Etsy Insurance

Compare Free Quotes and Get an Affordable Policy in Less Than 10 Minutes.

Secure a Policy 100% Online

Digital Certificate of Insurance

Top-rated insurance providers

Insuring over 1 million small business owners worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

Insurance Made for Your Etsy Business.

You can find almost anything on Etsy — from flavored toothpicks to dog booties to vintage jewelry. For small business owners like you, it’s a great place to sell your goods. Using Etsy as your Ecommerce platform is an effective way to reach customers, and it may be easier than building and managing your own website.

But selling on Etsy doesn’t necessarily mean you’re protected if something were to go wrong. No matter where you sell your products, business insurance is essential.

At Simply Business, we can help you find Etsy business insurance that fits your needs. We’re an online insurance platform that makes it extremely easy to compare affordable policy options from insurers specializing in Ecommerce businesses like yours.

All it takes is 10 minutes. Get a quote, get insured, and get back to all those Etsy sales.

What to Consider When Looking for Etsy Business Insurance

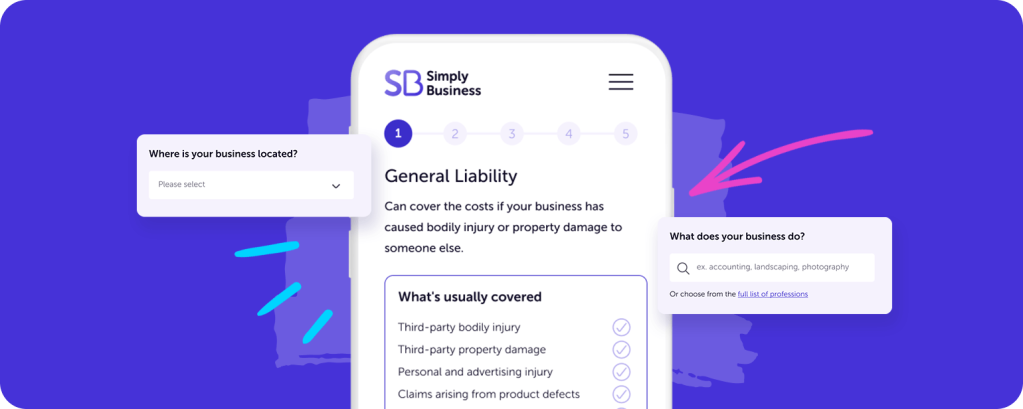

Looking for the best coverage fit for your small business? Simply Business can help. Our free quote comparison tool matches you with policy options based on your business’s needs.

Hi there, we’re Simply Business, and small business insurance is what we do.

We work with top insurers who specialize in small business coverage—no one-size-fits-all solutions here. We’ve worked with thousands of business owners like you, so we have a good idea of what different businesses need.

We get it: you do one web search, and the results can be overwhelming, and not in a good way.

We can save you from that. We’re ready when you are.

It takes just a few minutes online—enter some information about your business, and some pretty cool technology shops for great coverage at competitive prices in just seconds.

You choose and purchase the coverage that works for you. Not to worry, we’ve got licensed insurance pros to help you over the phone.

Then we zip your Certificate of Insurance and other policy documents straight to your inbox. That’s how easy it is to insure your business with Simply Business.

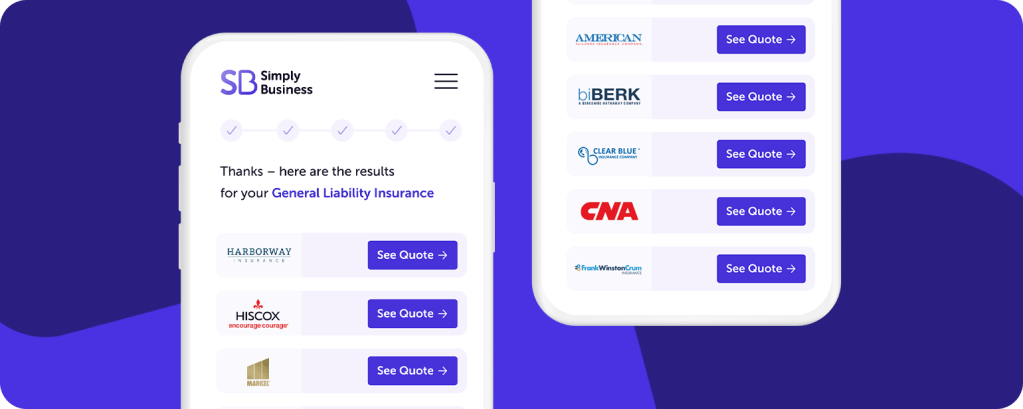

Simply Business is pleased to provide tailored insurance options from:

Benefits of Etsy business insurance:

- It can protect your business from certain claims.

