Retail Insurance for Shops

Get Coverage to Fit Your Business in Less Than 10 Minutes.

Simply Business is pleased to provide tailored insurance options from:

Insurance for Your Retail Business.

Running a store isn’t for the faint of heart. It takes perseverance, a willingness to work long hours, and a knack for customer service. It takes the right insurance coverage too.

Whether you own a gift shop, a toy store, or an antique business, all types of people will walk through your shop’s front door. The moment they do, your business needs protection from potential accidents and property damage. At Simply Business, we can help you find top-of-the-line, yet affordable, insurance to cover your retail venture. That way, you can focus on growing your business and serving customers as they shop.

When we refer to “Retail Insurance,” we mean any one or combination of multiple business insurance policies that will help cover a retail shop business. We’ll get into more detail below.

Sold on getting a policy? Let’s get started!

Business Insurance FAQs:

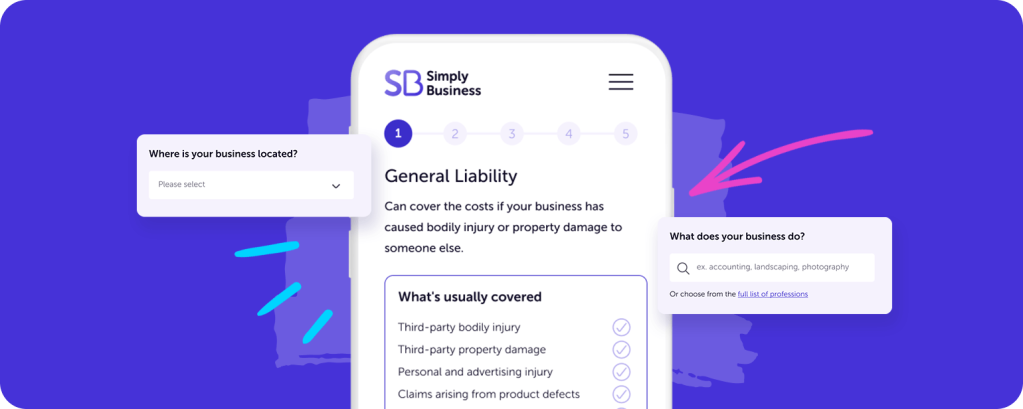

What is General Liability Insurance?

Policies typically available for retail shops:

Depending on the policies you purchase, the benefits of business insurance for retail shops could include:

- Protection if a customer gets injured.

- Coverage for damage to your store’s goods or to the building you own or lease.

- Help replacing stolen or vandalized products.

- Protection for your business if an employee gets sick or injured on the job.

What Types of Insurance Might General Retailers Need?

General Liability Insurance

When you think of business insurance, chances are general liability insurance (GL insurance) comes to mind. This policy can cover you if there’s a third-party accident, injury, or property damage at your store. In fact, many building owners require you to have general liability insurance before signing a lease.

It’s easy to see why general liability insurance is so important. Let’s say a customer walks in your front door and trips over one of your product displays. If your customer is seriously injured, you may be on the hook to pay for medical bills and more. This could add up to hundreds or even thousands of dollars in damage. But with GL insurance coverage, your business is safer.

Here’s what you can expect in general liability coverage:

- Third-party bodily injury

- Third-party property damage

- Personal and advertising injury

- Claims arising from product defects

- Medical expenses

- And more

Here’s what general liability insurance usually doesn’t cover:

