Insure your

small business in minutes.

Fill out one form, compare quotes from top-rated insurers, and get proof of insurance instantly.

Exclusively dedicated to small business

Available online 24/7

Rates as low as $20.75/month*

Exclusively dedicated to small business

Same day proof of insurance

Rates as low as $21/month*

Insuring over 1 million small business owners worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

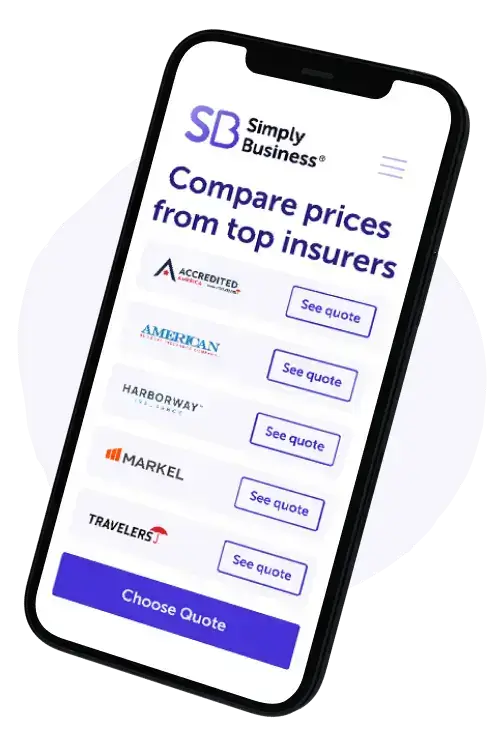

Highly rated insurers. Handpicked for small businesses.

Highly rated insurers, handpicked for small businesses.

Buy Small Business Insurance Online

General Liability

Coverage for third-party accidents, property damage, and bodily injury. This policy is the most common type of insurance for many small businesses.

Professional Liability

Coverage for damages and legal costs due to mistakes or negligence claims. This policy is often recommended for businesses that provide advice and guidance to their clients.

Workers’ Compensation

Coverage to help take care of employees who get sick or injured on the job. Many states require this for businesses with full or part-time employees.

Business Owner’s Policy (BOP)

General liability, property insurance, and more all in one convenient package. A BOP policy typically lets you add different types of coverage to meet the needs of your specific business.

We cover 400+ types of businesses

Don’t see what you’re looking for? No worries. You can find more businesses here.

Business insurance simplified

Tell us about your small business

Receive and compare quotes from top-rated insurers

Get back to what matters — your business

We’ve helped insure more than 1 million small businesses, worldwide.

See what some of them have to say.

This block is configured using JavaScript. A preview is not available in the editor.

Frequently asked questions

Simply provide some information about your business and we’ll search for the coverage your business may need from leading insurers. Then, you choose what works best for you.

We recommend our online quote tool. It’s easy to use and can provide you with a quote in just 10 minutes.

See our average business insurance costs here, but in general business insurance premiums are based on several factors, including:

- What your business does

- Where your business is located

- How many employees you have

- Your estimated revenue

Premiums also can vary among insurers, which is why we work with a variety of different providers to help find the coverage and price that works for you.

You can download a copy of your certificate of insurance (COI) to your computer or mobile wallet 24/7 using your Simply Business online account.

Currently every state, except Texas, requires most employers to purchase workers’ compensation insurance. You can learn more here.

It depends on your type of business, but we typically recommend both general liability and professional liability insurance. You can get expert recommendations by using our online quote tool.

*Displayed price is an estimate based on the 10th percentile of General Liability policies sold by Simply Business between January – June 2025, divided evenly across a 12 month policy term. Actual price and payment terms, including an initial down payment, may vary based on your state, insurance provider, and business.

†Prices, costs, premiums, savings and coverage displayed on this website before receiving a bindable quote are estimates only and may not be available. Actual prices, costs, premiums and savings, and the availability of coverage may vary by state, insurance provider, and nature of your business. Our website contains general descriptions of coverage however your coverage is subject to the terms and conditions of the policy you purchase. Policies are underwritten by third-party insurance providers, and each provider handles claims on its own policies.