- It can help cover damages caused by your work.

- Proof of insurance can help clients feel good about using your business.

Do I Need Business Insurance to Sell on Etsy?

Etsy doesn’t currently require that you have insurance to sell or operate an online store. However, if that sounds like you’re off the hook, think again.

As a business owner, it’s up to you to set your business up for success. And that means protecting it with Etsy business insurance. People sue businesses for many reasons, which is why you may need to protect yourself with more than one policy.

Here are three types of policies we typically recommend for Etsy sellers to consider:

Ecommerce insurance

As an online merchant, you may not be interacting with your customers. But your customers are interacting with your products, which can potentially lead to product liability claims. That’s why you need Ecommerce business insurance, which typically includes general liability insurance (also referred to as “GL” insurance).

A GL insurance policy typically helps cover incidents such as:

- Third-party bodily injury

- Third-party property damage

- Product liability

- Advertising injury

- And more

For Etsy sellers, product liability coverage is especially important since it may protect you in the event a customer claims that a product from your Etsy store caused them damage in some way.

Let’s say you sell men’s grooming products. A customer purchases your beard oil kit and breaks out in a terrible rash after using it. The beard oil contains coconut oil, which he is allergic to. Unfortunately, you didn’t list that ingredient in the description on your Etsy page.

As a result, the customer sues your Etsy store. In this scenario, you’d likely be financially responsible for the cost of the claim, plus legal fees, if you have to defend yourself in court.

Did you know that the average cost of a product liability claim can be in excess of $7 million? That’s enough to put a small Etsy store out of business! However, with general liability insurance, there’s a good chance you won’t have to pay out-of-pocket expenses.

GL insurance can cover a lot of the risks you face as an online business, including financial damages you’re ordered to pay as a result of a covered claim and attorney’s fees (up to your policy limits).

There are other benefits to having Ecommerce insurance. It also can help reduce many financial risks you may face for claims associated with advertising injury, and third-party accidents.

Cyber insurance

Small businesses are attractive targets for hackers, and just one cyberattack could put an end to your online business. That’s why we recommend cyber insurance for Etsy sellers.

Cybercriminals can wreak havoc on your business. They can steal the personal and financial information of your customers, employees, or vendors. Or they can steal directly out of your account by posing as a bank or vendor.

Another type of malicious attack is ransomware, which can send your business into crisis mode. Ransomware is when a hacker locks and encrypts your data then demands payment to restore your access. As an online seller, you can’t run your business without control of your computer system.

If you think a cyberattack won’t happen to you, consider that there were around 236.1 million ransomware attacks during the first half of 2022. As a small business owner, you can’t afford to lose thousands of dollars to hackers. Cyber insurance can help cover many of the costs associated with cyberattacks, so you can keep your Etsy store running.

Here’s what cyber insurance usually helps cover:

- Crisis management expense

- Forensic and legal expense

- Fraud response expense

- Extortion loss

- Public relations expense

- And more

Cyber liability insurance usually does not cover:

