Monkey Business Images // Shutterstock

Household spending on restaurant food has grown at a faster rate than spending on groceries since restaurants began recovering from the COVID-19 pandemic, according to a Simply Business analysis of recent data from the Census Bureau and the Department of Agriculture.

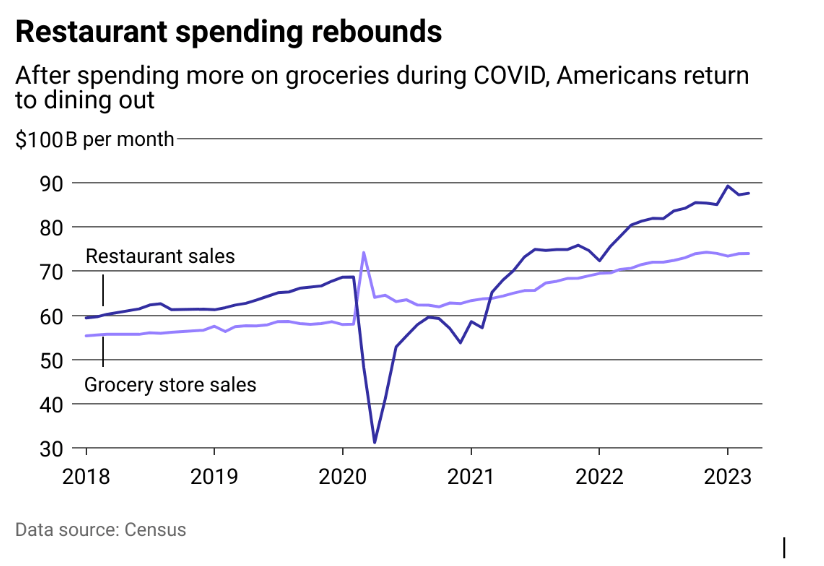

So far this year, Americans are spending about $73 billion on groceries per month, compared to $88 billion on restaurants. The upward trend seen in restaurant spending that began in 2021 has only been stifled by each subsequent wave of COVID-19 variants, including the omicron wave in winter 2022.

Inflated prices for everything including food, labor, and even the gas required to get to and from grocery stores and restaurants are a factor behind the overall growth in spending on all foods, whether from a grocer or eatery. Simply put, feeding ourselves in 2023 is far more costly than it was in 2019.

In summer 2021, one industry analyst called inflation the “greatest gift the supermarket sector could get.” Seeing conditions ripe for price increases, grocery stores began raising their prices in 2021 and into 2022. Amid the backdrop of news headlines highlighting supply chain woes and the rising cost of staples like milk, meat, and eggs, the nations’ grocers had to raise prices to offset those increased costs—and then some.

In the meantime, spending on restaurant food has taken off, rebounding beyond levels last seen before the world was flipped upside down by disease. That’s despite the restaurant industry presenting diners with higher costs as well.

A shortage of people willing to return to the food service industry saw restaurant operators raise wages to retain workers and increase prices to cover the costs of their food supplies, which were also increasing in cost. Restaurant food delivery apps have also grown in popularity since the pandemic as they made it convenient to enjoy a restaurant meal without leaving your home. And those delivery apps have raised their fees.

Historically, grocery shopping has been a more economical way of feeding a family. For a period of time in 2020, however, it was the only way. Spending on groceries has grown steadily due to consumers purchasing more foods to be prepared at home at higher costs. But spending on restaurants may also be influenced, at least in part, by our collective yearning to be served food once again.

BUSINESS OWNER’S POLICY INSURANCE

What is BOP insurance? Learn more about BOP and the benefits that come with packaged insurance policies.

Simply Business

Americans are spending more on dining out…

American households’ spending on groceries has only increased since the pandemic threw supply chains and eating habits into disarray. The industry managed to sustain households through curbside pickup and delivery while local governments issued orders for restaurants to shut down dining rooms to the public.

The spike in grocery sales seen in spring 2020 coincided with an even more extreme dip in spending at restaurants. Around this time, restaurants, many of which are small businesses, laid off staff and quickly pivoted their business models to emphasize takeout while appealing to communities to support them with online food orders.

Today, food sold from restaurants is becoming an even larger part of Americans’ monthly spending habits, continuing a trend seen before the COVID-19 pandemic’s arrival.

PROTECT YOUR BUSINESS

Find answers to questions like “What’s business insurance?” and compare free quotes from top insurers online.

Simply Business

…but are buying more items at the grocery store

Census Bureau data also reveals Americans are buying more at the grocery store—5% more each week than they were in 2019.

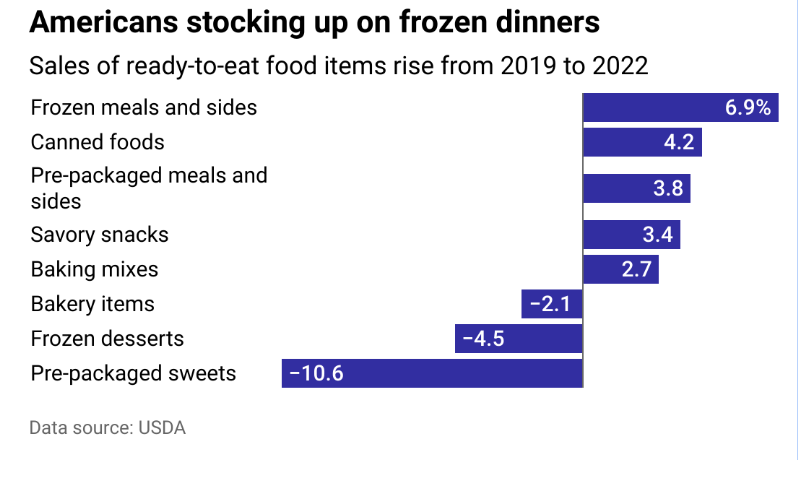

Frozen and pre-packaged meals, canned foods, snacks, and baking mixes have been purchased more in the last year compared with pre-pandemic times, while spending on sweets and frozen desserts has taken a big hit.

Growth in frozen food sales over the period could result from the lingering influence of pandemic thinking. In the early weeks of the pandemic, frozen foods were being bought at almost double the rate they were before. That growth in sales has tapered off steadily over the years since, averaging nearly 7% from 2019 to 2022.

Data reporting by Elena Cox. Story editing by Jeff Inglis. Copy editing by Paris Close.

Get Insured in Under 10 Minutes

Get an affordable & customized policy in just minutes. So you can get back to what matters: Your business.