Errors & Omissions Insurance Cost

Insuring over 1 million small business owners worldwide.

Buy instantly online. No junk mail. No spam calls.

Errors & Omissions Insurance Cost

Each business owner has their own strengths, skills, talents, and vision for their business. But the one thing they all have in common is the potential to make a mistake. While mistakes can be a great way to learn, they also can be costly for your business. This guide breaks down what errors and omissions (E&O) insurance typically costs, what affects the price, and how Simply Business makes getting coverage easier and more affordable.

What is Errors and Omissions Insurance?

Errors and omissions insurance, also known as professional liability insurance, can help financially protect your business from mistakes and errors. Even if you don’t believe you’re in the wrong, you could still face a claim. This type of coverage covers the costs of legal claims or damage caused by errors or unintentional omissions from your work.

Errors and Omissions

A one-minute explanation.

Find out what errors and omissions and professional liability insurance cover, why you might need it, and how we can help — all in just 60 seconds.

How much does errors and omissions (“E&O”) insurance cost?

Most of our small business customers pay under $95 per month for E&O insurance. However, the price is tailored to your specific business.

Here’s a snapshot of what our customers typically pay for E&O insurance:1

Monthly Errors and Omissions Insurance Costs1

Under $25

5% of customers

$25 to $95

83% of customers

Over $95

12% of customers

1Data from Simply Business customers who purchased an E&O policy from July 1, 2024 to December 31, 2024

How Much Will I Pay for E&O Insurance?

Get a quick estimate in just 3 steps. No obligation. No email required.

Which trade has the highest premiums?

The type of work you do plays a big role in your insurance premium. For example, if you’re a consultant or real estate agent, you might pay more because there’s more risk involved. But if you’re a notary or insurance agent, your risk is generally lower — so your premium may be as well.

| Profession | Median Monthly Cost2 |

|---|---|

| Business consulting | $47 |

| Tax preparation | $33 |

| Insurance professionals | $71 |

| Bookkeeping | $28 |

| Real estate agents/brokers | $48 |

| Land surveyors | $159 |

| Business consulting | $47 |

2Data from Simply Business customers who purchased an E&O policy from July 1, 2024 to December 31, 2024.

Which location has the highest premiums?

Your errors and omissions insurance price can vary, based on where you work. In some states, certain professions are required to carry this type of coverage as part of their professional licensing requirements.

Below are examples of the median cost of errors and omissions insurance across different states:

| State | Median Monthly Cost3 |

|---|---|

| New Jersey | $44.67 |

| Florida | $41.67 |

| New York | $41.67 |

| Washington | $34.42 |

| Georgia | $37.50 |

| Pennsylvania | $36.25 |

| Texas | $35.08 |

| California | $33.33 |

| North Carolina | $33.33 |

| Virginia | $33.33 |

3Data from Simply Business customers who purchased an E&O policy from July 1, 2024 to December 31, 2024.

What Affects the Cost of Errors & Omissions Insurance?

Number of employees

You’re not the only one who’s human. Mistakes can happen to others, such as your employees. And the more employees you have, the more chances there are for something to go wrong. That’s why insurers may ask how many people work for you when calculating your premium.

Policy limits

Higher coverage can offer more protection, but it usually means a higher premium.

What else can affect the price?

- Your claims history: If you’ve had previous claims, that might increase your premium.

- Your experience: Have you been in business for years with no claims? That could work in your favor.

How to Save on Errors and Omissions Insurance

Trusted by Over 1 Million Small Businesses Worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

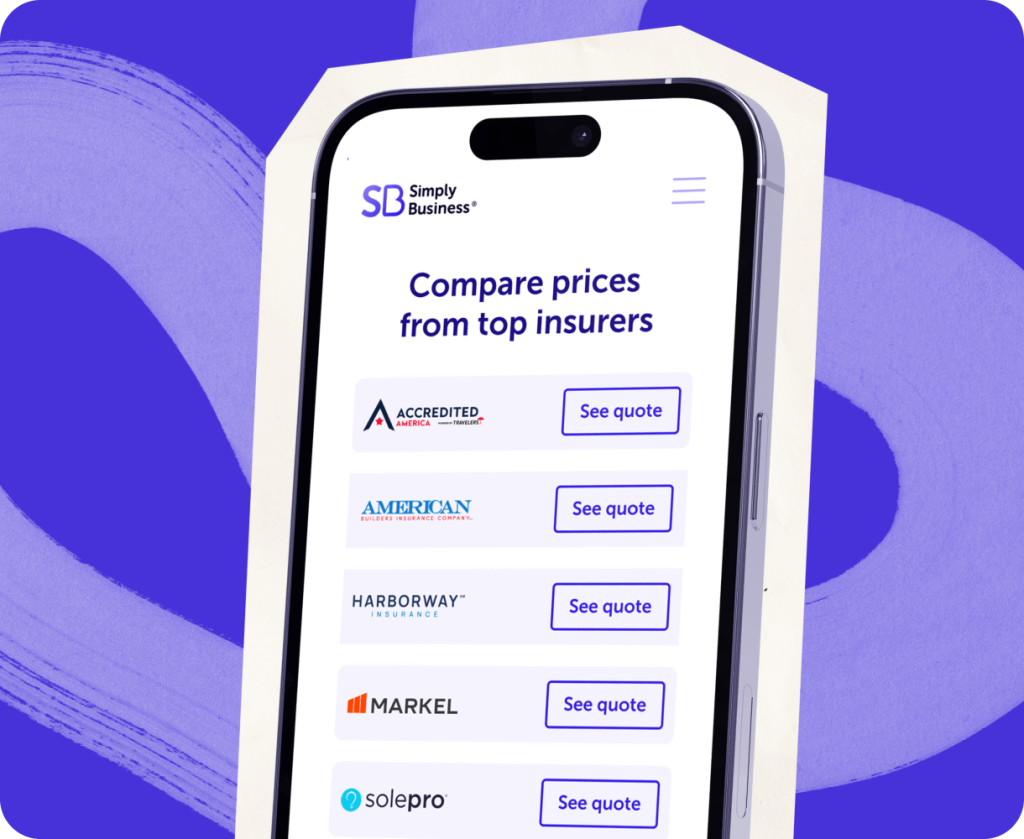

The Simply Business Difference

We make small business insurance simple — so you can get covered without the hassle. We’re a digital insurance brokerage. That means we’re not tied to one insurance provider. Instead, we partner with a range of top-rated carriers. With one easy form, you can compare quotes and choose coverage that fits your business, your risks, and your budget.

No hidden costs. No guesswork. Just clear, affordable options built for small business owners like you — so you can move forward with confidence, knowing you’re not overpaying.