New Hampshire Business Insurance

Monthly Payments to Fit Your Budget

Simply Business is pleased to provide tailored insurance options from:

You’ve finally done it: you’ve taken the initiative to start a business in New Hampshire. Amid dreams of adding employees, growing revenues, and building a sizable nest egg for yourself, you start to realize there’s one area you may be lacking: business insurance.

The problem? Business insurance is confusing.

It’s a complicated world with a lot of fine print. And since you’re the one footing the bill, you’re the one who needs to know what’s required.

So we’ve taken the time to sort through New Hampshire business insurance for you.

Below, we’ve put together a guide to New Hampshire business insurance that will show you the specific requirements you’ll be expected to meet, as well as steps for making sure you have the coverage you may need.

New Hampshire Business Insurance: The Basics

General Liability Insurance in New Hampshire

Let’s start with the specific types of insurance you should think about.

General liability insurance is a top consideration for many new businesses.

That’s for good reason. If your business has a physical location, you should consider New Hampshire general liability insurance.

Why? Because general liability insurance in New Hampshire may protect you against damages of personal injury or property damage from accidents that occur while doing business.

This may be the case, even if the incident in question has little to do with the business itself.

Let’s consider an example. Imagine you run a hair salon. As part of maintaining the salon, you mop the floors.

But one day, you forget to leave a sign that warns customers of the wet floors. A customer walks in, slips, and breaks a hip, which may end up making you liable for the customer’s medical expenses.

This isn’t the only situation that applies. General liability also extends protection to issues such as:

- Third-party accidents

- Bodily injury/medical payments

- Property damage

- Reputational harm

What are the requirements in New Hampshire? You do not have to get general liability insurance to conduct business in New Hampshire, but we strongly encouraged it.

According to the state of New Hampshire, there are approximately 450 companies offering general liability insurance in New Hampshire. There is no shortage of available insurers who can provide general liability insurance. You can easily compare quotes from insurance carriers here. And what do you get for your investment?

It depends on the policy you get. However, general liability will typically help cover you in the following situations:

If you run a restaurant and a lamp hanging over a table suddenly falls and shatters, any damage and/or bodily harm to a third-party or their property may cause you trouble. General liability insurance can help protect your business if you were sued for damages.

If you do contract work such as power-washing a business’s property, and one of their employees trips over a piece of your equipment (such as a hose), then that may apply as well.

If you run a consultancy and a client sues you for some reputational harm they suffered due to working with you, it may fall within the realm of general liability insurance, which may help you with any legal fees.

In New Hampshire, general liability insurance is not a requirement for most businesses.

However, there may be instances (such as contract work for highly expensive projects) in which you should double-check your legal requirements with the state.

What if you’re a contractor? Did you know that the average property damage claim is $30,000?

As a contractor, that means you’re generating business income, too, which means you’ll want general liability insurance. Our contractor’s licensing hub for New Hampshire addresses the licensing needs you’ll have in New Hampshire. You’ll also learn about getting the proper insurance coverage for contracting work.

Professional Liability Insurance in New Hampshire

What’s the difference between “general” and “professional” liability insurance? With general liability insurance, you’re looking to protect yourself from the unknown, such as accidents.

With professional liability insurance in New Hampshire, you’re seeking coverage from potential damages as a direct result of the work you do.

Let’s look at an example. If you run a marketing campaign on behalf of a client and accidentally use someone else’s trademark, you could expose your client to a potential lawsuit. This, in turn, exposes you to risk.

In this case, because the work of your business itself was directly responsible for the error, professional liability insurance is more likely to provide the proper coverage.

In general terms, professional liability insurance can help protect you from damages that result from your direct work.

Be careful of one trap: it’s easy to assume you won’t need professional liability insurance in New Hampshire. After all, what business owner isn’t careful? Should you really bet against yourself?

But don’t think of it that way. Think of it as protecting yourself.

Consider how a minor error in any one of these services could result in damages for a client:

- Tax preparation services

- Accounting/general bookkeeping

- Photography

- Marketing consultation services

- Real estate agencies

- Construction

- And more

Don’t bet against human error. You never know what claims may come up. Instead, look for the best coverage for your business.

New Hampshire Workers Compensation Insurance

One type of insurance you are required to carry as a business in New Hampshire under certain circumstances is workers compensation insurance.

Workers compensation insurance is a coverage policy held by the business. But it often protects workers as well.

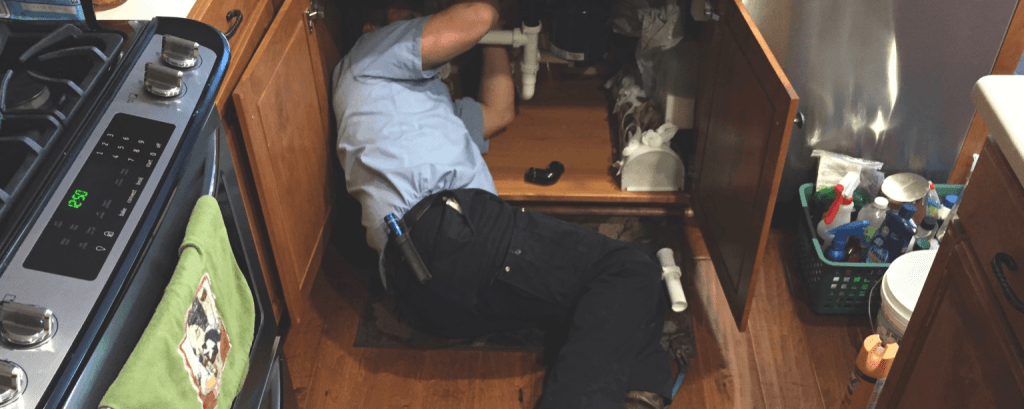

What does that mean? Consider that while working for your business, an employee is vulnerable to certain harm or risks. For example, an employee working on a construction site exposes themselves to all sorts of hazards.