- Potential future lost profits

- Cost to improve system security

- Loss of intellectual property value due to theft

- And more

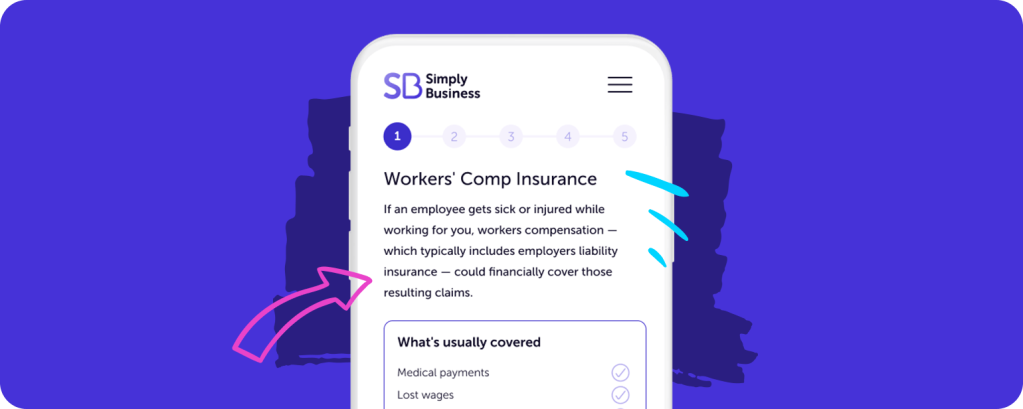

Workers’ compensation insurance

If you have employees working for your Etsy store — even if they’re part-time or temporary — you may need to get workers’ compensation insurance. In most states, employers must carry workers’ compensation insurance when they hire their first employee.

Workers’ compensation is insurance coverage that can cover an employee’s medical bills — as well as lost wages — if they get sick or injured on the job.

For example, let’s say your Etsy shop sells custom-made furniture, and one of your employees falls off a truck while delivering a large coffee table. He breaks his arm and heads to the hospital, where he’s put into a cast and instructed to take several days off from work.

In this scenario, your workers’ comp insurance policy could kick in and pay your employee’s medical bills (including rehabilitation expenses), since they were injured while working for you. Workers’ comp could also cover your employee’s lost wages.

Workers’ compensation insurance typically covers:

- Medical payments

- Lost wages

- Rehabilitation expenses

- Death benefits

Why Do I Need Etsy Business Insurance?

While you may not be required to carry Etsy business insurance, operating without it can be extremely risky. Did you know 43% of small business owners say they’ve dealt with lawsuits or the threat of one? If your business is sued, it could be financially devastating to your Etsy store.

You’ve invested time, money, and dedication into selling your products on Etsy. Business insurance ensures that you stay protected. At Simply Business, we’ll help you find a plan that fits your needs and your budget. We keep you covered so you can keep running the business you love.

And it’s easy to compare quotes online. Just answer a few questions about your business to get started. At Simply Business, we make getting insured simple!

Etsy Insurance FAQs

Etsy doesn’t currently require you to have business insurance to sell your products. However, having Etsy liability insurance is highly recommended for anyone running an online store.

In general, the cost of your Etsy insurance likely is tax-deductible by the IRS. However, it’s best to talk to an accountant if you have questions about your business’s specific deductible expenses.

The answer really depends on your online business, so it’s tough to make an exact recommendation.

But to help give you a better idea of how much you may need, your insurance coverage is typically built based on:

- Your location

- Where your sales are located

- The products you sell

- How long you’ve been in business

- Your experience in the industry

- Your payroll and annual revenue

- And more

And if you have questions? A Simply Business licensed insurance agent can help. We’re just a phone call away at 844-654-7272.

Although Etsy doesn’t currently require sellers to have business insurance, that doesn’t mean you don’t need it. There are many risks involved with running an Etsy store, and business insurance can protect you from the unexpected.

Your Etsy business insurance coverage can be customized to cover you against the most common risks you face as an online retailer. For example, a bundled plan that includes general liability insurance and workers’ compensation (if you have employees) can cover:

- Product liability

- Third-party accidents and damages

- Employee injuries

- And more

Simply Business can help you find the coverage you need at an affordable price.

There’s no set cost for Etsy sellers since insurance is customized to your specific needs and risks, but your insurance premium is usually determined by:

Your payroll

Where you’re located

The products you sell

Annual revenue estimates

And more

Want to see how much your business insurance coverage may cost? Answer a few questions about your business, and we’ll send you a free quote that’s tailored to retailers like you.

Why Choose Simply Business?

Simply Business is an online business insurance platform that makes it easy to compare and buy policies from top insurers. We have over a decade of global experience making business insurance clear and simple for our customers.

We pride ourselves on making business insurance:

- Fast and Affordable: You have better things to focus on, like running your business. Our policies are fast, affordable, and ready when you are.

- Tailored to You: Forget one-size-fits-all insurance. Get the protection your business needs when you need it.

- Flexible Coverage: Whether you need increased coverage for the launch of a new product or a policy to meet an Ecommerce platform’s requirements, Simply Business can help.

You’ve worked hard to build your Etsy business. Now you can choose the best coverage to protect it.

Business Insurance FAQs:

What is General Liability Insurance?

Insurance policies available for Etsy businesses:

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.