Janitorial Insurance Cost & Coverage Guide

Try our insurance calculator.

Get a quick estimate in just 3 steps. No obligation. No email required.

Insuring over 1 million small business owners worldwide.

Buy instantly online. No junk mail. No spam calls.

Janitorial Insurance Cost

As the owner of a janitorial business, you leave every space spotless. But on any job, accidents can happen. A client slipping on a wet floor, an employee having a reaction to a chemical, or damage from the wrong cleaning product can lead to thousands of dollars in unexpected costs. Janitorial insurance is your financial safety net, protecting your business from the risks you face daily so you can focus on making your clients shine.

This guide will break down the essential insurance coverages for cleaning businesses, what they typically cost, and how you can get the right protection. We’ve got you covered.

On This Page

Find the information you need quickly

How much does janitorial insurance cost?

Janitorial Insurance

Your work involves operating in your clients’ spaces, often after hours, using specialized equipment and chemicals. This exposes you to unique risks, from property damage to employee injury and even accusations of theft. Janitorial insurance is a suite of policies designed to protect your cleaning business from the financial consequences of these risks. Without it, you could be personally responsible for paying for costly legal fees, medical bills, and property replacement. Many commercial clients will require you to show proof of insurance before you can even start working.

How Much Does Janitorial Business Insurance Cost?

The cost of janitorial insurance varies, but most cleaning businesses pay a median price of $51 per month, or about $612 per year, for a policy package. Your final premium will depend on factors like your location, number of employees, the types of properties you clean (e.g., offices vs. industrial sites), and your claims history.

Here’s a look at the median costs1 for the most common policies janitorial businesses purchase.

| Insurance Policy | Median Monthly Cost | Median Annual Cost |

| General Liability | $42 | $504 |

| Workers’ Compensation | $89 | $1,068 |

| Tools & Equipment | $21 | $252 |

1Data from Simply Business customers specializing as a “janitor” who purchased at least one or a combination of general liability, tools and equipment, or workers’ compensation policies from July 1, 2024 to December 31, 2024. Reflected price tiers may not include purchase of all available policies under janitors insurance.

What Insurance Does a Janitor Need?

While every cleaning business is different, most professionals need a combination of the following coverages to be fully protected from common on-the-job risks.

General liability

This is the foundation of your protection. It covers costs related to third-party accidents, property damage, and bodily injury claims that happen as a result of your work.

Why You Need It: An office employee doesn’t see your “wet floor” sign, slips, and breaks their wrist. Your general liability policy can cover their medical bills and your legal defense costs if they file a lawsuit.

Median Cost: $42/month

Tools & Equipment (Inland marine)

Your industrial floor buffers, vacuums, and other cleaning equipment are expensive assets. This policy protects your gear from theft or damage, whether it’s at a client’s site, in your vehicle, or in storage.

Why You Need It: Your work van is broken into, and your commercial-grade carpet cleaner and floor polisher are stolen. This coverage can help pay for their replacement so you don’t have to absorb the full cost.

Median Cost: $21/month

Workers’ comp

If you have employees—even just one part-timer—most states require you to carry workers’ compensation. This policy covers medical bills and lost wages for employees who get injured or become ill on the job.

Why You Need It: One of your employees develops a severe respiratory reaction from inhaling chemical fumes in a poorly ventilated area. Workers’ comp can cover their doctor’s visits and a portion of their lost wages while they recover.

Median Cost: $89/month

Business Insurance Made Better

A one-minute explanation

Learn how we’re making finding business insurance fast, easy, and affordable — all in just 60 seconds.

Trusted by over 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

Frequently Asked Questions (FAQs)

The Simply Business difference

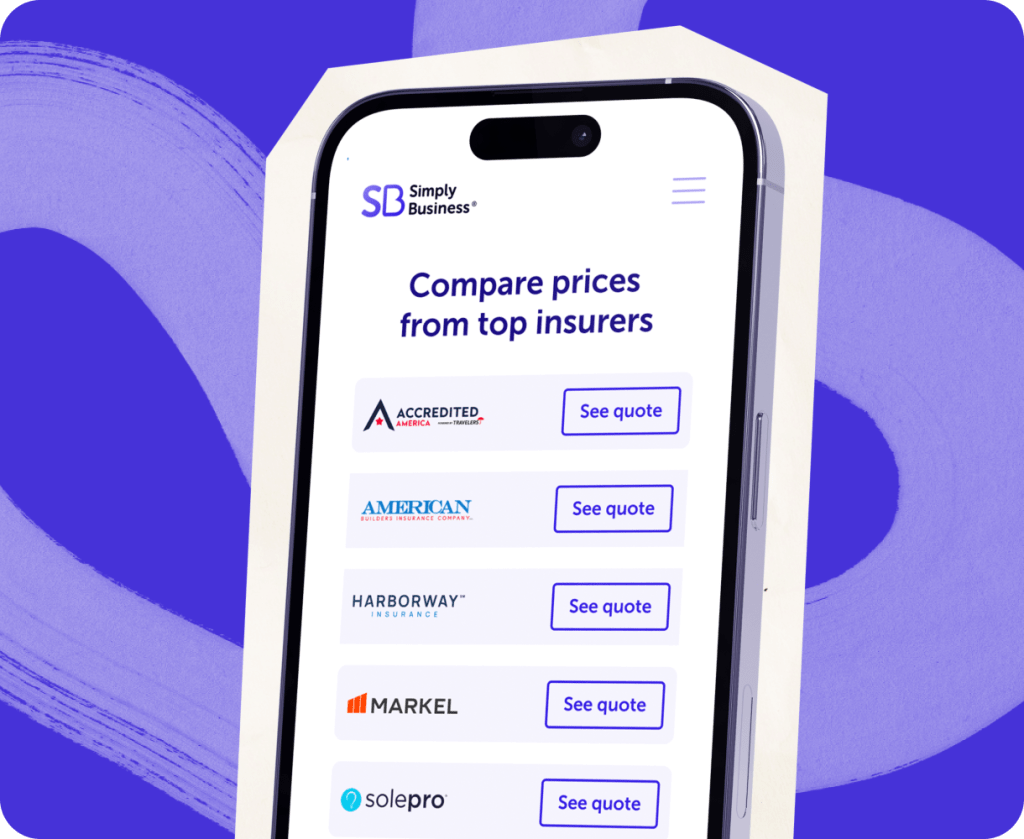

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you with policies that fit your specific business, your risks, and your budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need janitorial insurance coverage that can grow with you. Either way, we’re here to help –– with a choice of affordable policies and small business expertise to help you get the coverage you need.