Event Planner Insurance

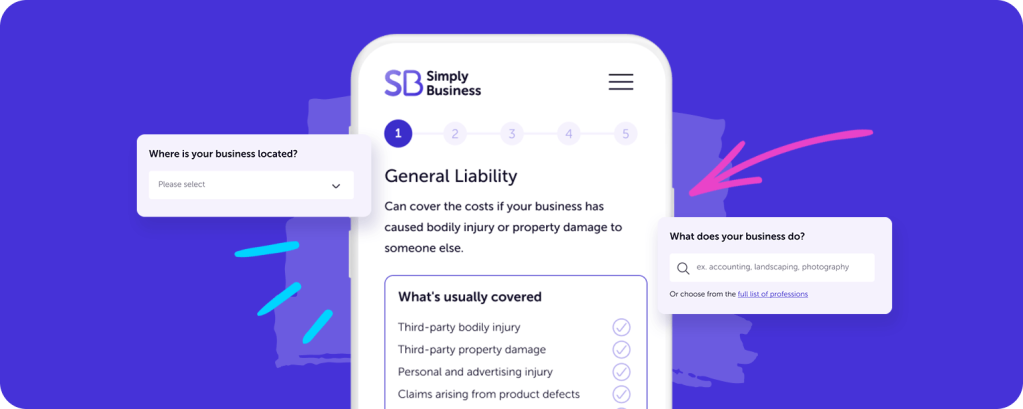

Compare Free Quotes and Get an Affordable Policy in Less Than 10 Minutes.

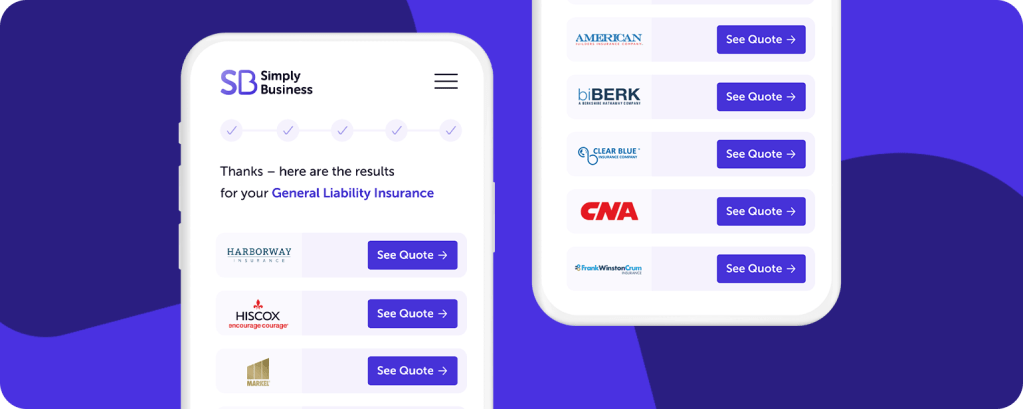

Simply Business is pleased to provide tailored insurance options from:

Let Us Help You Plan for the Unexpected

As an Event Planner, you’re an expert at anticipating issues and problem-solving on the fly. Whether you’re orchestrating a workshop for 10 executives or a conference for 10,000, you know how to stay calm under pressure. But no matter how much you prepare, you can’t always control the inevitable accidents, mishaps, and unforeseeable circumstances.

At Simply Business, we can help you plan for the unexpected. All it takes is a phone call or a single online visit. We’ll go to work finding quotes from the nation’s top insurers. We can usually get you covered with a fresh blanket of protection in about 10 minutes.

Ready to make the call?

Business Insurance FAQs:

What is General Liability Insurance?

Insurance policies available for event planners:

Benefits of event planner insurance:

- It can protect your business from certain claims.

- Proof of insurance can help clients feel good about your work.

- It may be required where you’re located.

What Type of Insurance do Event Planners Need?

Event planners often find themselves managing chaos from the eye of the storm. And each event brings a different set of challenges and risks. At Simply Business, we have multiple coverages available to help you customize your event planner insurance to fit your specific needs.

Here are three types of policies we typically recommend:

General Liability Insurance

General liability insurance covers costs resulting from third-party accidents, property damage, and bodily injuries, including clients and vendors.

As an event planner, it’s your job to make sure the day goes smoothly. But unforeseen accidents happen to the best of us. And without this type of coverage, your business may be responsible for those costs.

Just imagine, you’re coordinating a major fundraising event. While entering the reception hall, the president of the nonprofit trips over your laptop cord and sprains her ankle. After the event, she sues you for the cost of the medical bills, claiming that your carelessness led to the incident. Not very charitable, but lawsuits do happen!

Without a general liability policy, you may need to pay the claim out-of-pocket and may even have to hire a lawyer to defend your business.

But fear not — we have your back! General liability insurance could help pay the cost of the claim, medical costs, and legal fees, up to your policy’s limit.

