Can I Get a Business License Without General Liability Insurance?

Small Business information you can trust.

Updated June 2025 by Ed Grasso

Insuring 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

Can You Get a Business License Without Insurance?

When it comes to business licenses, requirements can vary by state. The good news is that you don’t need a business license to get general liability insurance. In fact, it’s a coverage we recommend for nearly every type of small business, as it can help financially protect your business from a number of risks.

Why You Should Consider General Liability Insurance

General liability (GL) can help cover the costs of claims, third-party medical bills, legal expenses, and more, which can run into tens of thousands of dollars.

This business insurance can also typically help cover your employee or employees if they cause damage. Here is an overview:

Third-party

property damage

General liability policies can help cover expenses if you or your employes accidentally break, damage, or destroy a client’s personal property.

Third-party injuries

If a customer is injured at your office or worksite, a general liability insurance policy can help cover their medical expenses.

Advertising injury

A GL policy can help cover claims and legal expenses if you’re sued as a result of your business’s advertising, marketing, or social media activities.

Faulty products

If you sell a faulty product that causes bodily harm or damage to a customer’s property, a general liability can help cover claims and legal costs.

Legal costs

A lawsuit can be costly, even if you successfully defend yourself. The legal expenses alone can add up to thousands, plus any damages you may owe.

Securing leases

and contracts

Some landlords may require you to have a GL policy to rent or lease space for your business. Certain types of work also may require proof of insurance to bid or work on projects.

We are fully dedicated to small businesses.

When Do You Need a Business License?

A business license is a permit issued by a local, state, or other government agency that allows a business to legally operate. It’s a way for the government to regulate and ensure a trustworthy business environment within a specific jurisdiction.

In some cases, you might not need a business license if you’re just working for yourself and using your own name. And while most states don’t make independent contractors or gig workers get a business license, it’s still best to check with your local government to make certain you’resure you’re following all the rules.

Even if your state doesn’t require you to have a business license, your city or county may. It’s always a good idea to check with your local government to be sure. Sometimes, to get a business license, you may also may need to have certain types of insurance.

Other types of licenses

Some types of businesses, such as builders, electricians, or plumbers, need special licenses to operate legally. Each state has its own rules, and what you need often depends on what you do and how much experience you have.

If you’re a professional who gives advice, such as a real estate agent or a lawyer, you might need professional liability insurance before you’re able to get your license in certain states. Regardless of whether your state requires professional liability insurance, this coverage helps protect you if a client claims you made a mistake. It’s sometimes also known as “errors and omissions” or “’malpractice insurance,” depending on your line of work.

When to Get a Business License and Insurance

State, county, and local requirements can vary, but you generally should apply for a business license before launching your business. Our Business License page has links to business license guides available for all 50 states.

Business Insurance

A 1-minute explanation

Find out what General Liability covers, why you might need it, and how we can help – All in just 60 seconds.

How Much is General Liability Insurance?

Get a quick estimate in just 3 steps.

What Determines the Cost of General Liability Insurance?

The size of your physical location

If you have a large space, especially one open to the public, there’s’s more potential for accidents or damage. This can sometimes lead to a slightly higher insurance cost.

Your type of business

Some businesses, such as construction, have a higher risk of accidents than others, like an office-based business. Insurers consider this risk when determining your premium. The higher the risk, usually the higher the cost.

How much your business earns

Typically, the more revenue your business makes, the higher your insurance cost might be higher. This isn’t’t always the case, though. It depends on your specific industry. Some industries see only a small increase with more sales, while others might see a higher jump due to the increased activity.

How many people work for you

More employees can mean a greater chance of accidents, as there are more people on-site or more people providing services to your customers. So if you have more employees, including part-timers and contractors, your insurance premium could be a bit higher.

Where your business is located

Location matters. Local laws and the general environment of your area can affect your insurance costs. For example, businesses in high foot traffic or high-crime areas might requireneed more coverage.

