Workers’ Compensation Insurance Cost

Insuring over 1 million small business owners worldwide.

Buy instantly online. No junk mail. No spam calls.

Workers’ Compensation Cost

Your team works hard. If an employee gets hurt or sick on the job, workers’ compensation insurance can help take care of them—and protect your business from significant financial loss. This guide will break down what workers’ comp typically costs, what affects the price, and how to find the right coverage.

On this page

Find the information you need quickly

What is workers’ compensation insurance?

How much does workers’ comp insurance cost?

How is the cost of workers’ compensation insurance calculated?

What affects the cost of workers’ compensation insurance?

What Is Workers’ Compensation Insurance?

Workers’ compensation insurance provides benefits to employees who suffer a work-related injury or illness. This can include covering medical bills, lost wages during recovery, and rehabilitation costs. In most states, businesses with employees are required by law to have this coverage. It not only protects your team but also shields your business from potentially costly lawsuits related to workplace incidents.

Workers’ Comp

A one-minute explanation

Find out what workers’ comp covers, why you might need it, and how we can help – all in just 60 seconds.

How Much Does Workers’ Comp Insurance Cost?

The median cost for workers’ compensation insurance is $92 per month, or about $1,104 per year. However, your final premium will depend on your industry, location, payroll size, and claims history. While most of our customers pay under $150 per month, the price is tailored to your specific business.

Here’s a snapshot of what our customers typically pay for workers’ comp insurance:1

Monthly Workers’ Comp Insurance Costs1

Under $150

65% of customers

$150 to $250

20% of customers

Over $250

15% of customers

1Data from Simply Business customers who purchased a WC policy from July 1st, 2024 to December 31st, 2024.

How Much Will I Pay for Workers’ Comp Insurance?

Get a quick estimate in just 3 steps. No obligation. No email required.

Your monthly premium will depend on a few key things, including: your industry, location, number of employees, and how much coverage you choose. But most small businesses will pay less than $150 per month.

Which trade has the highest premiums?

Your industry plays a significant role in determining your insurance rate. Higher-risk professions like carpentry often have higher premiums due to the increased chance of injury. Lower-risk jobs, such as software development, typically have lower costs.

Top Trades Median Monthly Premium

| Trade | Median Workers’ Comp Monthly Cost2 |

|---|---|

| Carpentry | $206 |

| Handyperson | $173 |

| Landscaping services | $122 |

| Electrical work | $119 |

| Housekeeping | $93 |

| Janitorial services | $89 |

| Child day care services | $85 |

| Software development | $41 |

2Data from Simply Business customers in the identified trades who purchased a WC policy from July 1st, 2024 to December 31st, 2024.

These numbers are based on real policies purchased through our site. But getting a great policy isn’t just about the numbers — it’s about working with a partner that understands your business. And because we work with a range of trusted insurers, you’ll see options to match your business, so you can choose a policy that works for you and your budget.

Which location has the highest premiums?

The cost of workers’ comp insurance varies significantly by state. Each state sets its own rules and base rates, which can impact your final premium.

States Median Monthly Premium

| State | Median Workers’ Comp Monthly Cost3 |

|---|---|

| Georgia | $134 |

| California | $130 |

| South Carolina | $127 |

| North Carolina | $117 |

| Virginia | $112 |

| New Jersey | $108 |

| Tennessee | $102 |

| Florida | $99 |

| New York | $76 |

| Texas | $75 |

3Data from Simply Business customers in the identified States who purchased a WC policy from July 1st, 2024 to December 31st, 2024.

How Is the Cost of Workers’ Compensation Insurance Calculated?

