Ice Cream Shop Insurance

Comprehensive coverage with a cherry on the top.

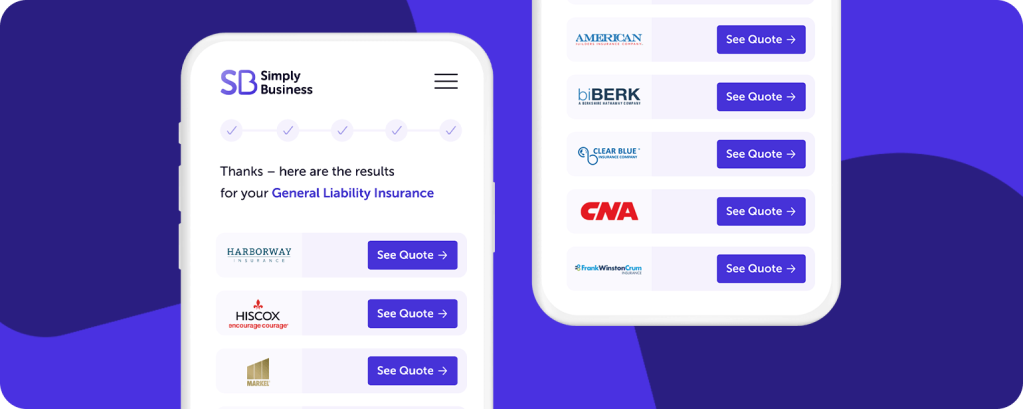

Simply Business is pleased to provide tailored insurance options from:

What is Ice Cream Shop Insurance?

You see them every day. Customers who just can’t seem to choose which flavor they want to order. Do they want versatile vanilla in a cone, a scoop of rich chocolate, or bold strawberry with all the fixings? They might stand there paralyzed with indecision for five minutes before realizing they don’t need to choose. Neapolitan ice cream will offer the best of all three worlds.

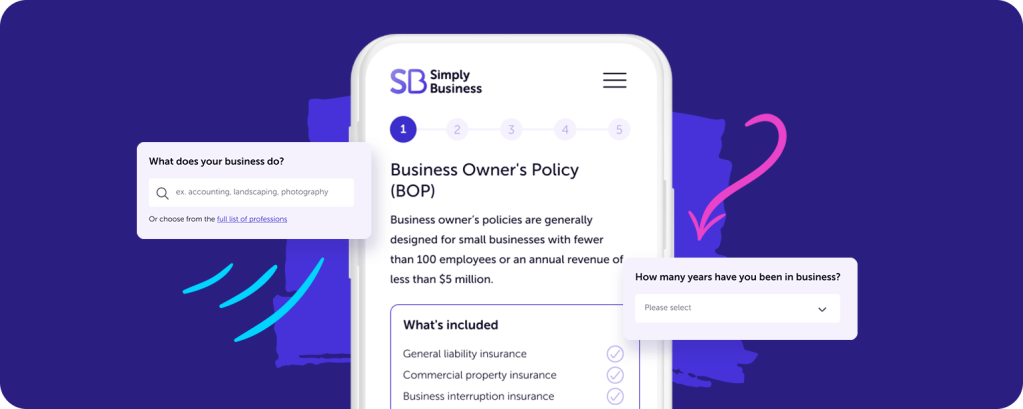

Insuring your ice cream shop can lead to similar decision paralysis. With so many choices for commercial insurance coverage, it can be difficult to choose. Plus, having multiple policies can feel like balancing too many scoops on a cone. Fortunately, there’s a Neapolitan option for small business insurance: a business owner’s policy (BOP). This type of insurance typically bundles three types of coverage into one convenient package policy. BOP insurance offers:

- Simplicity: Manage one policy instead of several.

- Flexibility: Add or drop coverages as your needs change.

- Value: Bundling coverage often can cost less than having separate policies.

