What to know about workers’ compensation insurance for small business owners

5-minute read

Main Image: Jacob Lund // Shutterstock

Small business owners play a vital role in the U.S. economy. As of 2019, small businesses generated about 44% of the U.S. economic activity—employing nearly every type of worker in every type of industry, from construction and restaurants to insurance, marketing, and media.

But while small businesses are a lifeline for the economy, owning a small business can come at a high cost. From the initial investment to the ongoing costs, there can be big bills to cover as a small business owner—and one of those hefty bills can be for workers’ compensation insurance.

Workers’ compensation insurance can help cover employee costs for injuries that occur while on the job—and also helps protect the employer from being sued by the employee if they receive compensation from this type of coverage.

The requirement to carry this type of coverage first started in the U.S. in 1911 in the state of Wisconsin with the Wisconsin Workmen’s Compensation Act. Prior to the passage of this act, injured workers were forced to prove the injury occurred because their employer was negligent, placing the burden on the employee to defend.

But the Workmen’s Compensation Act created a “no-fault” system that did not require injured workers to prove that an employer was negligent in order to receive benefits.

Wisconsin was just the first state to employ such a system, and shortly after the state created its workers’ compensation program, nine other states followed suit. By 1937, workers’ compensation programs were a requirement in every state nationwide—and that remains true even today.

While there are certain exclusions, workers’ compensation coverage is generally required of nearly every type of business in every state across the country.

Healthy employees are important to a productive business, and both workers and employers have benefited greatly from these programs over the last century.

These programs aren’t always cut and dry, though. In fact, they can be confusing, as the requirements and exclusions vary from state to state and region to region.

Simply Business compiled a list of eight tips for small business owners thinking about workers’ compensation. Keep reading to learn just how these programs can work and what small businesses need to know about them.

Every state has different requirements, fines, and exemptions

The workers’ compensation requirements your small business must meet will depend highly on the state in which your business is located. Not only do the requirements tend to vary by state, but they can also differ based on the industry you’re in or the size and structure of your business.

For example, Alabama businesses with five or more employees are required to carry workers’ compensation coverage—and in many cases, officers or members are also counted as employees.

Alaska, on the other hand, requires that most businesses with one or more employees have workers’ compensation insurance—but there are certain exceptions made for sole proprietors, partners, members of non-managed LLCs, part-time babysitters, and other types of businesses.

Businesses in Kansas, however, aren’t bound by a certain number of employees, but by their gross payroll. Any Kansas business with employees and a gross payroll over $20,000 is required to carry workers��’ compensation insurance, though there are some exceptions.

It’s important to know what the rules and requirements are for businesses in your state or you could face fines, lawsuits, and even criminal charges for not adhering to a state’s workers’ compensation laws.

Where to buy coverage depends on your state

Workers’ compensation coverage is required by most states, and each state generally handles the workers’ compensation system differently. That includes where you can buy your coverage.

Nearly every state allows businesses to purchase private workers’ compensation insurance policies from private carriers. In some states and jurisdictions, coverage may be offered by a state fund, which means businesses can buy coverage directly from the state or a private insurance carrier.

And there are a handful of states—North Dakota, Ohio, Washington, and Wyoming—that require businesses to purchase workers’ compensation coverage from the state fund.

What that means is businesses in these states can’t purchase coverage from private insurance carriers. As such, where your business is located will directly impact the type of coverage you can buy.

Employees with a higher risk of injury are more expensive to insure

As with other types of insurance coverage, it generally costs more to buy workers’ compensation coverage for employees who are deemed “high risk” due to certain factors.

Each group of employees is given a class code, and that code is then used by insurance companies to estimate the risk level of the work the employees are performing. In turn, that risk level will determine the rates you as a small business owner will pay for coverage.

For example, construction workers using heavy machinery would likely be deemed riskier than a call center employee or receptionist due to the nature of the work. As such, their class code would indicate a higher level of risk to insurers, who would adjust rates accordingly.

Independent contractors may not count

Workers’ compensation is almost always required for your employees, but that may not be true of the independent contractors you hire for your projects.

In many cases, state law doesn’t necessarily require independent contractors to be covered under your workers’ comp insurance policies, as they’re technically someone else’s employees.

That said, it’s important to differentiate between who you’re required to cover and who you’re not. In particular, you need to know what qualifies someone as a 1099 independent contractor.

This specific classification means that a worker is not considered an employee under the state workers’ comp laws.

The criteria to consider someone an independent contractor can vary based on the state in which your business is located, so it’s important to know what the parameters are for independent contractors in your state to avoid misclassification.

Misclassification of employees is widespread—but illegal

When a business misclassifies an independent contractor, it classifies a worker who should be considered a direct employee of the business as a self-employed independent worker who receives a 1099 form for tax purposes rather than a W-2 form.

This misclassification is often done to avoid carrying costly workers’ compensation insurance on the employee, and it’s surprisingly common. According to numerous studies, between 10-20% of employers misclassify at least one worker as an independent contractor.