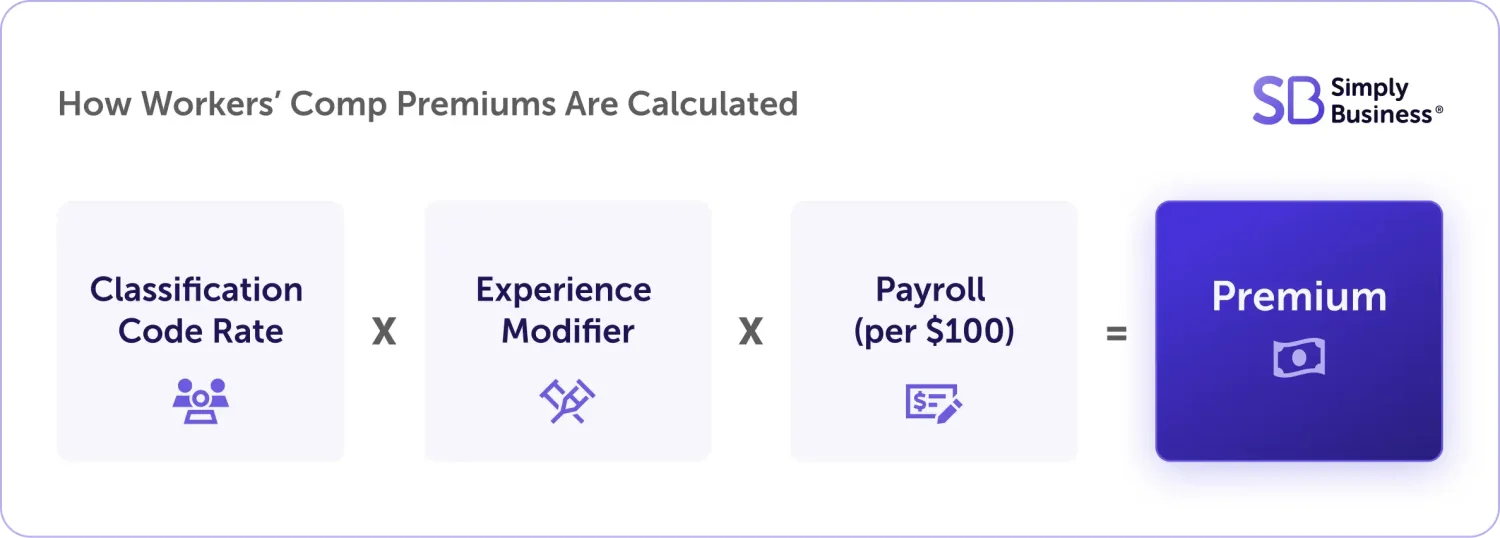

Workers’ comp premiums are determined by a standard formula that considers your industry’s risk level, your business’ claims history, and your payroll.

Three factors go into determining a workers’ comp premium.

1. Classification codes: These are assigned by insurance companies or state rating bureaus to categorize businesses by risk level, based on their industry and the nature of their work. For example, construction work typically has more risks than photography, so it will have a higher classification rate.

2. Experience modifier (X-Mod): This is based on the number of claims your business has had compared to other businesses with the same classification. Businesses with a workers’ comp history of less than four years typically have an X-Mod of 1.0. An X-Mod above 1.0 indicates more claims or losses than average, potentially resulting in higher premiums.

3. Payroll: This is what you paid to employees, including wages, salaries, and benefits. The premium is often calculated using a percentage payroll.

How the calculation works.

Let’s say you have a new HVAC business in Florida with a payroll of $75,000. The classification rate is 4.36 per $100 of payroll and your X-Mod is 1.0.

Your premium calculation would be ($75,000/100) x 4.36 x 1.00 = $3,270.

What Affects the Cost of Workers’ Compensation Insurance?

Several key factors determine your final workers’ compensation insurance cost.

Your industry

The type of work your employees do is a primary cost driver. Industries with a high risk of injury, like construction, will have higher rates than office-based professions.

Your location

Each state has its own workers’ compensation laws and rate-setting bureaus. This means that your premium can vary significantly depending on where your employees work.

The size of your business

The number of employees you have is a direct factor in your premium calculation, as more employees generally mean a greater chance of a workplace incident.

Your payroll

Workers’ comp premiums are often calculated as a percentage of your total payroll — the higher your payroll, the higher your premiums:

Average workers’ comp premium by payroll.

Annual Employee Payroll Band

Median Workers’ Comp Monthly Cost4

Less than $50,000

$92

$50,000 to $250,000

$132

$250,000 to $500,000

$212

$500,000 to $1,000,000

$161

$1,000,000 to $2,500,000

$226

4Data from Simply Business customers with the identified annual payrolls who purchased a WC policy from July 1st, 2024 to December 31st, 2024.

Your policy limits

Higher coverage usually means a higher premium. But it also means more protection if something goes wrong.

And don’t forget the deductible — that’s what you pay out of pocket before the insurance kicks in. In many states, employers can choose to participate in workers’ compensation deductible programs, where they agree to cover a portion of each claim in exchange for a reduced premium. For more information, consult with a legal professional in your state or with one of our licensed agents on the phone.

