Business Insurance Cost & Coverage Guide

Insuring 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

Small Business Insurance Cost

From damaged laptops to stolen gear and surprise legal fees, even a small setback can throw your small business off course. That’s where business insurance comes in — helping you stay covered so you can keep growing with confidence.

This guide breaks down what business insurance costs, what affects your business insurance price, and how Simply Business makes getting coverage easier and more affordable.

On this page

Find the information you need quickly

What is small business insurance?

How much is small business insurance?

How much will I pay for business insurance?

What affects business insurance costs?

What is small business insurance?

Small business insurance is designed to protect owners from financial losses caused by property damage, legal liability, and employee-related risks. It typically includes essential coverages like general liability, business owner’s policy, and workers’ compensation to ensure a company (of any size) can remain operational after an unexpected lawsuit or disaster.

Business Insurance Made Better

A one-minute explanation

Learn how we’re making finding business insurance fast, easy, and affordable — all in just 60 seconds.

How much is small business insurance?

Most small businesses pay around $29-$116 per month for core coverages (listed below). A bundled business owner’s policy (BOP) often falls around $61/month, but your price varies by industry, number of employees, limits/deductibles, location, and claims history.

There’s no one-size-fits-all policy, but here are some of the common coverage options our small business owners typically consider and the median cost:

General Liability

A foundational coverage to help handle costs from third-party accidents, property damage, and bodily injury.

The median cost is:

$41 per month and $492 per year.

Business Owner’s Policy (BOP)

General liability, property insurance, and more all in one convenient package.

The median cost is:

$61 per month and $732 per year.

Workers’ Compensation

Coverage to help take care of employees who get injured or sick on the job.

The median cost is:

$116 per month and $1,392 per year.

Professional Liability

Also known as errors and omissions insurance, this coverage can protect against damages and legal costs for mistakes or negligence claims.

The median cost is:

$56 per month and $672 per year.

Inland Marine

Also known as tools and equipment Insurance, this coverage can financially protect your tools, equipment, and inventory in transit, onsite, and at your business location.

The median cost is:

$29 per month and $348 per year.

Here’s a snapshot of how much our customers typically pay for business insurance:

Average Monthly Small Business Insurance Costs1

General Liability Insurance

$42/month

Business Owner’s Policy (BOP)

$57/month

Professional Liability or E&O Insurance

$61/month

1Data from Simply Business customers from July 1, 2024 to December 31, 2024.

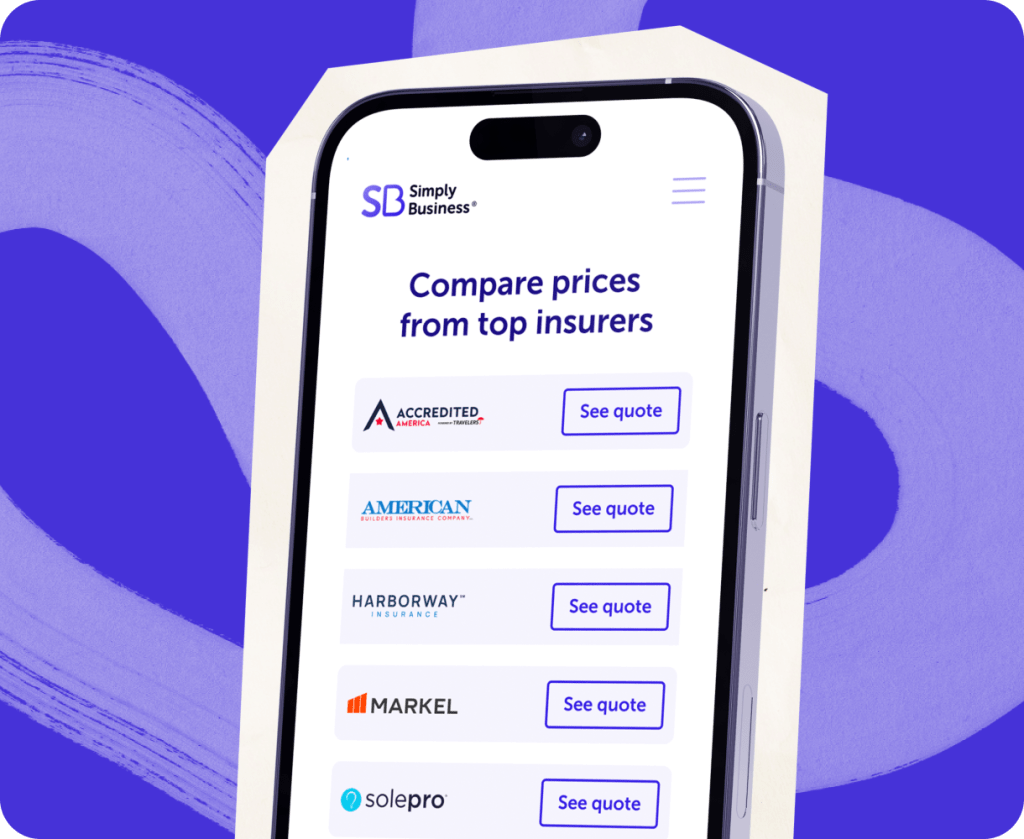

These numbers are based on actual policies purchased through our site. But getting a great premium isn’t just about the numbers — it’s about working with a partner that understands your business. And because we work with a range of trusted insurers, you’ll see coverage options to match your business, so you can choose a customized package that works for you and your budget.

How Much Will I Pay for Business Insurance?

Get a quick estimate in just 3 steps. No obligation. No email required.

What Affects Business Insurance Cost

If you’ve searched online for business insurance, you’ve likely seen a wide range of prices — and no clear reason why. The truth is there isn’t a set price, since the cost depends on several key factors, including:

- Type of work you do: High-risk jobs (like electrical or roofing) tend to cost more to insure than lower-risk work, such as IT consulting or photography.

- Business size: Solo business owners often pay less than those running busy shops, restaurants, or crews across multiple job sites.

- Location: Rates can vary by city or state based on local laws, industry risk, and foot traffic.

- Number of employees: More employees may mean more exposure to workplace injuries — and higher workers’ comp premiums.

- Coverage type & limits: The more protection you need — from general liability to workers’ comp or inland marine coverage — the more you’ll likely pay.

- Your claims history: If you’ve had previous claims, that may bump up your rate.

- Your experience: Have you been in business for years with no claims? That could work in your favor.

How to save on business insurance

Shop around

Simply Business provides customized coverage options from top-rated small business insurers — all in just 10 minutes. We do all the leg work so you can sit back, compare quotes, and save.

Trusted by over 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

The Simply Business difference

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you with policies that fit your specific business, your risks, and your budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need coverage that can grow with you. Either way, we’re here to help –– with a choice of affordable policies and small business expertise to help you get the coverage you need.