If, for example, a hammer were to fall off a beam and onto the employee’s toe, they might be unable to work for a while.

Because states like New Hampshire want to ensure that working people can carry on when accidents like these happen, they require businesses to carry New Hampshire workers compensation insurance.

This insurance may help you cover the costs associated with damages, rehabilitation costs, medical costs, and other issues that result from an accident at work.

You are required to have New Hampshire workers compensation insurance if you have employees. That includes covering family members and part-time employees who work for you.

Other Types of New Hampshire Business Insurance

New Hampshire also may require commercial auto insurance for businesses with vehicles.

If you use your personal car insurance on a vehicle that you use only to get to and from the office, this is an option. In that case, your vehicle would likely be considered your personal property.

However, if you have a vehicle that you use for commercial purposes, make sure it’s properly covered with commercial-specific auto insurance.

While commercial auto insurance and workers compensation insurance are two statewide requirements for all businesses that meet those criteria, there are other types of insurance relevant to New Hampshire that you should consider.

One of the most common is business interruption coverage. Both business owner policies and commercial “multi-peril” policies may offer this type of coverage, as the state government website notes. What does it mean? It helps protect business owners from the loss of income resulting from issues stated in the policy, like theft or storm damage.

This is an insurance product you can customize to your needs. Each policy can specifically prescribe the issues for which you’re covered. These are known as “perils.”

When looking at which policy may be right for you, try to think of the most likely “perils” that could threaten your ability to generate income.

You might also consider getting a business owner’s policy, which may include business interruption coverage, which is sometimes a convenient way to combine business property and business liability insurance into the same policy, potentially saving you money.

New Hampshire Workers Compensation: What You Need to Know

Yes, in most circumstances, you do have to get workers compensation insurance in New Hampshire if you have any employees.

That includes part-time employees or family members. If they’re hired as a W-2 worker at your company, you need workers compensation coverage.

For 1099-NEC contractors, the rules are slightly different. New Hampshire law says that everyone is considered an employee — unless they can demonstrate otherwise. For contractors, there are 12 specific requirements.

It’s a lot to read through. But in general here’s how it boils down in New Hampshire: if people work for you, get workers compensation insurance.

However, if your business meets certain requirements, there is an option to self-insure. Keep in mind that even this arrangement might have specific insurance requirements, such as excess insurance coverage that leaves no gaps between your risk and your ability to self-insure.

For many businesses, the simplest way to handle workers compensation situations is to get proper coverage. Just take a look at the New Hampshire statutes on workers compensationto get an idea of how complicated it is.

To keep things simple, remember that in most every case workers compensation is a requirement.

To learn more directly from the state itself, read more about workers compensation at the New Hampshire website.

How Much Does New Hampshire Business Insurance Cost?

That is one big, complicated question!

But the quick answer is simple: it depends on what coverage you need to have.

Start by looking around to find a quote. The reason most insurance websites won’t tell you their prices off the bat … is that they can’t.

They need to know some details first. What coverage do you need? What specific losses are you looking to protect against? What type of business do you run?

How Do I Get New Hampshire Business Insurance?

Does the process of getting insurance seem overly complicated?

Let’s break it down. Buying insurance should be a confidence-booster — it shouldn’t be another added worry. But you’ll need to know how to go about it the right way. Here are some steps you can take to prepare:

Make a list of your biggest risks. This is square one, because this is the information you’ll use to inform the type of policy you’ll need.

Ask around. Do you know any business owners in a similar situation as yours? Ask them about the kinds of coverage they have, and why they have it.

Know your minimum legal responsibilities. For instance, workers compensation insurance in New Hampshire may be a legal responsibility. This will be your bare minimum coverage, but you may need more.

Compare rates. Once you know what insurance you want, start getting quotes so you can compare rates. This puts you in the driver’s seat.

Estimate your insurance budget. Do you want annual premiums? Monthly? What works best for your budget and your long-term goals?

Seek out support. Do you need help in any of these steps? No problem. Seek out an agent. Here at Simply Business, our helpful insurance agents are happy to guide you through the process. If you have a business in New Hampshire, call 855-559-0271.

Want to keep things really simple? You can start right now! Check out our FREE business insurance quote tool to find a price specifically for you.

Secure Your New Hampshire Business Insurance

You now know a lot more about business insurance in New Hampshire than when you were starting out. You know you need workers compensation insurance and commercial auto insurance at minimum, depending on your situation.

What’s next? Browse through the offerings here at Simply Business to see if there are specific liabilities that would require you to have protection. And it won’t hurt to pop over to our guide to growing your business with the proper coverage.

Businesses We Insure

- Architect Insurance

- Attorney Insurance

- Digital Marketing Insurance

- Dj Insurance

- Draftsman Insurance

- E-commerce Insurance

- Education Consultant Insurance

- Engineering Insurance

- Financial Planner Insurance

- Home Inspector Insurance

- Insurance For Insurance Agents

- Interior Design Insurance

- Insurance It Consulting

Other Businesses We Insure

- Land Surveyor Insurance

- Lawyer Insurance

- Life Coach Insurance

- Management Consultant Insurance

- Mortgage Broker Insurance

- Photographers Insurance

- Insurance For Private Tutors

- Project Manager Insurance

- Real Estate Agent Insurance

- Social Work Insurance

- Tax Preparer Insurance

- Travel Agent Insurance

- Videographer Insurance

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.