- Damage to your own property

- Professional services

- Workers’ compensation or injury to your employees

- Damage to your work

- Motor vehicles while in business use

- Expected or intentional injury or damage

- And more

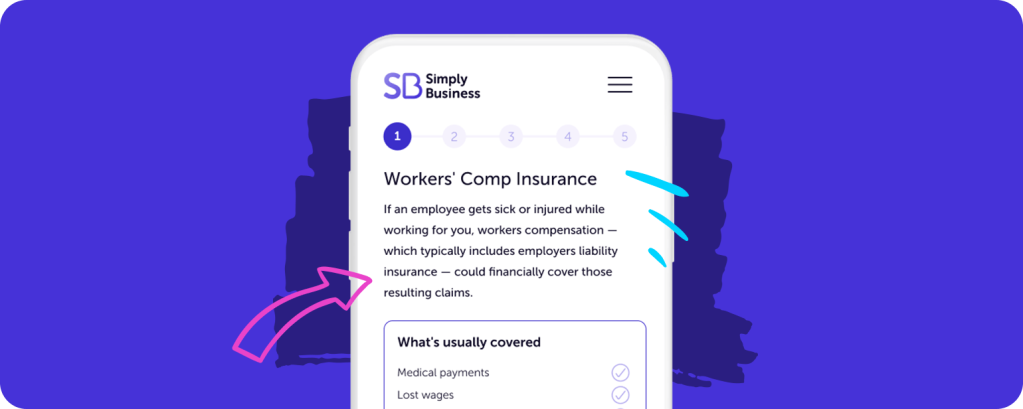

Workers’ Compensation Insurance

It’s possible you work solo, but most store owners have one or more employees. And if you do, you may need workers’ compensation insurance. In most U.S. states, it’s legally required — and for good reason. Workers’ compensation insurance can help protect you if an employee gets sick or injured on the job. Without insurance, you could be responsible for paying for their medical bills, job rehabilitation, time off work, and more. With the right insurance coverage, though, your policy could help pay for these costs.

For example, most workers’ compensation policies typically cover:

- Medical costs

- Lost wages during a worker’s time off

- Rehabilitation expenses

- Death benefits

Workers’ compensation usually doesn’t cover:

- Client or vendor accidents

- OSHA fines

- Work safety improvements

- Wages for a worker who replaces the injured employee

Business Personal Property Insurance

If you’re a general retailer, it’s generally a good idea to protect your store’s inventory, furniture, tools, and equipment. Imagine if your store was burglarized or if items were damaged or destroyed. It could close your shop down, possibly for good.

Fortunately, business personal property insurance is there to protect the items and assets you need to run your business. Purchasing business personal property insurance is a smart way to enhance your general liability coverage and secure your business even more.

For example, personal property insurance usually covers:

- Machinery and manufacturing equipment

- Inventory

- Furniture

- And more

Cyber Insurance

A University of Maryland study found that a hacker attacks every 39 seconds on average. Sooner or later, it’s something just about every business owner is likely to run up against.

There’s a good chance small businesses like yours don’t have the IT resources and sophisticated cyber defenses of larger companies. That can make you an easier target for cybercriminals.

While firewalls and anti-virus software are good, they’re not perfect. Even if just one cyberattack is successful, the financial damage could be tens of thousands of dollars. That’s why we think you should consider adding cyber insurance to your general retailer coverage. It can help cover many of those costs.

Cyber insurance usually covers:

- Crisis management expense

- Forensic and legal expense

- Fraud response expense

- Extortion loss

- Public relations expense

- And more

Cyber liability insurance usually does not cover:

- Potential future lost profits

- Cost to improve system security

- Loss of value from theft of intellectual property

- And more

Why Do I Need Insurance as a General Retailer?

Running your own business, and especially a retail shop, isn’t for the faint of heart. It takes hard work, commitment, and usually quite a few working hours. Whether you’ve owned a shop for a few years or you just began a new venture, you want to protect your business for years to come.

General liability insurance, including business personal property coverage, as well as workers’ compensation, can keep your shop open and running. Imagine if an injured or unhappy customer files a claim against your business. Depending on the claim, it could cost you thousands of dollars.

In fact, here are examples of some of the most common small business claims and how much they could cost:

- Product Liability: $35,000

- Customer Injury or Damage: $30,000

- Customer Slip and Fall: $20,000

- Burglary: $8,000

Having a strong business insurance policy can also help you lease a storefront, rent equipment, and even hire new employees. Depending on your business, it also can attract new customers. In fact, many small business owners request a Certificate of Insurance from us. This important document provides proof to customers, vendors, and other business owners that you’re covered by an insurance policy.

Business Insurance for General Retailer FAQs

It depends on where your store is located, as well as the type of store you run. Some states and local municipalities require you to carry business insurance. If you have employees, your state may require you to purchase workers’ compensation insurance, in the event an employee gets injured or sick on the job.

