General Liability Insurance Cost

Insuring 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

General Liability Insurance Cost

General liability is like a safety net for your business. If a customer gets hurt or their property is damaged, this coverage type can help cover the costs so you can stay focused on what you do best – growing your business. This guide will break down what general liability typically costs, what affects the price, and how to find the right coverage.

What is general liability insurance?

General liability insurance can help small businesses cover the costs of claims, medical bills, legal expenses, and more. This business insurance also typically helps cover your employee or employees if they cause damage. Some common things that general liability insurance covers include third-party property damage, third-party injuries, advertising injuries, and faulty products.

General Liability Insurance

A one-minute explanation

Find out what general liability insurance covers, why you might need it, and how we can help – All in just 60 seconds.

How much does general liability insurance cost?

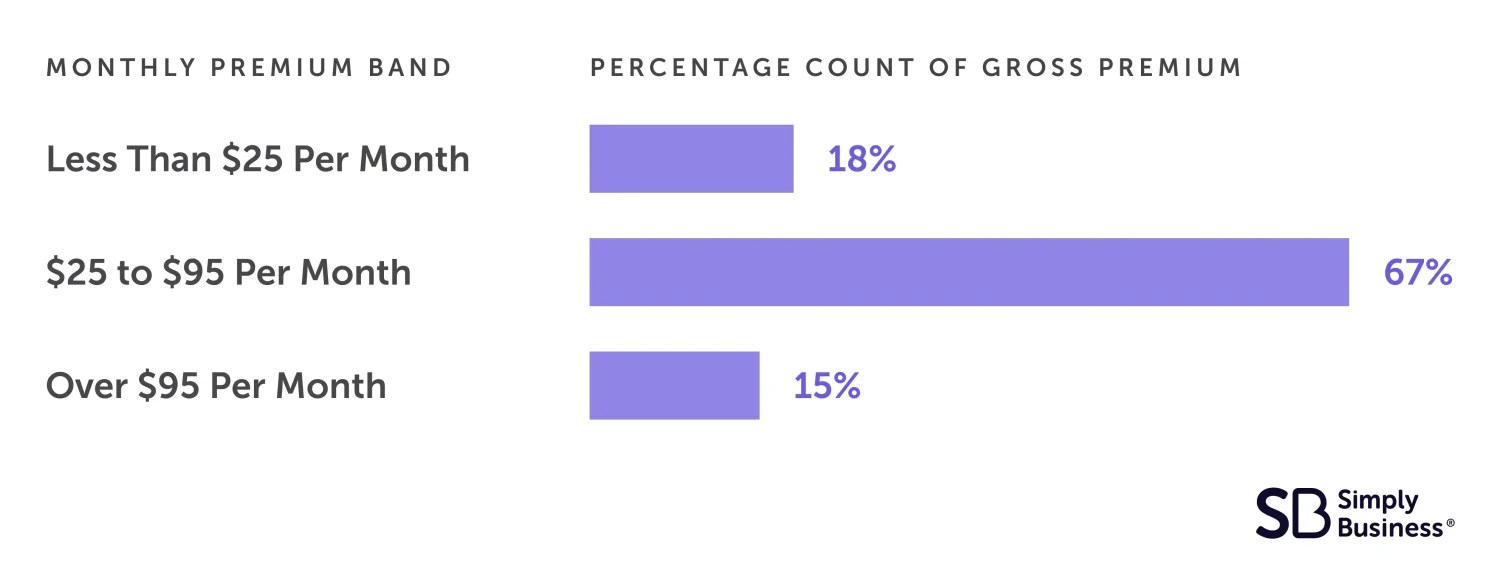

Most of our customers pay less than $95 per month for general liability insurance. However, your final premium will depend on your industry, location, payroll size, and claims history.

Here’s a snapshot of what our customers typically pay for general liability insurance:1

Monthly General Liability Insurance Costs

Data from Simply Business customers who purchased a GL policy from July 1st, 2024 to December 31st, 2024.

