Starting a small business is hard. For women, it can be even harder. Still, data compiled from 2018 shows that more than 12 million U.S. small businesses are women-owned.

In recognition of Women’s Equality Day, we’re acknowledging some of the major gains made by women business owners, as well as offering some inspiration and insight from women entrepreneurs we’ve had the pleasure to talk with.

Making Bank

While male-owned businesses received nearly twice as much funding ($93,976 to $55,898) on average in 2022, that didn’t seem to slow down the women owners. The annual Biz2Credit Women-Owned Business Study found that women-owned businesses boosted their average revenue to $263,091, up 2% from 2021.

Cutting Costs.

As any good business owner knows, it’s not just about what you bring in — it’s also about how much you keep. Along with the 2% increase in revenue, the same report showed women-owned businesses had cut operating expenses by 3%, year over year.

Meeting Needs.

Women are finding and taking advantage of opportunities in a variety of fields. According to one study, more than half of those businesses are in these three industries:

Cosmetology trades (hair and nail salons), pet care, and other services made up 22% of women-owned businesses.

Child care, home healthcare, and other related businesses came in at 15%.

Accountants, architects, consultants, and other professionals were right behind at 13%.

Insights from our Women’s Small Business Owners Forum

Being a business owner means dealing with challenges. Women business owners often deal with different types of challenges than their male counterparts. They also often do that with particular skills and strengths.

In our forum, we talked with women who own businesses in the professional services, health and wellness, and home service fields. You can read about their experiences, their learnings, and their successes in this exclusive content from Simply Business®.

Key Findings from our Women Small Business Owners Study

Along with the forum, we also did a deeper dive into the world of women business owners. Here is some of what we discovered in our Women Small Business Owners Study from October 2022:

Start me up.

While entrepreneurs start businesses for different reasons, our study revealed that more than 50% of women tend to do so for lifestyle or financial reasons.

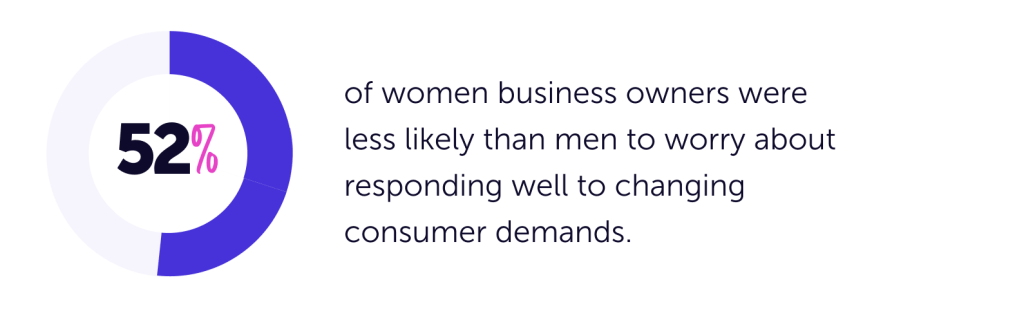

You’ve got this.

There are some challenges that can keep most business owners up at night, but we found that when it came to dealing with what customers might want, women were able to roll with the changes better than male business owners.

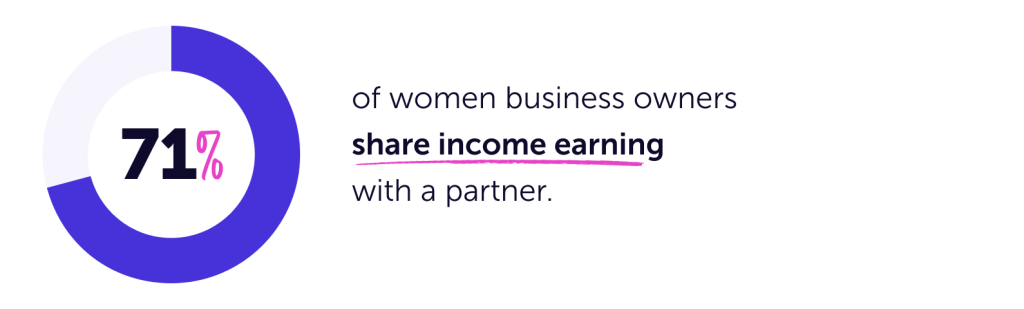

A team effort.

Another insight from our study was that women are sharing the breadwinning with their partner.

Get Insured in Under 10 Minutes

Get an affordable & customized policy in just minutes. So you can get back to what matters: Your business.

Making Business Insurance Simple. That’s our Inspiration.

We get it. Insurance may not be the most inspiring part of running a business, but it doesn’t have to be a drag, either. We make it easy to get covered. Either online or on the phone, we tailor the quote process specifically for your type of business. That way, you won’t waste time providing unnecessary information or deciphering insurance jargon.

After all, there’s a business out there you need to run.