Any claims you’ve had before

If you have a history of claims, some insurance companies might see your business as a higher risk, which could affect your insurance cost. A clean claims history may help lower your premiums.

For a full break down what general liability typically costs, what affects the price, and how Simply Business makes it easier and more affordable, read our general liability cost guide.

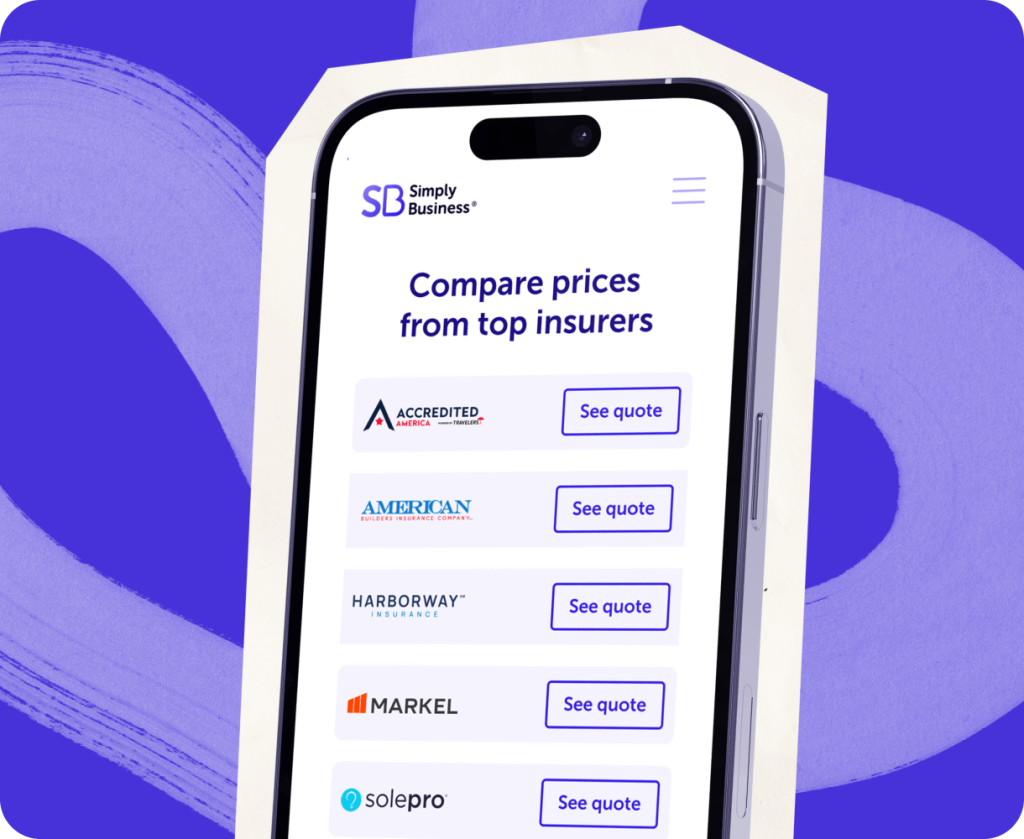

The Simply Business Difference

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you up with policies that fit your specific business, your risks, and budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need coverage that can grow with you. Either way, we’re here to help — with a choice of affordable policies and small business expertise to help you get the coverage you need.

Small business insurance made simple.

Search

Answer a few questions and get coverage recommendations for your business.

Compare

View custom quotes from top-rated small business insurers.

Save

Choose your policy, many with up to 20% savings.*

Trusted by over 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

We’ve Got More Helpful Information About General Liability Insurance

Highly rated insurers. Handpicked for small businesses.

Highly rated insurers, handpicked for small businesses.

*Actual savings may vary based on the nature of your business, its location, and insurance provider appetite. Savings percentage is calculated using the average price difference of quotes from the Simply Business panel of insurance providers.