Carpenter Insurance

Find out which carpenter insurance coverage you need. Compare policies from leading national insurers. Get a quote in just minutes.

Protection starting at:

$42.62

/ mo*

Coverage Limits: $1M to $2M

Can help cover claims of accidental damage to a customer’s property, such as dents to walls or floors.†

Over 1 million customers worldwide.

Buy instantly online.

Carpenter Insurance

Find out which carpenter insurance coverage you need. Compare policies from leading national insurers. Get a quote in minutes.

Protection starting at:

$42.62

/ mo*

Coverage Limits: $1M to $2M

Can help cover claims of accidental damage to a customer’s property, such as dents to walls or floors.†

Over 1M customers worldwide.

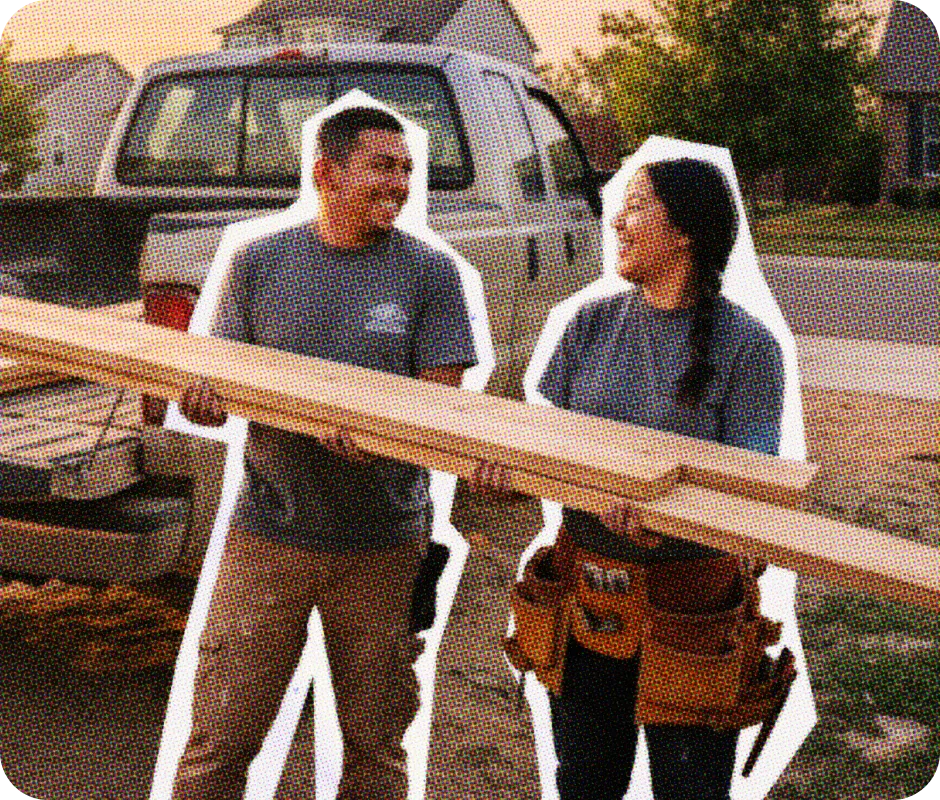

Why Does a Carpenter Need Insurance?

As a carpenter, every project demands precision, craftsmanship, and care. But even the best preparation can’t prevent every setback. From accidental damage to a client’s property, stolen tools, or jobsite injuries, carpenter insurance can help protect your business and keep you building with confidence.

What Type of Carpenter Insurance Do I Need?

General Liability Insurance

A foundational carpenter insurance coverage to help handle costs from third-party accidents, property damage, and bodily injury.

Business Owner’s Policy (BOP)

General liability, property insurance, and more all in one convenient package.

Workers’ Comp Insurance

Coverage to help take care of employees who get sick or injured on the job. Most states require this coverage for small businesses with full- or part-time employees. It also can benefit business owners who don’t have employees.

Contractor’s Equipment and Small Tools Insurance

Also known as inland marine insurance, this coverage can financially protect equipment and inventory that’s in transport or stored offsite.

Business insurance —

a one-minute explanation

Learn more about policies for small businesses, what they cover, why you might need them, and how we can help — all in just 60 seconds.

What Does Carpenter Insurance Cover?

From custom cabinets to backyard decks, quality carpentry can transform a client’s home. But without the right insurance, one mishap could leave you footing the bill. Here’s how carpenter insurance can help protect against some of the most common risks you may face:

Damage to someone else’s property

While fitting baseboards in a living room, your nail gun slips from the ladder and dents in the homeowner’s new hardwood floors. A general liability policy could help cover those types of third-party claims.

Protection for your business property

A late-night electrical fire breaks out in your workshop destroying stacked lumber, hand tools, and a nearly finished set of built-in shelves. A business owner’s policy (BOP) bundles general liability, commercial property protection, and business interruption coverage to help pay for cleanup, material replacement, and lost income — so you can get back to building for your clients quickly. Commercial property protection can also cover tools or equipment that are stolen.

Many carpenters choose a BOP because it offers more protection than a stand-alone general liability policy without usually costing much more — a great option if you’re established or planning to grow.

Care for sick or injured employees

One of your crew is ripping boards on a table saw when their hand slips, causing a serious cut that requires stitches. Workers’ compensation insurance can help cover their medical bills and provide wage replacement as they recover.

Workers’ comp is often legally required and can protect your business from costly claims, as well as taking care of your crew if they get sick or injured on the job. Even if you operate solo, we recommend workers’ comp, because many health insurance policies won’t cover work-related injuries.

Damaged or stolen equipment

You return to a remodel the next morning and discover your miter saw and cordless drill set are missing from the on-site storage area. If you have a general liability policy, adding contractor’s equipment and small tools coverage, also known as inland marine insurance, can help pay to replace or repair your stolen or damaged equipment, whether it’s on the move or at a jobsite.

Honest mistakes and negligence claims

Even seasoned carpenters can face disputes over workmanship. Suppose you install a set of custom cabinets, but within weeks the doors don’t close properly, and the client demands that you repair them. Adding a contractor’s errors and omissions endorsement to your general liability policy could help cover repair costs and protect you against a negligence claim.

Peace of mind for your clients

You’re contracted to build a large home addition, and the homeowner wants assurance the work will be completed on time and to code. That’s where a surety bond comes in. It’s a financial guarantee that protects your client if you can’t meet your contractual obligations. If the job isn’t finished or doesn’t meet agreed-upon standards, the bond can compensate the client for their losses.

How Much is Carpenter Insurance?

Try our carpenter insurance calculator

Get a quick estimate in just 3 steps.

Answers to More Carpenter Insurance Coverage Questions

Feel confident in your choice.

We partner with a range of top-rated carriers and use smart technology to match you with policies that fit your specific business, your risks, and budget.

400+

business types covered

4.6/5

customer rating on Trustpilot

1M+

customers worldwide

18

top-rated small business

insurance providers

More Helpful Information for Carpenters

*The displayed price for each product is a monthly estimate calculated from the 10th percentile of relevant policies sold by Simply Business (e.g., General Liability data is used for General Liability estimates). This estimate uses data from relevant policy sales between January–June 2025. Final price and payment terms, which may include an initial down payment, are subject to change based on your state, selected insurance provider, and specific business details.

† Limits may vary by state and nature of your business.