Cafe Insurance

Flexible and simple coverage that’s sure to perk you up.

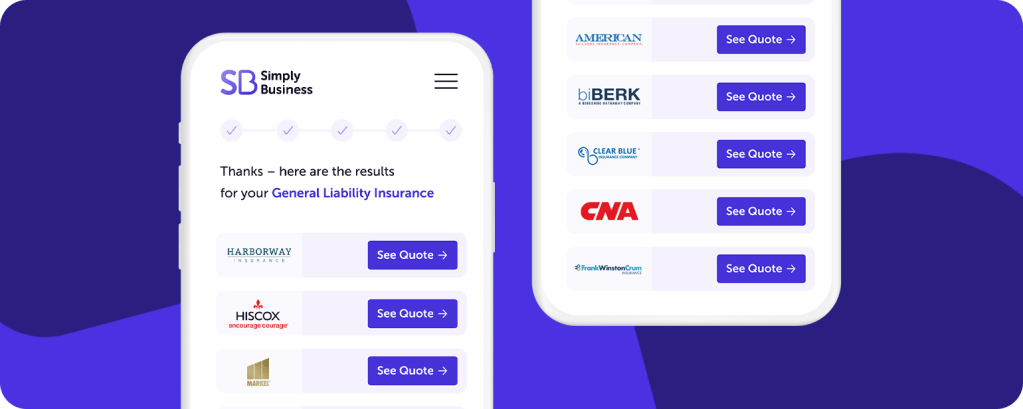

Simply Business is pleased to provide tailored insurance options from:

What is Cafe Insurance?

You know that the quality of espresso can make or break a macchiato. You know the exact science of making a perfect Americano. You might even know how to top it all off with some latte art. But you may not know offhand the right kinds of business insurance for a cafe.

When referring to “Cafe Insurance,” we mean any one or combination of multiple business insurance policies that will help cover a cafe business. We’ll get into more detail below.

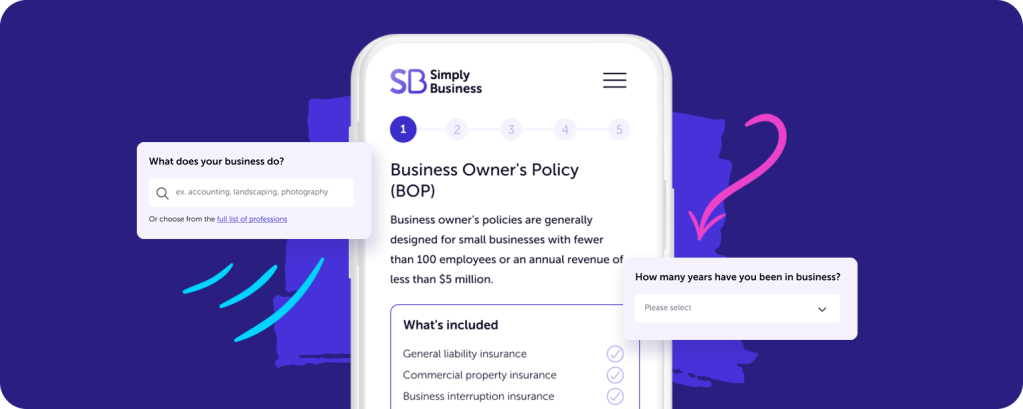

A business owner’s policy (BOP) is a great place to start. A BOP bundles several types of coverage — typically including property and liability insurance — into one convenient policy. As a cafe owner, you’re used to the grind in more ways than one. But your commercial insurance doesn’t have to make things more complicated for you.

- Simplicity: Manage one policy instead of several.

- Flexibility: Add or drop coverages as your needs change.

- Value: Bundling coverage often costs less than having separate policies.

Get started online today and have a quote ready in minutes.

What Insurance Do I Need for a Cafe?

Like coffee and cream, some things just go together. BOP insurance bundles different types of coverage to create a bold blend of protection for your small business. We recommend BOP insurance for cafes and coffee shops because it can be customizable and typically combines different coverage types, including:

1. General liability insurance

A general liability (GL) policy typically covers:

- Third-party bodily injury

- Third-party property damage

- Personal and advertising injury

- Claims due to defective goods

GL isn’t generally a legal requirement, but it’s a very popular type of policy for small businesses. It generally covers a variety of common commercial claims and can be a smart choice for just about any business.

2. Commercial property insurance

A commercial property insurance policy generally can cover damage to assets resulting from:

- Fire

- Wind, storms, and snow

- Vehicular damage to the business’s property

- Sprinkler leakage and various other forms of water damage

- Vandalism or theft on the premises

- Building collapse

Property insurance for small businesses is particularly useful for businesses with valuable physical property. If you own your cafe location, this can be great coverage to have in your back pocket. If you rent, your landlord may even require you to carry it.

While commercial property insurance typically covers losses following certain natural disasters, it does not apply to damage from floods or earthquakes. Vehicle damage and cyber claims are typically not included, either.

3. Business interruption insurance

If your cafe is forced to close due to theft, arson, or certain natural disasters, business interruption insurance may be able to help you cover some expenses, up to your policy limits. These expenses typically include:

- Temporary relocation

- Payroll

- Operational expenses

- Loan payments and taxes

- Closure due to damage to a nearby building or business

- Training costs on new replacement equipment

Business interruption due to floods, earthquakes, and public health events isn’t eligible. However, it could be a lifeline for you, your employees, and your cafe in the event of a forced closure due to a covered event.

Optional add-ons and customizations

Depending on your cafe’s specific needs, you may want to expand your coverage to include some other common risks to small businesses. BOP insurance can be amended to include:

- Spoiled merchandise

- Equipment breakdown

- Forgery

- Employee theft

Cafes rely on costly specialized equipment and high-quality ingredients to deliver the best food and beverages possible. If your whole milk spoils or your espresso machine blows a gasket, it could slow or even shut down your business until replacements and/or repairs are dealt with. While these coverage add-ons aren’t required, they may help prevent you from paying out of pocket for common cafe problems.

Cafe Insurance Cost

The cost of insurance is difficult to predict without getting the full picture. It’s like making a complicated coffee drink without measuring your ingredients to keep your ratios in check. As with most types of insurance, the cost of cafe insurance coverage will depend on a variety of factors including:

- The coverage limits you select

- The location of your cafe

- The size and age of the cafe

- The value of your property

- Any previous claims associated with the cafe

- Any optional coverage you decide to add

One of the best ways to figure out how much a business owner’s policy for your cafe would cost is to get a quote. In certain cases, cafes and restaurants may be able to find coverage for as low as $575 a year, with the option to make interest-free monthly payments.

Ordering Large Coverage in a Small Cup

Everyone has a go-to cafe order that’s tried and true. Iced or hot, cream or oat milk, plain or sweetened. Each order is unique and tailored to fit that customer’s preferences. A business owner’s policy is just like that. BOP is a combination of coverage designed to suit just about any cafe or restaurant, but able to be modified to suit your business needs.

Are you ready to order?