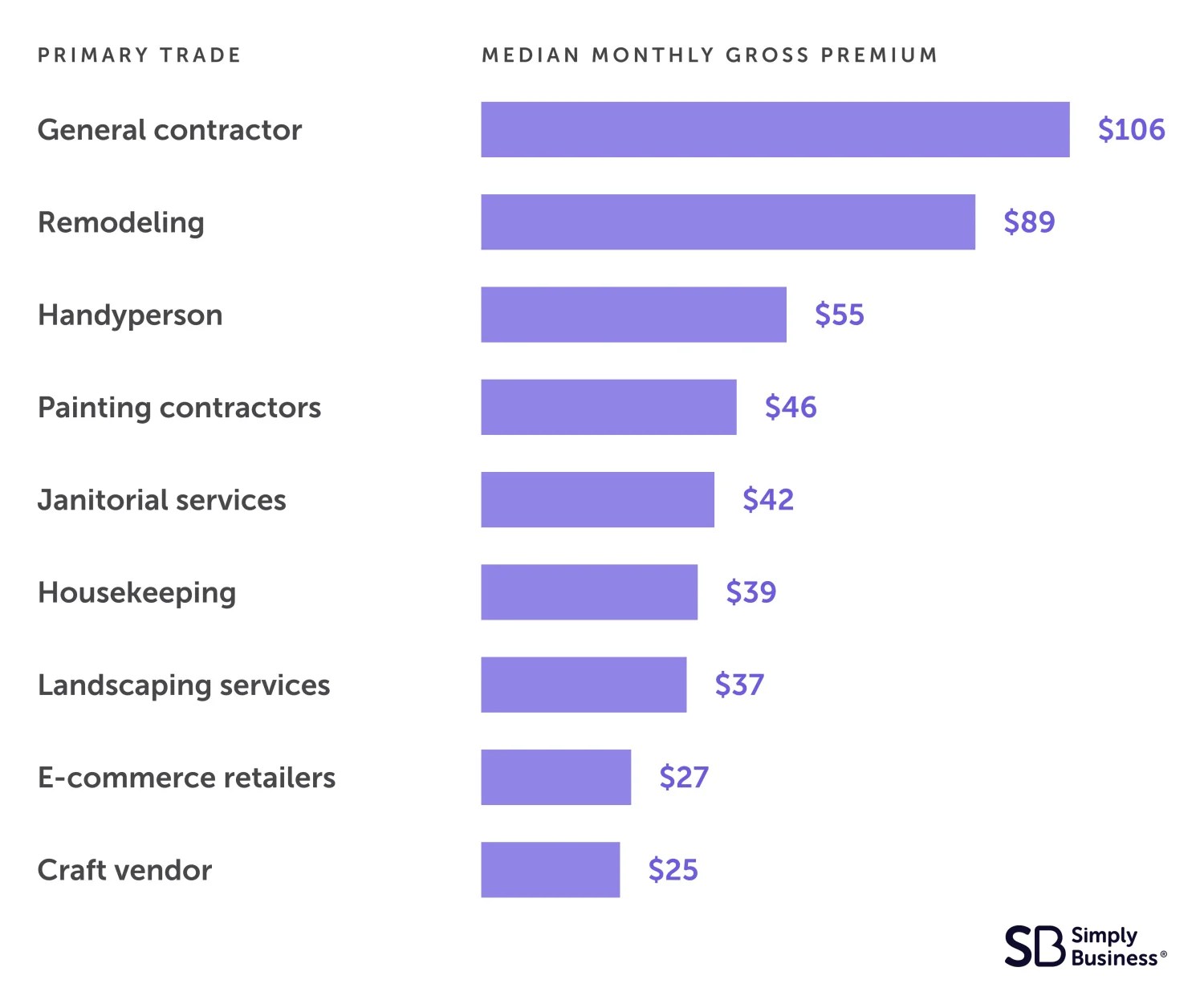

Which trade has the highest premiums?

General liability costs vary by trade and the type of work you do. Here’s a list of the median monthly costs for some of the trades we service.