Most likely, yes! But it’s a good idea to consult with a tax professional or an accountant first. Often, business insurance premiums can be deducted on your income tax return.

There’s no one-size-fits-all answer here. Every retail shop owner has unique needs — and that includes insurance. It depends on how you run your business, if you have employees (and how many), and several other factors, such as:

- The size of your business

- Your business’s location

- Your annual revenue

And more

When you fill out Simply Business’s online quote form, our insurance professionals will help you find the right amount of coverage for your retail business.

And if you have questions? A Simply Business licensed insurance agent can help. We’re just a phone call away at 844-654-7272.

We want to make purchasing business insurance as fast and easy as possible. To help the process go smoothly, it helps to have the following information on hand before you begin requesting a quote:

- Annual revenue estimates

- Payroll estimates

- Information on any previous claims

Business insurance for retail shops might include a variety of different policy types. Your coverage, therefore, will depend on the policies you carry. If you have general liability insurance, business property insurance, and workers’ compensation insurance your coverage could protect your business against:

- Third-party bodily injury

- Accidents and damages

- Employee injuries

- Property damage

- And more

The cost of business insurance typically varies. It depends on a few factors, such as if you have employees, the location of your business, and what you’re selling. Generally speaking, the cost of a policy depends on:

- Your revenue

- Your payroll

- Your business location

- The type of product(s) you sell

- And more

If you want to know what business insurance for general retailers might cost, check out our online quote form. It’s simple and fast to compare quotes. In fact, you might just get coverage today!

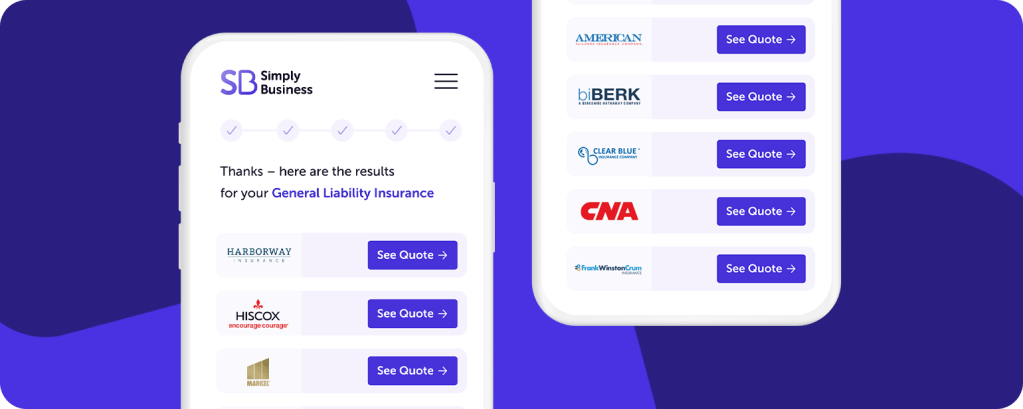

Why Choose Simply Business?

Having what your customers need and want can be a key to a successful retail store. We have the same belief about business insurance. We work to make getting business insurance fast, easy, and affordable. Thousands of small business owners all over the country trust us to protect their growing companies.

Our online quote tool makes it easy to find and compare free quotes from some of the best insurance companies around.

Choosing Simply Business is a simple choice. Here’s why.

We’re fast and affordable. It’s our goal to make getting insurance hassle-free. When you work with us, you can feel confident that you’re getting the right coverage at the right price.

We’re flexible with coverage. We understand that your business needs may change. If this happens, just give us a call, and we can likely adjust your coverage.

We get small business owners. After all, we specialize in small business insurance. We work with small business owners like you every day, so we understand your needs and how to meet them.

We’re trustworthy. You don’t need to worry if an accident or injury happens at your business, or even if you get sued. We’re here for you. Trust us to help cover the costs, so you can get back to doing what you do best.

We make it simple to compare free quotes. You don’t want to spend all day researching insurance. That’s why we offer an online quote form that lets you compare policies and find the right ones for your business.

Other Businesses We Insure

Content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.