Jewelry Maker Insurance

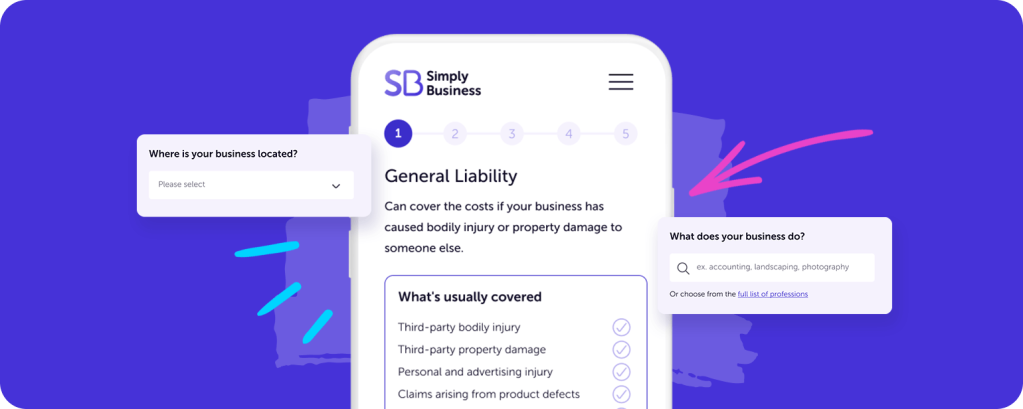

Compare Free Quotes and Get an Affordable Policy in Less Than 10 Minutes.

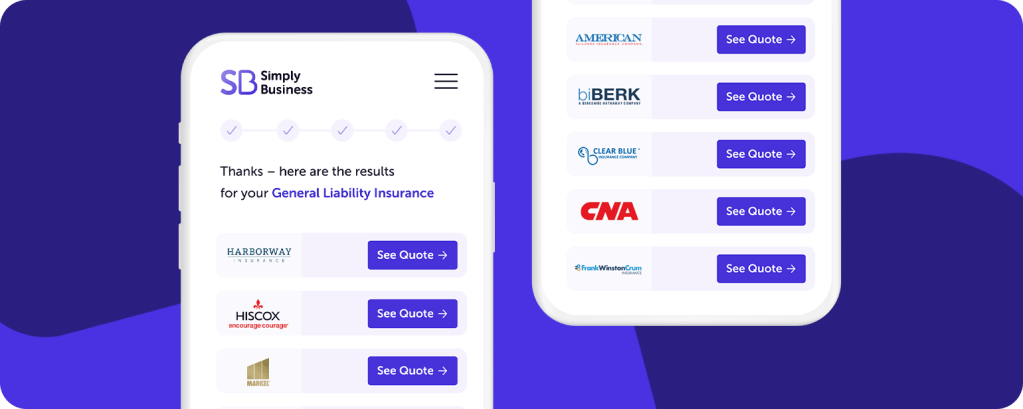

Simply Business is pleased to provide tailored insurance options from:

Insurance for Jewelry Makers

If you’re earning a living as a jewelry maker, you’ve turned your passion into a small business. Designing jewelry requires creativity, attention to detail, and countless hours. With all the time you’ve put into building your business, you deserve insurance that helps protect your hard work.

At Simply Business, we’re here to help you protect what you’ve created so your business can continue to shine. No worries if you’re unsure what types of insurance you need. We make it easy to get started. Just answer a few questions about your business to receive a free policy quote that’s tailored to your specific needs.

Ready for the best part? It takes just 10 minutes or less.

Business Insurance FAQs:

Insurance policies we recommend for jewelry makers:

Benefits of business insurance for jewelry makers:

- It can protect your business from certain claims.

- Proof of insurance can help customers feel good about your work.

- It may be required where you’re located.

Why Do I Need Business Insurance for Jewelry Makers?

If you’re selling jewelry, you’re running a business. And you likely need to protect it the same way you protect your home, vehicle, and health — with insurance coverage.

Accidents can happen in any business, so it’s best to be prepared with insurance coverage. As a jewelry maker, having business insurance before something goes wrong may save you time, money, and stress in the long run.