Here’s what general liability (GL) insurance usually covers:

-

Third-party bodily injury

-

Third-party property damage

-

Personal and advertising injury

-

Claims arising from product defects

-

Medical expenses

-

And more

GL insurance usually doesn’t cover:

-

Damage to your own property

-

Professional services

-

Workers’ compensation or injury to your employees

-

Damage to your work

-

Automobiles while in business use

-

Expected or intentional injury or damage

-

And more

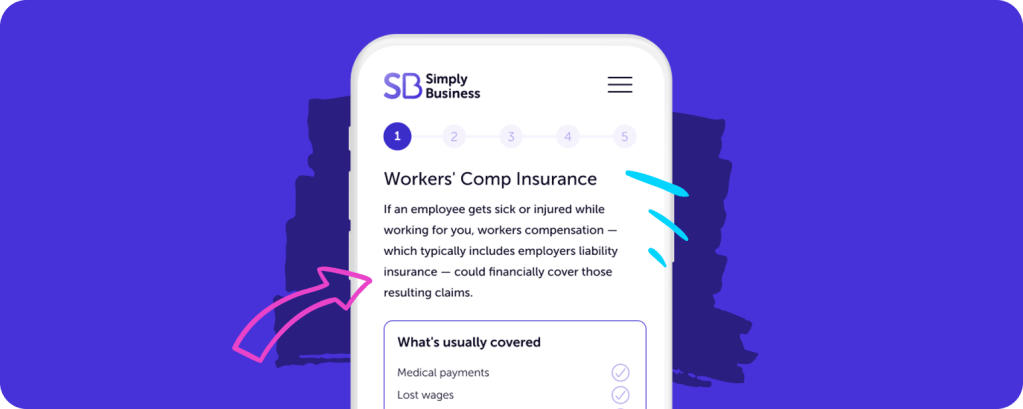

Workers’ Compensation Insurance

As an event planner, you often collaborate with multiple partners to deliver memorable experiences. But if you have employees — whether they’re part-time or full-time — there’s a good chance you’ll also need workers’ comp (WC) coverage. Workers’ compensation insurance helps protect your business financially if an employee gets injured or sick while working for you.

States can have different laws and regulations. You can learn more about the requirements in your state here.

Workers’ comp can cover:

- Medical costs

- Lost wages during a worker’s time off

- Rehabilitation expenses

- Death benefits

It does not cover:

- Client or vendor accidents

- OSHA fines

- Work safety improvements

- Wages for a worker who replaces the injured employee

Inland Marine Insurance

As an event planner, you’re constantly on the go. Inland marine insurance helps to financially protect the equipment you use while in transit or at an event site. Inland marine coverage can protect your business from occurrences such as:

· Damage to business property

· Vandalism to business property

· Theft of business property

An inland marine policy typically covers property that is:

· In transit

· On movable vehicles

· Stored offsite

Why Do I Need Event Planner Insurance?

Accidents can happen no matter how carefully you plan. And when things do go sideways, clients sometimes file a lawsuit. Roughy between 36% – 53% of small businesses could face a lawsuit in a given year. And lawsuits can be devastating — the average liability lawsuit costs at least $54,000. It doesn’t matter who’s at fault.

You know how to plan the best day. We know how to plan for the worst. With event planner insurance, you’ll have peace of mind, knowing that you and your business are covered if the unexpected happens.

Event Planner Insurance FAQs

Whether or not you need insurance as an event planner may depend on where you live. Check with your local government to find out what’s required in your location.

For example, if you have part-time or full-time employees, you’ll likely need to carry workers’ compensation insurance.

Additionally, you may need proof of business insurance to rent office space or equipment.

You may be able to deduct your insurance premiums when filing your business’s income taxes. We recommend checking with an accountant for more information.

Your business is unique, so every career coach has different insurance needs. After you answer key questions about your business on our online quote form, we can provide insurance options for you. Our online quote tool will consider the following factors to suggest plans:

- The services you provide

- Payroll and revenue estimates

- The state you work in

- And more

Simply Business lets you quickly compare plans and purchase a policy online. The amount of coverage you’ll need will depend largely on the policy type and on other factors such as:

- The size of your business

- Your business’s location

- Your annual revenue

- And more

Our quote form and licensed insurance agents will gather information to help you find coverage for your event planning business. If you have questions, our insurance pros are there to assist! They’re just a phone call away at 844-654-7272.

It’s helpful to have the following information on hand:

- Your annual revenue estimates

- Your payroll information

- Information on any previous insurance claims

A comprehensive solution that includes both general liability and business personal property insurance can cover:

- Third-party bodily injury

- Third-party accidents and damages

- Theft, damage, and loss of business property

- And more

It often depends on many factors, including which policies you decide to purchase. As a general rule of thumb, you can expect the cost of a policy to be determined by:

- Your revenue

- Your payroll

- Number of employees

- Your business location

- The type of services you provide

- And more

You can get business personal property coverage as an addition to your general liability (GL) insurance.

Wondering how much you’ll pay for event planner insurance? Click here to answer a few easy questions and get free quotes to compare policies.

Why Choose Simply Business?

We’re a fast-growing online insurance provider for small business owners, meaning thousands of customers trust us to protect their growing businesses.

At Simply Business, we also make it easy to get insured. We work with the nation’s most trusted insurance companies to help you find and compare free quotes for event planner policies.

So why choose Simply Business? It’s simple:

We’re fast and affordable. Our policies are fast, affordable, and ready when you are. Say goodbye to stressing about having coverage.

We’re flexible with coverage. If you need to make changes to your insurance coverage, we’re here to help.

We get your business. Your business is unique, so shouldn’t your insurance policy be? We understand small businesses, and we’ll help make sure you find the coverage you need for your business’s needs.

We’re trustworthy and reassuring. No one wants to experience an accident, injury, or lawsuit. But if one of those events happens to you, we have your back. You can trust your insurance policy to help cover costs and help you get back doing the work you love.

We make it easy to compare free quotes. Insurance doesn’t need to be complicated. Our online quote form lets you choose from policies that meet your needs.

Other Businesses We Insure

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.