Restaurant Insurance

A Robust Blend of Simplicity, Flexibility, and Value. Get a Restaurant Insurance Quote Today.*

Why Do You Need Restaurant Insurance?

You bring together ingredients, skill, passion, and flair in a way that turns food into an expression of love and art. We can help you protect your passion with curated business insurance recommendations to financially safeguard your restaurant from third-party injuries, property damage, and more.

Coverage Types

General Liability

Coverage for third-party accidents, property damage, and bodily injury.

Professional Liability

Coverage for damages and legal costs for mistakes or negligence claims. This policy is often recommended for businesses that provide advice and guidance to their clients.

Workers’ Compensation

Coverage to help take care of employees who get sick or injured on the job. Many states require this for businesses with full or part-time employees.

Business Insurance

Other coverages to protect your business.

Restaurant Insurance FAQs

General liability.

A general liability policy typically covers third-party bodily injury, third-party property damage, and even reputational damage caused by your business.

Commercial property insurance.

This type of insurance can cover damages to your building caused by fire, theft, weather, and certain other disruptive events. It also can cover damage to physical assets such as inventory, supplies, and equipment.

Business interruption insurance.

If certain covered events force you to close down for a period of time, business interruption coverage can replace your lost income, up to your policy limits.

BOP insurance for restaurants bundles together different policies, so it often can be less expensive than buying all those policies separately.

As with most types of insurance, the cost of restaurant insurance will depend on a number of factors, such as:

- Your type of business

- The services you provide

- Where your business is located

- The number of employees you have

- Your estimated revenue

- And moreIf you’re still unsure, getting a quote or speaking with an agent could help you get a better idea of how much a business owner’s policy will cost you.

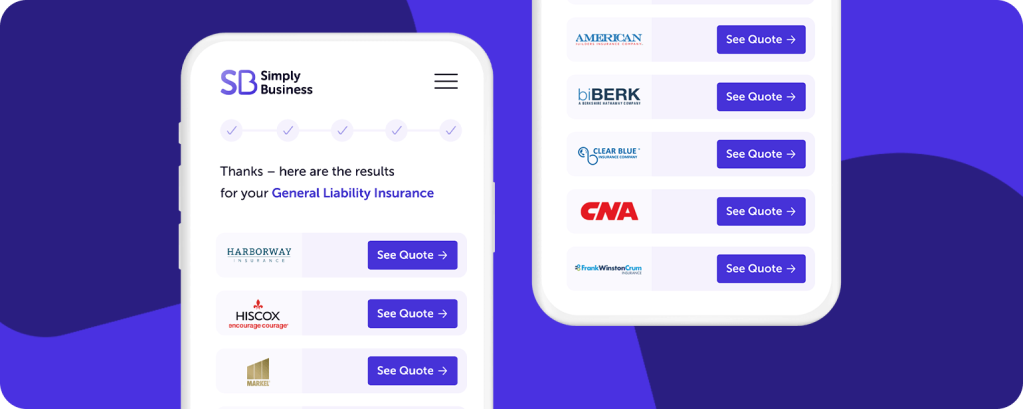

We provide customized coverage options and quotes from top-rated small business insurers – all in just 10 minutes. More than 1 million small business owners worldwide trust us with their insurance, and we consistently earn high customer ratings and reviews.

We have more insurance FAQs here.

What Insurance Does a Restaurant Need?

You bring together ingredients, skill, passion, and flair in a way that turns food into an expression of love and art. But that may not extend to knowing what insurance coverage to consider for your restaurant.

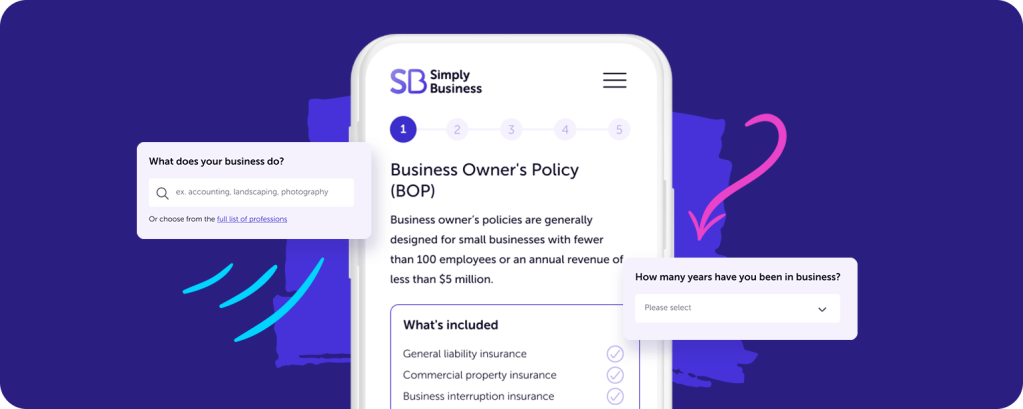

One option is a business owner’s policy, also known as “BOP.” A business owner’s policy combines different coverages, such as property and liability insurance, into a single policy. And this insurance for restaurants can deliver some great benefits for owners who have a lot on their plates.

