Compare workers’ comp quotes. Tailored coverage as low as $47/mo. Get an Affordable Quote →

Want better business insurance? Meet

Simply Business.

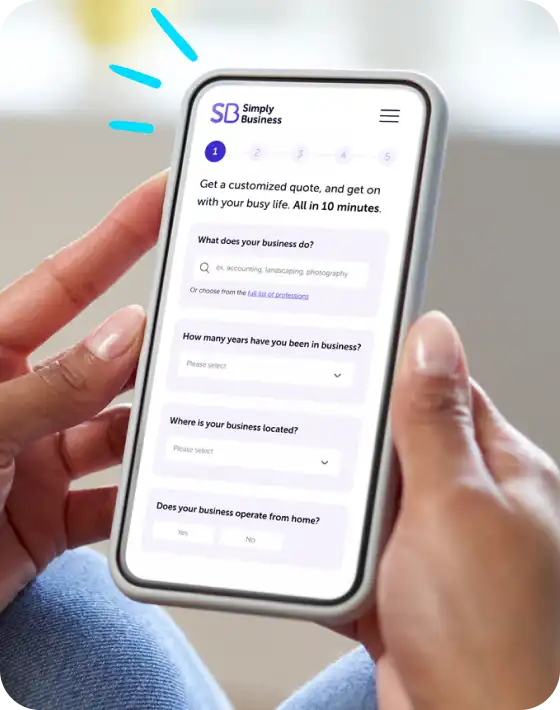

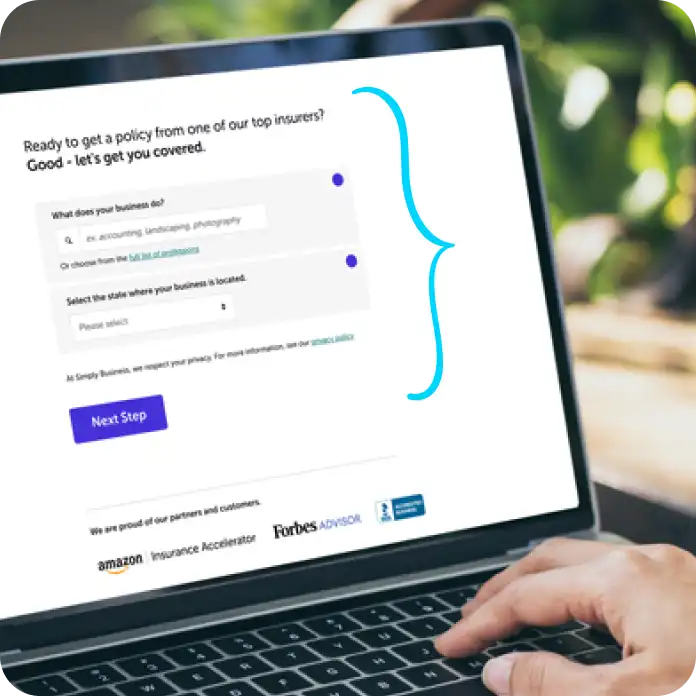

Tell us a little about your business. We do the legwork. You choose the policy that’s right for you. Online or on the phone.

This block is configured using JavaScript. A preview is not available in the editor.