While it can be tempting to misclassify an employee as an independent contractor to avoid paying for workers’ comp insurance, it’s not wise—and it can result in serious penalties if you’re caught.

It also hurts employees, depriving them of benefits they are often entitled to, like health care, overtime, and workers’ compensation benefits if they’re injured on the job.

Fraud can be perpetrated by employees, employers, or health care providers

Workers’ compensation fraud can be committed by a few different groups. For starters, some employers have committed workers’ compensation fraud to cut down on the costs of their coverage premiums or to deny otherwise legitimate claims.

This is typically done by lying about or purposely omitting facts about their business, their revenue, their employees, or the individual claims themselves. And not just employers do this.

Employees may commit workers’ compensation fraud by faking or exaggerating injuries that they received on the job in order to obtain financial benefit from their employer’s policies.

Health care workers may also commit workers’ compensation fraud by invoicing for care that wasn’t necessary or wasn’t conducted, which lets them receive a financial payoff from the coverage in place.

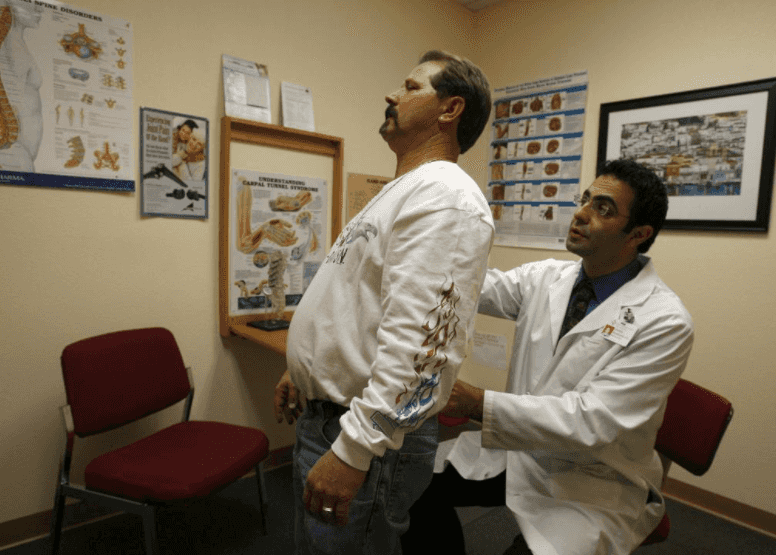

Certain workplace injuries aren’t covered

While workers’ compensation insurance is meant to protect employees from footing the bill for injuries that occur at work.

That said, not all injuries are covered by workers’ compensation coverage—even if they occurred while on the job. For example, if a waiter or a kitchen staff member slips on a wet floor and hurts their back, the employee would likely be entitled to benefits under the restaurant’s workers’ compensation policy.

On the other hand, if the waiter or kitchen staff was intoxicated at work and sustained injuries by a fall because of that, the workers’ compensation benefits would likely not apply.

Other types of injuries, including self-inflicted injuries, injuries that occurred while committing a crime, or injuries that happened when violating company policy, are also not typically covered.

Written by

Angelica Leicht

This content is for general, informational purposes only and is not intended to provide legal, tax, accounting, or financial advice. Please obtain expert advice from industry specific professionals who may better understand your business’s needs. Read our full disclaimer

INSURANCE

Business InsuranceGeneral Liability InsuranceWorkers Compensation InsuranceProfessional Liability InsuranceErrors & Omissions InsuranceSole Proprietors Workers CompensationCyber InsuranceSelf-Employed InsuranceBUSINESSES

Contractors InsuranceCleaners InsuranceE-commerce InsuranceHandyman InsuranceHome Improvement Contractor InsuranceLandscaping InsuranceLawn Care InsurancePhotographers InsuranceABOUT

About usContact UsCareersSite MapInsurance ProvidersSIMPLY U

General BusinessProtect Your BusinessStart Your BusinessADDRESS

Simply Business1 Beacon Street, 15th FloorBoston, MA02108

LEGAL

Terms & ConditionsPrivacy PolicyPrivacy Notice for CA ResidentsResponsible Disclosure PolicyDo Not Sell or Share My Personal Information (CA Residents)*Harborway Insurance policies are underwritten by Spinnaker Insurance Company and reinsured by Munich Re, an A+ (Superior) rated insurance carrier by AM Best. Harborway Insurance is a brand name of Harborway Insurance Agency, LLC, a licensed insurance producer in all 50 states and the District of Columbia. California license #6004217.

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business, LLC is a licensed insurance producer in all U.S. States and the District of Columbia. Simply Business has its registered office at Simply Business, 1 Beacon Street, 15th Floor, Boston, MA, 02108. In California, we operate under the name Simply Business Insurance Agency, LLC, License #0M20593. In Colorado, we operate under the name Simply Business, LLC DBA Simply Business Insurance Agency. In New York, we operate under the name Simply Business Insurance Agency. In Pennsylvania, we operate under the name Simply Business Insurance Agency, LLC. In Texas, we operate under the name, U.S. Simply Business, LLC. For more information, please refer to our Privacy Policy and Terms & Conditions.