- Simplicity: Make one purchase instead of multiple purchases.

- Flexibility: Add or drop coverages as your needs change.

- Value: It often costs less than buying all those policies separately.

You can get started right now and get covered online in just minutes.

What to Consider When Looking for The Best Small Business Insurance

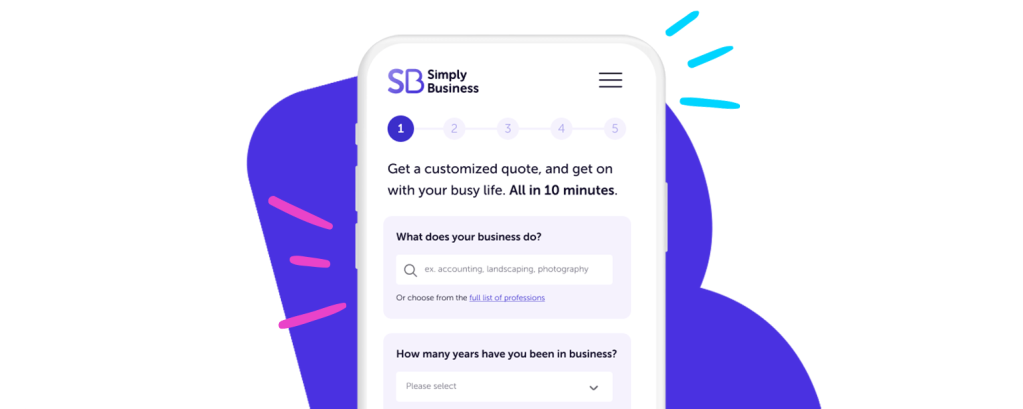

Looking for the best coverage fit for your small business? Simply Business can help. Our free quote comparison tool matches you with policy options based on your business’s needs.

Hi there, we’re Simply Business, and small business insurance is what we do.

We work with top insurers who specialize in small business coverage—no one-size-fits-all solutions here. We’ve worked with thousands of business owners like you, so we have a good idea of what different businesses need.

We get it: you do one web search, and the results can be overwhelming, and not in a good way.

We can save you from that. We’re ready when you are.

It takes just a few minutes online—enter some information about your business, and some pretty cool technology shops for great coverage at competitive prices in just seconds.

You choose and purchase the coverage that works for you. Not to worry, we’ve got licensed insurance pros to help you over the phone.

Then we zip your Certificate of Insurance and other policy documents straight to your inbox. That’s how easy it is to insure your business with Simply Business.

BOP FAQs:

How much does a business owner’s policy cost?

What does a business owner’s policy cover?

Insurance policies available for restaurants:

What Does Restaurant Insurance Cover?

Like a good mushroom fennel sauce, using a BOP for your restaurant insurance can cover quite a bit.

A typical restaurant business insurance BOP includes these three coverages:

General liability.

A general liability policy typically covers third-party bodily injury, third-party property damage, and even reputational damage caused by your business.

Commercial property insurance.

This type of insurance can cover damages to your building caused by fire, theft, weather, and certain other disruptive events. It also can cover damage to physical assets such as inventory, supplies, and equipment.

Business interruption insurance.

If certain covered events force you to close down for a period of time, business interruption coverage can replace your lost income, up to your policy limits.

Other coverages to consider.

A business owner’s policy offers a lot of flexibility. If you want to tailor your restaurant insurance quote, the following add-ons may be available:

- Employee theft

- Spoiled merchandise

- Forgery

- Equipment breakdown

Business Owners Insurance. A staple you’ll likely want to consider.

Just like different cooking utensils can help you create all kinds of dishes, each type of restaurant insurance coverage can help protect you from different types of claims.

Here are some examples:

- A customer gets up to use the restroom and slips and falls from a spilled drink on the floor that wasn’t cleaned up. A business owner’s restaurant insurance policy that includes general liability insurance may help cover medical costs and other related claims (up to the policy limits).

- One morning, you arrive at the restaurant and find that the door lock has been damaged by vandals and must be replaced. With lock replacement coverage — which may be available as an add-on — the cost of replacing the damaged lock likely won’t have to come out of your pocket.

