can check out the upcoming schedule for the Florida exam here.

In order to register for an exam, you can apply by phone at (407) 264-0562 or online by clicking here. You’ll need to pay two fees to take this exam: the $135 registration fee (payable to Professional Testing) and the $80 exam site administration fee (payable to the Florida Department of Business and Professional Regulation).

If you choose to apply for the exam online, you can pay these fees all at once.

Submit your application, along with these three things.

Once you’ve taken and passed the Florida license exam for contractors, you’ll be able to finish applying for your license. Here’s a checklist of everything you’ll need to submit with your contractor’s license application, which you can download here:

1. Licensing fees

If you passed your exam before August 31st, 2019, your license fee is $249; if you passed the exam and submit your license application after August 31st, 2019, the prorated fee is $149.

2. Electronic fingerprints

Florida has a list of vendors that you can use to provide fingerprint records to the licensing board. Click here to learn more about the fingerprinting process to get your Florida contractor’s license.

3. Your credit report

This refers back to your general requirements to get a contractor’s license, as you need to demonstrate you’re financially stable. If your credit score is under 660, the state of Florida requires that you submit a bond with your application.

After you’ve collected your information, documentation, and fees, you can submit your completed application to:

Department of Business and Professional Regulation 2601 Blair Stone Road Tallahassee, FL 32399-0783

How Long Does It Take to Get A General Contractor License in Florida?

Once your application is submitted, the Florida state licensing board needs to review it. The board reviews applications in the order they are received. In general you can expect to know your application status within 30-45 business days.

How Do I Get a General Contractor License in Florida with No Experience?

You know what it takes to get your contractor's license in Florida, but know that you don't have enough experience. What now?

Fortunately, there are ways for you to move forward with your contracting career even if you don't have four years of contract experience under your belt.

1. Get a grandfathered contractor's license.

This method is common for contractors who tend to inherit the license of a contractor within their family or someone close to them. When retiring, one contractor may pass their license on to another. However, this doesn't excuse the new contractor from taking the licensing exam.

If you're interested in a grandfathered contractors license from a different state than the one you work in, contact The Office of Business and Professional Regulation.

2. Work with a Responsible Managing Officer (RMO).

You may be ready to run your own business, but you can't get very far without a license. Instead, you have the option of working with what's called a responsible managing officer (RMO) or a responsible managing employee (RME).

In this case, the responsible contractor or employee assumes responsibility with the board for any legal qualifiers under the license. If you hire an RME or RMO, then that contractor is considered an employee of your business until the project is completed. Keep in mind that this applies to jobs that pay over $500.

3. Get a waiver from the licensing board.

Depending on the specific situation, you may be able to get a waiver from your state licensing board. Waiver criteria differs from state to state and by project specifics. Talk to your local licensing board to learn more.

4. Continue to gain experience.

While it may not be the most attractive option, you can continue to gain experience through work. Maybe this means working in a professional apprenticeship or maybe it means working with a licensed and established contractor.

Having more time could also give you the chance to start building your brand and marketing materials, which can help you attract new customers once you're licensed.

Either way, you'll have the chance to learn more and gain experience while you prepare to take your licensing exam.

Remember to Renew Your General Contractor License in Florida

You'll need to renew your general contractor license Florida every two years.

During those two years, be sure to complete 14 hours of continuing education credits. The continuing education is required to cover topics such as workplace safety, workers compensation, business practices, and more.

The renewal of your license costs $209 and typically an additional $50 per business.

Remember all of the work that goes into getting your contractor license in Florida in the first place. It's important to keep track of your renewal schedule so that your license stays current. That way there won't be any conflicts that keep you from getting work.

Good Luck with Your Application!

I hope this information helps you; good luck getting your contractor’s license! Don't forget that you may need a Florida business license as well, so read our helpful guide today.

Once licensed, don't forget to run a contractors insurance quote to ensure you're covered.

Written by

Mariah Bliss

I love writing about the small business experience because I happen to be a small business owner - I've had a freelance copywriting business for over 10 years. In addition to that, I also head up the content strategy here at Simply Business. Reach out if you have a great idea for an article or just want to say hi!

Mariah writes on a number of topics such as small business planning, contractor insurance, and business licenses.

This content is for general, informational purposes only and is not intended to provide legal, tax, accounting, or financial advice. Please obtain expert advice from industry specific professionals who may better understand your business’s needs. Read our full disclaimer

INSURANCE

Business InsuranceGeneral Liability InsuranceWorkers Compensation InsuranceProfessional Liability InsuranceErrors & Omissions InsuranceSole Proprietors Workers CompensationCyber InsuranceSelf-Employed InsuranceBUSINESSES

Contractors InsuranceCleaners InsuranceE-commerce InsuranceHandyman InsuranceHome Improvement Contractor InsuranceLandscaping InsuranceLawn Care InsurancePhotographers InsuranceABOUT

About usContact UsCareersSite MapInsurance ProvidersSIMPLY U

General BusinessProtect Your BusinessStart Your BusinessADDRESS

Simply Business1 Beacon Street, 15th FloorBoston, MA02108

LEGAL

Terms & ConditionsPrivacy PolicyPrivacy Notice for CA ResidentsResponsible Disclosure PolicyDo Not Sell or Share My Personal Information (CA Residents)*Harborway Insurance policies are underwritten by Spinnaker Insurance Company and reinsured by Munich Re, an A+ (Superior) rated insurance carrier by AM Best. Harborway Insurance is a brand name of Harborway Insurance Agency, LLC, a licensed insurance producer in all 50 states and the District of Columbia. California license #6004217.

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business, LLC is a licensed insurance producer in all U.S. States and the District of Columbia. Simply Business has its registered office at Simply Business, 1 Beacon Street, 15th Floor, Boston, MA, 02108. In California, we operate under the name Simply Business Insurance Agency, LLC, License #0M20593. In Colorado, we operate under the name Simply Business, LLC DBA Simply Business Insurance Agency. In New York, we operate under the name Simply Business Insurance Agency. In Pennsylvania, we operate under the name Simply Business Insurance Agency, LLC. In Texas, we operate under the name, U.S. Simply Business, LLC. For more information, please refer to our Privacy Policy and Terms & Conditions.