How Much Does $1 Million in General Liability Coverage Cost?

Small Business information you can trust.

Updated June 2025 by Ed Grasso

Insuring 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

What Does it Mean to Have $1 Million in Liability Insurance?

A $1 million insurance policy generally means that your insurance will take care of any covered costs up to that amount that occur when that policy is in effect (usually a year).

Policies typically use two terms to better define their coverage:

$1 million per-occurrence limit. With a $1 million per-occurrence limit, your insurance policy will cover up to $1 million for a single incident that occurs while the policy is active.

$2 million aggregate limit. This means that over the course of a year-long policy, your insurer will pay a maximum of $2 million to cover multiple incidents.

Note that occurrence and aggregate limits may vary and are not always the amounts above.

What Does a $1 Million General Liability Policy Cover?

General liability can help cover a variety of claims, such as these:

Third-party

property damage

General liability policies can help cover expenses if you accidentally break, damage, or destroy a client’s personal property.

Third-party injuries

If a customer is injured at your office or work site, a general liability insurance policy can help cover their medical expenses.

Advertising injury

A GL policy can help cover claims and legal expenses if you’re sued because of your business’s advertising, marketing, or social activities.

Faulty products

If you sell a faulty product that causes bodily harm or damage to a customer’s property, a general liability can help cover claims and legal costs.

Business Insurance

A 1-minute explanation

Find out what General Liability covers, why you might need it, and how we can help – All in just 60 seconds.

How Much is General Liability Insurance?

Get a quick estimate in just 3 steps.

What Determines the Cost of General Liability Insurance?

The size of your physical location

If you have a large space, especially one that is open to the public, there’s more potential for accidents or damage. This can sometimes lead to a slightly higher insurance cost.

Your type of business

Some businesses, such as construction, have a higher risk of accidents than others, like an office-based business. Insurers consider this risk when determining your premium. The higher the risk, usually the higher the cost.

How much your business earns

Typically, the more revenue your business makes, the higher the cost of your insurance might be. This isn’t always the case, though. It depends on your specific industry. Some industries see only a small increase with more sales, while others might see a bigger jump as a result of the increased activity.

Where your business is located

Location matters. Local laws and the general environment of your area can affect your insurance costs. For example, businesses in high foot traffic or high-crime areas might requireneed more coverage.

Any claims you’ve had before

If you have a history of claims, some insurance companies might see your business as higher risk, which could affect your insurance cost. A clean claims history can lead to lower premiums.

How to Get a $1 Million General Liability Insurance Policy for Your Business

We’re small business insurance experts. We can make getting the coverage you need fast, easy, and understandable. We provide customized coverage options and quotes from top-rated small business insurers – all in just 10 minutes. More than 1 million small business owners worldwide trust us with their insurance, and we consistently earn high customer ratings and reviews.

We also have a team of licensed agents available on the phone to help you evaluate coverages and answer questions about your quotes. You can speak with them Monday-Friday, 8 a.m. to 6 p.m. ET.

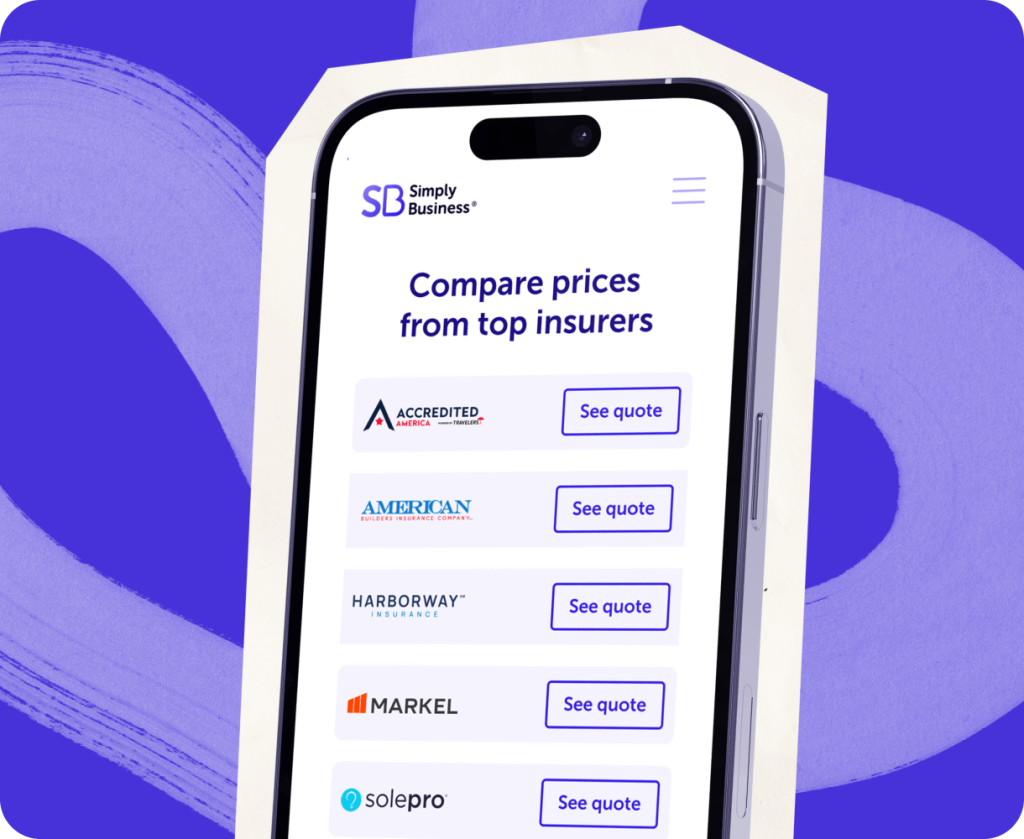

The Simply Business Difference

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you up with policies that fit your specific business, your risks, and your budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need coverage that can grow with you. Either way, we’re here to help — with a choice of affordable policies and small business expertise to help you get the coverage you need.

Small business insurance made simple.

Search

Answer a few questions and get coverage recommendations for your business.

Compare

View custom quotes from top-rated small business insurers.

Save

Choose your policy, many with up to 20% savings.*

Trusted by over 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

We’ve Got More Helpful Information About General Liability Insurance

Highly rated insurers. Handpicked for small businesses.

Highly rated insurers, handpicked for small businesses.

*Actual savings may vary based on the nature of your business, its location, and insurance provider appetite. Savings percentage is calculated using the average price difference of quotes from SB’s panel of insurance providers.