- You open the restaurant in the morning to find the refrigerator has stopped working. All the food in the refrigerator has spoiled and is unusable. Spoilage coverage as an added part of BOP insurance for restaurants may help take care of the cost of replacing the food.

Without restaurant insurance coverage, you could be financially responsible for claims or damages that arise from any one of those events, which could spell disaster for your restaurant.

Insurance for Restaurant Employees

Whether it’s taking care of customers, prepping food, or turning out your daily specials, there’s a good chance you rely on your staff to make all that happen. In most states, if you have employees, you’re required to have workers’ compensation insurance.

Workers’ comp is restaurant employee insurance that can protect your business and help take care of employees who get sick or injured on the job. Consider these possibilities:

Insurance for Restaurant Employees

One of your employees gets a nasty burn on his arm while working in the kitchen. He heads to the hospital, where he’s treated and given instructions to take several days off from work.

Or maybe one of your part-time employees slips on a wet floor and hits her head on the floor. She’s taken to the emergency room, where she’s diagnosed with a concussion and as a result will miss two weeks of work.

In both instances, your workers’ comp insurance policy could kick in and pay your employees’ medical bills (including rehabilitation expenses if needed). It also could cover their lost wages while they’re off work recovering.

How to Get Commercial Restaurant Insurance Quotes

While blending with complex flavors is right up your alley, dealing with complex insurance language and requirements may not be.

We’re Simply Business. We’ll be taking care of you.

That’s where we come in. We’re insurance pros, and that includes restaurant insurance. We can help you determine what coverage you may need, find affordable policies from leading insurers, and offer you choices that are easy to understand and even easier to put into place.

We do what we do quickly. Spend a few minutes online or on the phone and we’ll put your quote together.

Insurance for Restaurant Employees

Whether it’s taking care of customers, prepping food, or turning out your daily specials, there’s a good chance you rely on your staff to make all that happen. In most states, if you have employees, you’re required to have workers’ compensation insurance.

Workers’ comp is restaurant employee insurance that can protect your business and help take care of employees who get sick or injured on the job. Consider these possibilities:

Insurance for Restaurant Employees

- One of your employees gets a nasty burn on his arm while working in the kitchen. He heads to the hospital, where he’s treated and given instructions to take several days off from work.

- Or maybe one of your part-time employees slips on a wet floor and hits her head on the floor. She’s taken to the emergency room, where she’s diagnosed with a concussion and as a result will miss two weeks of work.

In both instances, your workers’ comp insurance policy could kick in and pay your employees’ medical bills (including rehabilitation expenses if needed). It also could cover their lost wages while they’re off work recovering.

How to Get Commercial Restaurant Insurance Quotes

While blending with complex flavors is right up your alley, dealing with complex insurance language and requirements may not be.

We’re Simply Business. We’ll be taking care of you.

That’s where we come in. We’re insurance pros, and that includes restaurant insurance. We can help you determine what coverage you may need, find affordable policies from leading insurers, and offer you choices that are easy to understand and even easier to put into place.

We do what we do quickly. Spend a few minutes online or on the phone and we’ll put your quote together.

How Much Does Restaurant Insurance Cost?

Just like your signature culinary dishes, your insurance coverage is unique to your restaurant. That’s why we work with leading insurers to find policies and work with you to find the coverages specific to your restaurant and your budget.

Since BOP insurance for restaurants bundles together different policies, it often can be less expensive than buying all those policies separately.

As with most types of insurance, the cost of restaurant insurance will depend on a number of factors, such as:

- Your type of business

- The services you provide

- Where your business is located

- The number of employees you have

- Your estimated revenue

- And more

In some cases, restaurants and retailers can pay as little as $550 annually. And whatever the amount of your premium, you may also be able to pay via convenient monthly installments, interest-free.

How to Get a Certificate of Insurance for a Restaurant

Here’s more good news. When you get your insurance through Simply Business, we send your certificate of insurance (COI) and policy documents immediately to your inbox.

Create a Simply Business account and you can download a copy of your COI any time.

Keeping it Fresh

Just like your specials may change with seasonal ingredients or new inspiration, we know your restaurant business insurance needs can change as well. That’s why we’re here after the sale to answer any questions you may have and advise you as needed. We work with a variety of insurance providers and present you with options. That way, you control how your insurance is put together — the same way you control how your signature dishes are put together.

Let’s get started.

Looking for More Resources for Your Restaurant Business?

We have some helpful guides to get you started:

Highly rated carriers. Handpicked for small businesses.

*When referring to “Restaurant Insurance,” we mean any one or combination of multiple business insurance policies that will help cover a restaurant business.