Top Trades Median Monthly Premium

Median data from Simply Business customers in these sample trades who purchased a GL policy from July 1st, 2024 to December 31st, 2024.

Which locations have the highest premiums?

Premiums vary by the state you work and live in. Here’s a look at the median monthly cost for many of the states we serve.

State

Median Monthly Cost

New Jersey

$78

Florida

$60

South Carolina

$52

Colorado

$51

Georgia

$50

Texas

$49

New York

$42

North Carolina

$42

Pennsylvania

$42

California

$38

Median data from Simply Business customers in some of the most popular states who purchased a GL policy from July 1st, 2024 to December 31st, 2024.

How much will I pay for general liability insurance?

Get a quick estimate in just 3 steps. No obligation. No email required.

Why do prices vary so much?

If you’ve searched online for general liability insurance, you’ve likely seen a wide range of prices — and no clear reason why. The truth is there isn’t a one-size-fits-all price for general liability since the cost depends on several key factors.

We’re dedicated to helping make business insurance easy to understand, so we’ve spelled out some of the particulars, such as:

Your industry

The type of work you do plays a big role in your insurance rate. For example, if you run a construction, landscaping, or cleaning business, you might pay more since there’s more risk involved. If you’re a freelance consultant, IT pro, or work from home, your risk is generally lower — so your premium may be too.

Your location

Where your business operates matters. Factors that can impact cost include:

- Amount of foot traffic (more chances for accidents)

- Local regulations

And yes, the state where you work or live can make a difference too. Rates vary a bit across the country, even for the same type of business.

Policy limits

Higher coverage usually means a higher premium. But it also means more protection if something goes wrong. Most small businesses go with a $1 million or $2 million policy. It’s solid protection for many types of lawsuits or accidents without overdoing it. In fact, 97% of our customers choose the $1 million level of coverage.

What else can affect the price?

- Your claims history. If you’ve had past claims, that might bump up your rate.

- Your experience. Have you been in business for years with no claims? That could work in your favor.

How to save on general liability insurance

Reduce your risks

Fewer claims can mean lower rates. That’s why risk management should be a top priority:

- Train your team on safety procedures and best practices.

- Invest in security, like surveillance cameras or alarm systems.

- Create clear policies for workplace conduct, social media use, and customer interactions.

- Keep your space safe by minimizing risks like trip hazards.

- Weatherproof your business to protect it from rain, snow, or wind-related damages.

- Learn from past claims and put steps in place to prevent future mishaps.

Pay monthly

Some carriers offer monthly payments, which you can take advantage of to spread the cost out over the year.

Shop around

Simply Business provides customized coverage options from top-rated small business insurers — all in just 10 minutes. We do all the leg work so you can sit back, compare quotes, and save.

Trusted by Over 1 Million Small Businesses Worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

The Simply Business Difference

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you with policies that fit your specific business, your risks, and budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need coverage that can grow with you. Either way, we’re here to help — with a choice of affordable policies and small business expertise to help you get the coverage you need.

More General Liability Insurance FAQs

What is general liability insurance?

It’s a type of insurance that can help cover the cost of third-party accidents, property damage, bodily injury, or related lawsuits.

Why do I need general liability insurance?

Because even a single accident or lawsuit could cost your business thousands out of pocket. General liability insurance helps protect you from a financial hit like that — so that one mistake doesn’t turn into a major setback.

What does general liability insurance cover?

Typically covered

Customer injuries, damaged property, legal fees, and more. Say a client trips and falls in your shop, or you accidentally ding their car on the jobsite — general liability could help cover the cost.

Typically not covered

Employee injuries, auto accidents, or damage to your own property — that’s where other types of business insurance come in.

Is it required in my state?

It depends on your state and industry. But whether it’s required or not, we strongly recommend having coverage. In fact, many clients and landlords may require it before doing business with you.

Is it tax deductible?

Yes — general liability premiums are usually considered a business expense. But always check with your accountant for certain.

How fast can I get a quote?

You can get a full quote in about 10 minutes — and an estimate even faster, with just 3 quick questions.

What other insurance might I need?

That depends on your business. You can explore more here.