Your claims history

If you’ve had past claims, that might bump up your rate. A safe track record can lead to discounts.

Your experience

Have you been in business for years with no claims? That could work in your favor.

How Can I Reduce My Workers’ Comp Insurance Cost?

Improve workplace safety

Fewer injuries mean fewer claims — and lower workers’ comp costs. Here are a few simple ways to create a safer work environment:

- Improve workplace safety: Implement a formal safety program and conduct regular inspections to identify and correct hazards before they cause an injury.

- Provide employee training: Cover safe-lifting techniques, handling hazardous materials, and job-specific best practices.

- Gear up: The right protective equipment — like hard hats and non-slip shoes — can prevent costly injuries.

- Conduct regular safety checks: Routine inspections can help catch hazards before they lead to accidents.

Having fewer claims over time also can help keep your premiums from increasing.

Review past claims

Looking at previous workers’ comp claims can reveal patterns. Use those insights to help prevent similar incidents in the future.

Consider a minimum premium policy

If you run a low-risk business with only a few employees, you may qualify for a minimum premium policy — the most affordable option available to businesses with strong safety records.

Shop around

The best way to find a competitive price is to compare quotes from multiple insurers. Simply Business provides customized coverage options from top-rated small business insurers — all in just 10 minutes. We do all the legwork so you can sit back, compare quotes, and save.

The Simply Business Difference

Simply Business is a digital insurance brokerage. That means we’re not tied to one insurer. Instead, we partner with a range of top-rated carriers and use smart technology to match you with policies that fit your specific business, your risks, and budget.

Maybe you’re just starting out and want solid protection without overspending. Or maybe you’re growing fast and need coverage that can grow with you. Either way, we’re here to help — with a choice of affordable policies and small business expertise to help you get the coverage you need.

Trusted by Over 1 Million Small Businesses Worldwide.

This block is configured using JavaScript. A preview is not available in the editor.

Workers’ Compensation Cost FAQs

Why do I need workers’ comp insurance?

Because even a single accident or lawsuit could cost your business thousand dollars out of pocket. If workers’ comp is required and you don’t have it, you could be looking at fines, lawsuits, or even criminal charges, depending on your state’s guidelines.

What if I’m just working for myself and have no employees?

Business owners are generally not required to have workers’ comp coverage. However, you may need it to land jobs in certain higher-risk fields, such as construction or roofing. And if you’re a sole proprietor, it can be good to have if a work-related injury or illness puts you out of action.

What does it cover?

Typically covered

If an employee gets sick or injured on the job, workers’ comp typically covers medical payments, lost wages, rehabilitation expenses, and death benefits.

Typically not covered

Client or vendor accidents, OSHA fines, work safety improvements, or wages for a worker who replaces the injured employee.

What if I already have health insurance?

A standard health insurance plan may not cover a work-related illness or injury. Plus, many health insurance plans won’t cover lost income as a result of your injury or rehabilitation and retraining costs.

Is it required in my state?

Workers’ compensation insurance is generally required by law in all states except Texas.* For more information, check out our helpful state guides for California, Colorado, Florida, Georgia, Illinois, Maryland, Minnesota, New Jersey, New York, North Carolina, Pennsylvania, Texas, and Wisconsin.

*Texas state law requires that you provide certain notices to your employees.

Is it tax deductible?

Yes, workers’ comp premiums are usually considered a business expense. But always check with your accountant to be sure.

How fast can I get a quote?

You can get a full quote in about 10 minutes — and an estimate even faster, with just 3 quick questions.

What other insurance might I need?

That depends on your business. You can explore more here.

Does workers’ comp cover remote employees?

Yes, workers’ compensation insurance does cover remote and hybrid employees. Under the law, your “workplace” is wherever you are performing duties for your employer. Consult a lawyer or legal advice on what types of injuries are covered from remote employees.

What’s the minimum coverage required for workers’ comp insurance?

Yes, workers’ compensation insurance does cover remote and hybrid employees. Under the law, your “workplace” is wherever you are performing duties for your employer. Consult a lawyer or legal advice on what types of injuries are covered from remote employees.

Can an employee’s job duties affect how much I pay for workers’ comp?

An employee’s job duties are the one of the most important factors in determining your workers’ compensation premiums. Insurance carriers use these duties to assign Class Codes, which represent the statistical risk of injury for that specific role. The higher the physical risk associated with a duty, the higher the “rate” you pay.