What Kind of Insurance Do You Need as a Jewelry Maker?

Your jewelry is unique, and so is your business. The types of insurance coverage you might need will depend on many factors.

Here are a few questions to consider:

- Do you own a storefront?

- Do you sell your jewelry online?

- Do you participate in events and craft fairs?

- Do you have employees?

Choosing insurance may seem daunting, but we can make the process less stressful. We work with small business owners to understand their specific needs so we can provide among the best insurance solutions.

Here are the policies we recommend looking into:

General liability insurance

As a jewelry maker, you turn gemstones and metals into hand-crafted earrings, rings, pins, necklaces, and more. You may not think there’s much risk involved with being an artisan, but accidents can happen anytime, anywhere. That’s why general liability insurance (“GL”) coverage is so important.

A GL policy typically covers third-party bodily injury, third-party property damage, and other third-party accidents. A “third party” could be your customers and vendors. Say a customer comes into your jewelry store, slips and falls on your freshly-waxed floor, and breaks her arm.

Without insurance, you’d likely need to pay your customer’s medical bills, and legal costs if she were to sue you. The average claim for property damage or accidents in small businesses is $30,000. Just think of how many precious gemstones you could buy with that money.

Here’s where general liability insurance can benefit you. It could help pay your customer’s medical expenses and the costs of damages or legal fees up to your policy’s limit.

General liability insurance typically covers:

- Third-party property damage

- Third-party bodily injury

- Third-party Medical expenses

- Personal and advertising injury

- And more

General liability insurance does not cover:

- Personal property damage

- Professional services

- Employee injury and workers’ compensation

- Damage to your work

- Automobile liability

- Intentional injury or damage

- And more

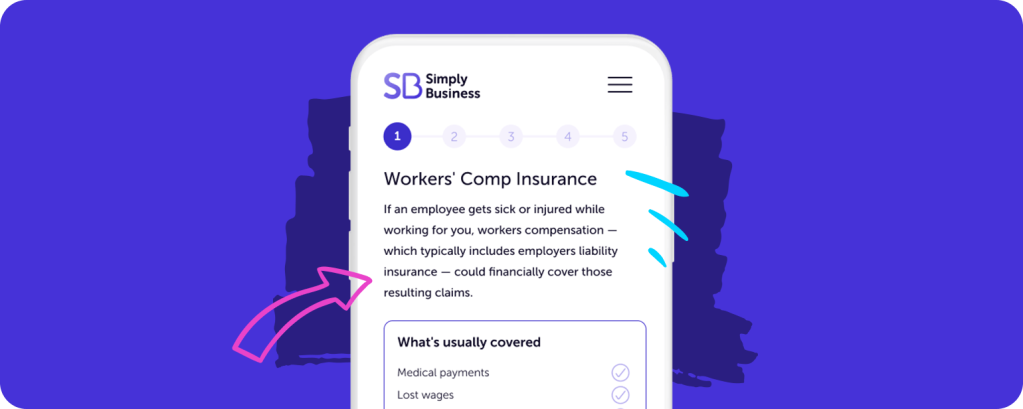

Workers’ compensation insurance

Do you have full-time, part-time, or temporary employees? If so, you may need workers’ compensation insurance. Most states require business owners with employees to have this type of coverage, so check your state’s laws to be sure you know the requirements.

Workers’ compensation can cover the costs of employee injury or illness while on the job. So having this coverage is usually a smart business move, even if your state doesn’t require it.

In general, workers’ compensation insurance for jewelers can cover:

- Medical payments

- Lost wages

- Rehabilitation expenses

- Death benefits

Cyber insurance

If you use the internet for your business and electronically store information, we recommend cyber insurance to protect your jewelry business from cyberattacks. Small businesses can be targets for this type of criminal activity, because they often collect and store customer data such as personal and payment information.

Businesses that suffer cyberattacks can face devastating financial consequences, because a cyberattack usually requires a business to respond to the event in multiple ways, which can be expensive and time-consuming.