Please pay particularly close attention to the BOP product you end up purchasing since included coverages can vary.

Start online today and have a quote in-hand in just minutes.

BOP FAQs:

How much does a business owner’s policy cost?

What does a business owner’s policy cover?

Insurance policies available for ice cream shops:

What is BOP Insurance for an Ice Cream Shop?

Ice cream doesn’t need toppings. But the full sundae experience isn’t the same without them. BOP insurance adds that little extra something on the top to turn basic coverage into something far more comprehensive. By bundling different types of commercial insurance coverage under one roof, it helps minimize the number of policies you need to juggle.

We generally recommend BOP insurance for ice cream parlors and scoop shops because it’s customizable and packages three broad coverage types:

1. General liability insurance

A general liability (GL) policy will generally cover:

- Third-party bodily injury

- Third-party property damage

- Personal and advertising injury

- Claims due to defective products

GL insurance isn’t generally a legal requirement, depending on the state you’re located in. It is, however, a very popular type of policy for small businesses, and it’s popular for a reason. It covers a wide variety of common commercial claims and is a sensible place to start for small businesses needing insurance.

2. Commercial property insurance

Commercial property insurance generally can cover damage to assets in the event of the following:

- Fire

- Wind, storms, and snow

- Vehicle-related damage to the business’s property

- Sprinkler leakage

- Vandalism or theft on the premises

- Building collapse

Commercial property insurance for small businesses is particularly useful when valuable physical property is at stake. If you own your ice cream shop location, having commercial property coverage can be a great way to protect the store’s premises. If you rent your shop, your landlord may even require you to carry it.

While commercial property insurance typically covers losses following certain natural disasters, it does not apply to damage from floods or earthquakes. Also, damage to your own commercial vehicles and cyber claims are not covered, either.

3. Business interruption insurance

If your ice cream shop is forced to close due to theft, arson, or certain natural disasters, for example, business interruption insurance (sometimes, also called ‘business income insurance’), may be able to help you cover some expenses. These expenses generally can include:

- Temporary relocation

- Payroll

- Operational expenses

- Closure due to damage to a nearby building or business

- Training costs on replacement equipment

Business interruption doesn’t cover losses due to floods, earthquakes, and public health events. However, it could be a lifeline for you and your employees if your ice cream shop is forced to close as a result of certain unforeseen situations.

Optional add-ons and customizations

BOP insurance for ice cream shops can be customized to fit your business’s specific needs, as well as your own preferences. These optional add-ons can include:

- Spoiled merchandise

- Equipment breakdown

- Forgery

- Employee theft

Ice cream shops rely on costly equipment and high-quality ingredients to deliver the best food and desserts possible. An industrial freezer malfunction could cause you to lose large quantities of frozen product, and potentially slow or shut down your business before replacements and/or repairs are dealt with. While these add-ons aren’t required, they may help prevent you from paying for common ice cream parlor problems out of pocket.

Ice Cream Shop BOP Insurance Cost

When deciding to open an ice cream shop, one of the first things to consider is what the expenses will be. In terms of insurance costs, they can be difficult to predict without getting the full picture. As with most types of insurance, the cost of insurance coverage for an ice cream shop will depend on a variety of factors.

- The coverage limits you select

- The business’s location

- The size and age of the shop

- The value of your property

- Previous claims associated with the shop

- Any optional coverage you decide to add

The best way to figure out how much BOP insurance would cost for your ice cream business is to get a quote. In certain cases, small restaurants such as ice cream shops may be able to find coverage for as low as $575 a year, with the option to make interest-free monthly payments.

Large Coverage Served in a Kiddie Cone

A business owner’s policy should be just like your favorite ice cream order. All the toppings you like on top of the perfect base flavor. BOP insurance allows small business owners to cover a lot of bases without requiring managing multiple policies. All the general liability coverage you need with add-ons that suit your needs make the policy as unique as your ice cream shop business itself.

Let’s get started.