If you’re self-employed, when do you start feeling like a small business owner — or do you ever reach that point?

For me, I never “officially” felt like a small business owner, even though I had all the key factors of being one:

- I had part-time employees whom I outsourced work to

- I had clients

- I had business insurance

- I had a business name

- The IRS considered me to be a business (woohoo!)

But those signs just didn’t convince me that I owned a small business. Mentally and emotionally, I identified as being self-employed. To this day, I still look back on my entrepreneurial history as a period of self-employment, and not necessarily that of being a small business owner.

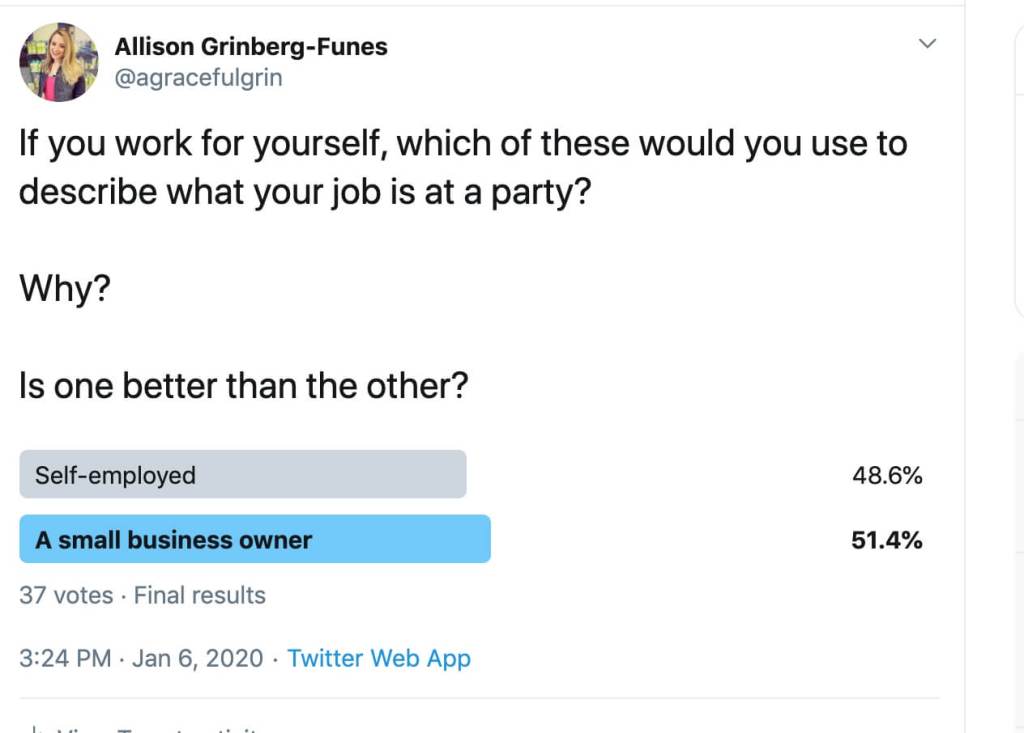

This distinction is important, but not for reasons I could really put my finger on. And I wondered if other people within the entrepreneurial community felt the same way. I asked my fellow writer to poll several small business owners, self-employed professionals, and freelancers to see if they felt the same way.

-Allison Grinberg-Funes, @agracefulgrin

Not surprisingly, the poll was pretty much split down the middle, with slightly more people identifying as small business owners than self-employed.

But what they had to say was surprising and definitely revealing about what key factors we need to realize in order to make that mental shift from being self-employed to being a “real” small business owner.

And there seemed to be one theme that stood out from all the rest:

You don’t consider yourself to be a small business owner until you have a part-time or full-time employee.

“I’ve had subcontractors, but I still think of myself as self-employed rather than a small business owner. The concept of truly managing another person’s time or workload seems like it pushes a person into small business owner realm.”

–Katie Taylor, Content Services

I definitely align with the above thought, which is probably why I identified as self-employed for so long, rather than as a small business owner. While I outsourced to other freelancers when I needed help with extra work, they weren’t on my full-time payroll.

Other folks told us that they continued to think of a small business as a traditional brick-and-mortar location with employees.

“I think I still associate the term ‘small business owner’ with a business that is brick + mortar/has tangible elements or products, or has other employees. Not sure why, though!”

–Steph Knapp, Freelance Writer

I do think the rules of being a small business owner are changing, thanks to the rise in the gig economy, independent contracting, and people starting side businesses to have several revenue streams.

Plus, there’s something to be said for thinking about yourself as a small business owner, even if it’s just you. When I do the work myself, it makes me think more strategically about my business and my role in it.

Instead of being a freelancer, I’m an owner.

Instead of working on projects, I have clients who expect a certain level of work from me.

Instead of taking whatever project comes next, I’m marketing my business to attract more clients.

That’s just me, though. The bottom line is this: If you identify as a small business owner, then that makes you a small business owner. Period.

But whether you consider yourself to be self-employed or a small business owner, there are certain things you need in place to make sure your work and finances are protected. These include:

- Business insurance

- A business license

- A good understanding of your tax structure and tax-filing requirements

- An accountant or bookkeeper to help out with your finances

On that note, I can’t stress enough how you shouldn’t let your identification as a self-employed individual stop you from getting a business insurance policy. Here’s why: When it comes to your liability and risk, it doesn’t matter if you work for yourself or you have a business with twenty employees — you will ultimately be responsible for paying any claims and damages that you cause.

Plus, business insurance is critical to protect your assets in case a customer or client decides to sue you. Insurance isn’t just for people with offices or stores or even employees; it can help protect you if you make errors in your work or simply if a customer claims you’ve made a mistake that affected them.

So, for example, say you’re an IT consultant and you work from home. You might be tempted to avoid getting business insurance because you don’t have a physical office, plus there’s no risk of people hurting themselves in your line of work.

Or so you think.

The truth is that a client can sue you if they claim you performed your work incorrectly, even if you can prove you did it perfectly. That means you’ll have to spend money on a lawyer to defend you, pay court costs, and possibly even pay a claim if you’re on the losing side of a case.

This isn’t a far-fetched scenario. In fact, it’s estimated that 20 million cases are filed against business owners every year, which include contract disputes (60%) and tort cases (11%), which is a type of lawsuit that involves claims of intentional or unintentional negligence.

It’s impossible to control if another person sues you, so the best thing you can do is to get a business insurance policy that protects you against this common occurrence.

By the way, if you’re not 100% comfortable getting business insurance because you don’t identify as a “business owner,” we also offer self-employed insurance for people like freelancers, independent contractors, and more.

What does the difference between being self-employed versus a business owner mean to you? What are your thoughts on this issue? Let me know in the comments below!

Get Insured in Under 10 Minutes

Get an affordable & customized policy in just minutes. So you can get back to what matters: Your business.