For example, a small business owner may be responsible for:

- Finding and fixing the breach

- Notifying their customers

- Providing credit monitoring for affected customers

- And more

Cyberattacks can wreak havoc on a small business. Knowing you have cyber insurance to cover costs, including legal fees, can help you focus on addressing the problem and taking care of your business and customers.

Here’s what cyber insurance usually covers:

- Crisis management expense

- Forensic and legal expense

- Fraud response expense

- Extortion loss

- Public relations expense

- And more

Cyber liability insurance usually does not cover:

- Potential future lost profits

- Cost to improve system security

- Loss of value from theft of intellectual property

- And more

What is Covered by Jewelry Business Insurance?

Your jewelry maker insurance coverage will depend on the policy or policies you choose. If you need multiple policies, we recommend that you consider bundling your policies into one insurance plan customized to fit your business’s needs. The coverages we’ve outlined can protect you from the most significant risks and liabilities you may face as a jewelry maker.

If you opt for all the suggested policies above, your jewelry maker insurance plan can cover:

Third-party bodily injury

Loss and damage to business property

Expenses related to responding to fraud events

Lost wages

And more

How Much Does Jewelry Business Insurance Cost?

Insurance costs for small business owners will vary, even among jewelry makers. Our quote process helps tailor each quote to your business and needs. Generally, you can expect your insurance costs to be based on:

- Payroll and revenue estimates

- The location of your business

- The specific services you offer

- And more

Want to see how much your insurance may cost? Just click here and get a free quote from some of the most trusted insurers in the country.

Jewelry Maker Insurance FAQs

Most states don’t require jewelry makers to have business insurance. But if you rent a physical space, your property manager might request that you have commercial general liability coverage. This plan can protect you if there’s an accident, injury, or loss on the property.

If you have employees, you’ll likely need workers’ comp coverage, as most states require it.

Business owners can usually deduct insurance premiums from their income tax. However, we always recommend that you talk to an accountant or tax advisor to make sure.

The amount of coverage you might need can rely greatly on your specific business, so it’s tough to give an exact answer that can apply to every jewelry maker. The level of coverage that’s right for your business depends on:

- The size of your business

- Your business’s location

- Your annual revenue

- And more

Our quote process takes all of this into consideration to provide the recommended coverage. One of our licensed agents will be happy to assist you if you have additional questions.

Getting your free insurance quotes takes only a few minutes, but having your information on hand makes the process even easier. We recommend you have the following:

- Annual revenue estimates

- Payroll estimates

- Information on any previous claims

Why Choose Simply Business?

We know you have a lot of choices when it comes to insurance. That’s why at Simply Business we aim to make protecting your jewelry maker business as easy as possible.

We’re an online insurance brokerage that helps small business owners like you find and compare policies from trusted insurers. Thousands of customers trust us to protect their growing businesses, making us one of the fastest-growing online names in small business insurance.

So why choose Simply Business?

We’re fast and affordable. You have a lot on your plate and don’t have time to worry about your insurance coverage. Our policies are fast, affordable, and we’re ready to get started whenever you are.

We’re flexible. Your business may change over time, and we get that. We’re here to help make sure you’re protected no matter what your business needs.

We understand the unique needs and challenges of your jewelry business.

You’ve worked hard to turn your creative passion into a business. That’s why we offer some of the best coverage options to protect it.

Businesses We Insure

- Accountancy Insurance

- Architect Insurance

- Attorney Insurance

- Business Consultant Insurance

- Digital Marketing Insurance

- Draftsman Insurance

- Education Consultant Insurance

- Engineering Insurance

- Financial Planner Insurance

- Home Inspector Insurance

- Insurance For Insurance Agents

- Interior Design Insurance

- IT Consulting Insurance

- Janitorial Services and Contractors

Other Businesses We Insure

- Land Surveyor Insurance

- Lawyer Insurance

- Life Coach Insurance

- Management Consultant Insurance

- Mortgage Broker Insurance

- Photographers Insurance

- Insurance For Private Tutors

- Project Manager Insurance

- Property Management Insurance

- Real Estate Agent Insurance

- Social Work Insurance

- Tax Preparer Insurance

- Travel Agent Insurance

- Videographer Insurance

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.