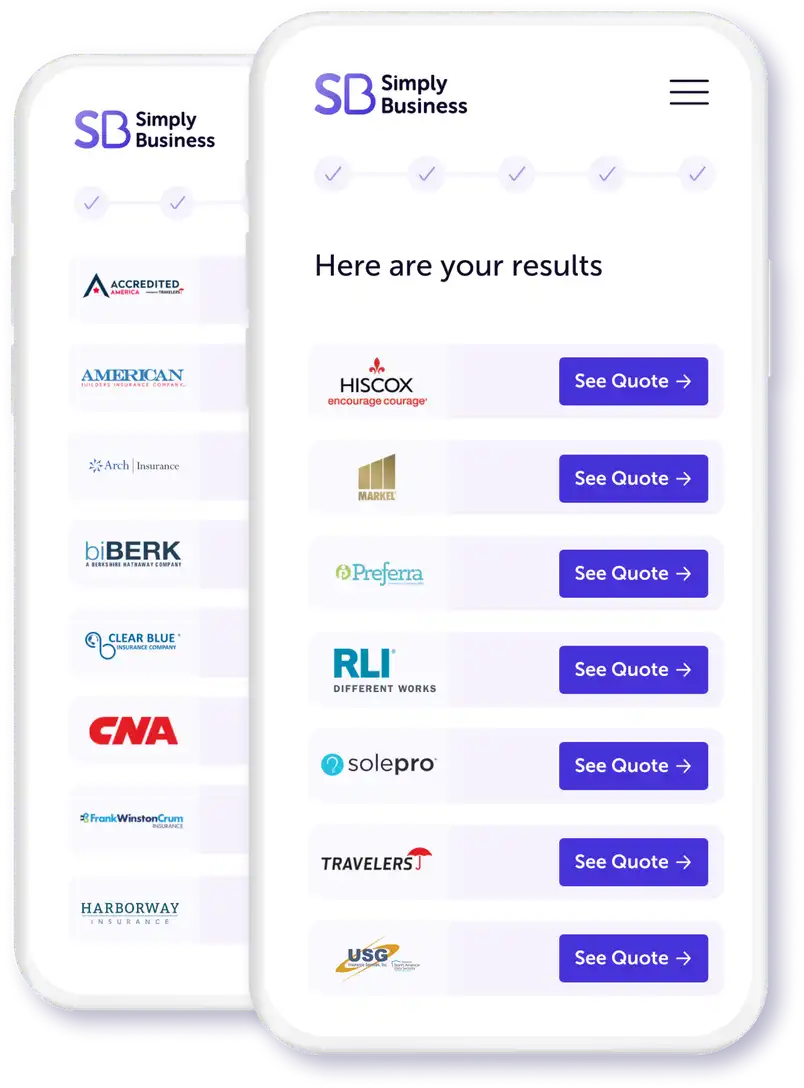

We are proud of the partners we work with.

Here’s how we get you covered

Tell us a bit about your business

Straightforward questions to help you figure out what you need. And just a few minutes to complete.

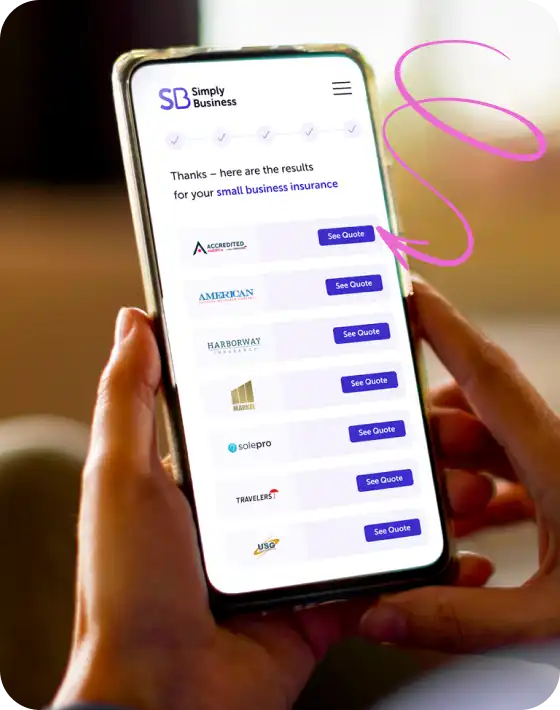

Select your insurer and price

Powerful technology lets us search among leading national insurers to find you coverage. You just choose the policy and price that’s best for you.

Get back to running your business

Your certificate of insurance (COI) and other policy documents are just minutes away from your inbox.

Protect your business with these policies

We specialize in finding coverages for small businesses.

Workers’ Compensation Insurance

Protect your business and help take care of employees who get sick or injured on the job.

Professional Liability Insurance

Nobody’s perfect. Get coverage for damages and legal costs for mistakes or negligence claims.

General Liability Insurance

A workhorse coverage to help handle costs from third-party accidents, property damage, and bodily injury.

Errors & Omissions Insurance

Cover the costs of legal claims or damage caused by errors or unintentional omissions from your work.

Choose your business type to get started

Don’t see your business here? No worries. We cover hundreds of types of businesses.

We’re different.

We’re built for small businesses.

You’re different, too

It’s your business. It should be your insurance as well. We offer the coverages small businesses need most. And you tailor the coverage for what you do and what you need.

We do the heavy lifting

We check availability and prices from top national carriers for you. No running around. No multiple forms to complete. And no annoying calls and emails from dozens of companies.

We’re insurance pros and small business champions

We’ve got an ever-expanding online resource center with helpful articles for starting and running a business. We’ve got free tools and templates. And we’ve got guides for businesses in every state in the U.S.

Frequently asked questions

How deep is the ocean? How high is the sky? Life comes with questions.

We’ve got answers to some of the business insurance ones.

What you do, how many employees you have, and other aspects of your business play into how much coverage you may need. With our online quote tool, we can quickly get the info we need to help find professional liability coverage for your business.

Good news! You can usually deduct insurance premiums as a business expense. As always, we recommend talking to an accountant or tax professional about your business tax returns. And if you have any business insurance questions, we’re here to help!

In most cases, yes. The IRS considers your policy payments to be a business expense. Keep in mind that you should always seek out the advice of an accountant or tax professional when filing your business taxes.

A lot depends on the type of business you own, the services you provide, and how many employees you might have. Not to worry. Small business insurance (like General Liability and Workers Comp) is all we do, so we can get you covered fast and easily online or on the phone.

Like many other insurance premiums, your workers’ comp premiums likely qualify as a business tax deduction. As with anything related to taxes, it’s a good idea to talk with an accountant or other tax professional who is familiar with your business.

Businesses are different. Coverages are different. So costs can vary as well. But that’s why we’re here. We get small business. So we can get you covered quickly, easily, and affordably. Online or on the phone.

Our customers. Unfiltered.

We like positive reviews, but we really love honest ones.

They help us make insurance better.

This block is configured using JavaScript. A preview is not available in the editor.

Delivering more choice.

We shop the nation’s leading insurers. You choose the coverage & price that’s best for you

Simply Business is pleased to provide tailored insurance options from: