Public Liability Insurance

Small Business information you can trust.

Updated June 2025 by Ed Grasso

Insuring 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

What is Public Liability Insurance?

Public liability insurance is an older term that’s now more commonly referred to as “general liability insurance.” It protects your business if a member of the public gets hurt or their property is damaged as a result of your business activities. It’s often bundled with other types of business insurance. If the accident happens on your business property, you might hear it named “premises liability.” This means it covers accidents that happen right where your business is located.

Public liability is often part of a larger insurance package named commercial general liability. You might also find it bundled with business property insurance or in a business owner’s policy (BOP). A BOP can be a great way to save money by getting multiple types of insurance together.

What Does Public Liability Insurance Cover?

Public liability insurance helps pay for costs if a member of the general public gets hurt or their property is damaged as a result of something your business did. This includes accidents that happen:

- At your business location: Such as your store, office, or workshop.

- At other places where you work: For example, if you’re a plumber and accidentally damage a customer’s sink while fixing their pipes in their home.

Here’s what it typically covers when someone makes a claim:

- Medical bills: If someone gets hurt, it can help pay for their medical treatment.

- Repair or replacement costs: If you damage someone’s property, it can help pay to fix it or replace it.

- Legal fees: If someone sues you, it can help pay for a lawyer and other legal costs, up to your policy’s limit. This also covers accidents that you or your employees cause when visiting a customer’s property.

We are fully dedicated to small businesses.

What Does Public Liability Insurance Not Cover?

It’s important to know what this insurance doesn’t cover. It won’t pay for:

- Your own injuries: If you get hurt, you’ll need other types of insurance (e.g. health insurance).

- Damage to your own business property: For that, you might need property insurance.

- Injuries to your employees: If an employee gets hurt on the job, you need workers’ compensation insurance.

How Does General Liability Insurance Help Cover Claims?

With general liability coverage, the insurance company steps in to help you with lawsuits. They can help you find a lawyer, and sometimes, they can even help you avoid going to court at all.

If you’re sued, your insurance company can help negotiate a settlement without going to court. This can save you a lot of time and money compared to a full court case.

For all the examples above, your insurance company would help cover legal costs that could include:

- Paying for a lawyer to represent your business in court;

- Covering court costs; and

- Paying the final amount if the judge or jury says you owe money (up to your policy’s’s limit).

Interested in learning more? See our guide on liability for business owners.

What Businesses Need Public Liability Insurance?

Sole proprietors, partnerships, LLCs, and more. Public liability insurance, as part of a general liability policy, is a coverage we recommend for just about any business.

We cover 400+ types of businesses. Including yours.

How Much is Public Liability Insurance?

You can get public liability coverage as part of a general liability policy. Here’s a snapshot of what our customers typically pay for general liability insurance:

Monthly General Liability Insurance Costs1

Less than $25 per month

18% of customers

$25 to $95 per month

67% of customers

Over $95 per month

15% of customers

1Data from Simply Business customers who purchased a policy from July 1st, 2024 to December 31st, 2024

What you pay depends on a few key things, including: your industry, location, and how much coverage you choose. But most small businesses will pay less than $95 per month.

These numbers are based on real policies purchased through our site. But getting a great premium isn’t just about the numbers — it’s about working with a partner that understands your business. And because we work with a range of trusted insurers, you’ll see options to match your business, so you can choose a policy that works for you and your budget.

How Much is General Liability Insurance?

Get a quick estimate in just 3 steps.

The Simply Business Difference

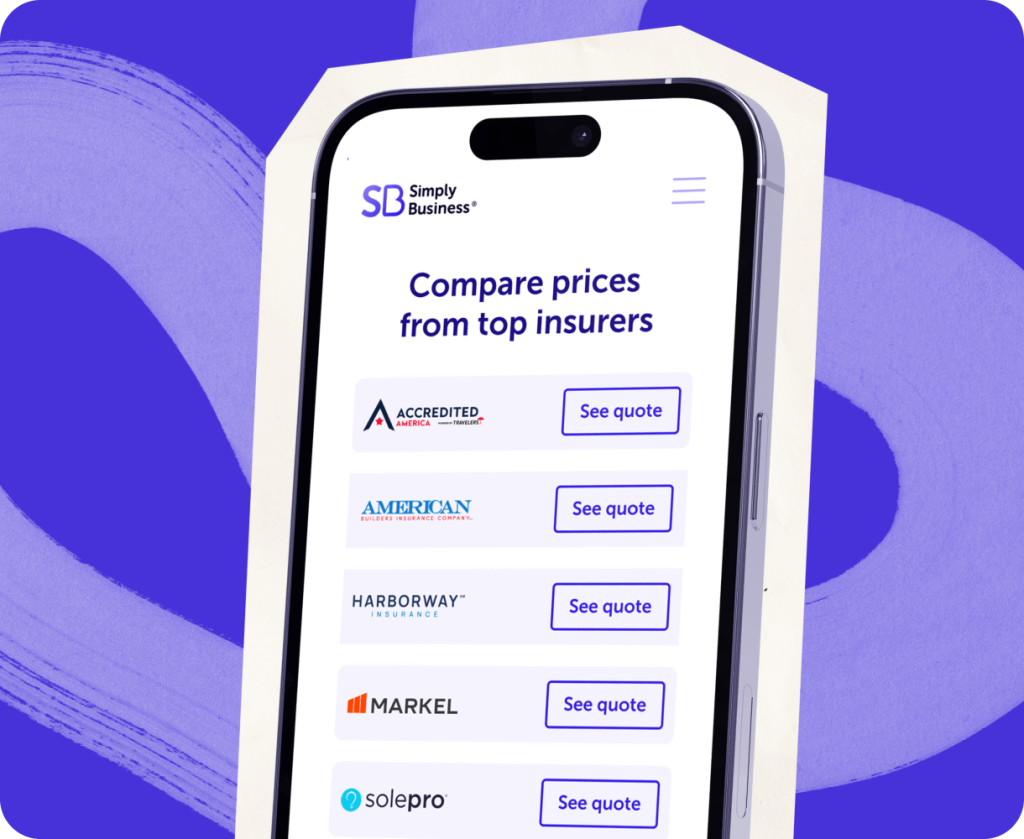

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you up with policies that fit your specific business, your risks, and budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need coverage that can grow with you. Either way, we’re here to help — with a choice of affordable policies and small business expertise to help you get the coverage you need.

Small business insurance made simple.

Search

Answer a few questions and get coverage recommendations for your business.

Compare

View custom quotes from top-rated small business insurers.

Save

Choose your policy, many with up to 20% savings.*

Trusted by over 1 million small businesses worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

We’ve Got More Helpful Information About General Liability Insurance

Highly rated insurers. Handpicked for small businesses.

Highly rated insurers, handpicked for small businesses.

*Actual savings may vary based on the nature of your business, its location, and insurance provider appetite. Savings percentage is calculated using the average price difference of quotes from the Simply Business panel of insurance providers.