Idaho Business Insurance

Get Insured in Under 10 Minutes

Simply Business is pleased to provide tailored insurance options from:

Want to understand the basics of Idaho business insurance — but don’t have the time to read hundreds of articles on all the different insurance types?

That’s why we’re here. We’ve researched each state’s unique insurance laws so you will know the lay of the land. That includes looking at some of the basic business insurance facts that define Idaho business insurance.

Below, you’ll find a handy introduction to some of the most popular types of Idaho business insurance. We’ll also show you what coverages Idaho may require your company to have.

Idaho Business Insurance: the Basics

General Liability Insurance in Idaho

You may have already heard of general liability insurance. But before we dig in, let’s get into the specifics of what it may help cover.

General liability insurance can help cover costs associated with third-party…

- Accidents

- Bodily injury

- Reputational harm

- Property damage

- And more!

Having coverage like general liability insurance can be affordable. It also can help protect you against damage claims.

Why should you care? After all, you’re careful. You make sure that you maintain good habits and keep people as safe as possible.

You’d be surprised. As many as 43% of small businesses find themselves dealing with civil lawsuits or threatened with one.

Beyond that, you may not even be aware of some of your business’s general liabilities. If you deal with customers or clients regularly, you may expose yourself to common risks without knowing it.

Let’s consider a few examples:

- Janitorial work: Say you offer cleaning/janitorial services. You apply a cleaning solution to a high-value, precious antique, and your customer sues you for the damages.

Even if you believe you applied the right cleaning product, you’ll likely have to pay legal fees to defend yourself. That’s where general liability insurance with the right coverage might help.

-

Personal training: For personal trainers, there are plenty of risks. Even something that may seem harmless, like leaving dumbbells out, could be a liability. If a customer trips over the dumbbells and gets hurt, you may be liable and have to pay their medical bills. General liability insurance could help you cover those expenses.

-

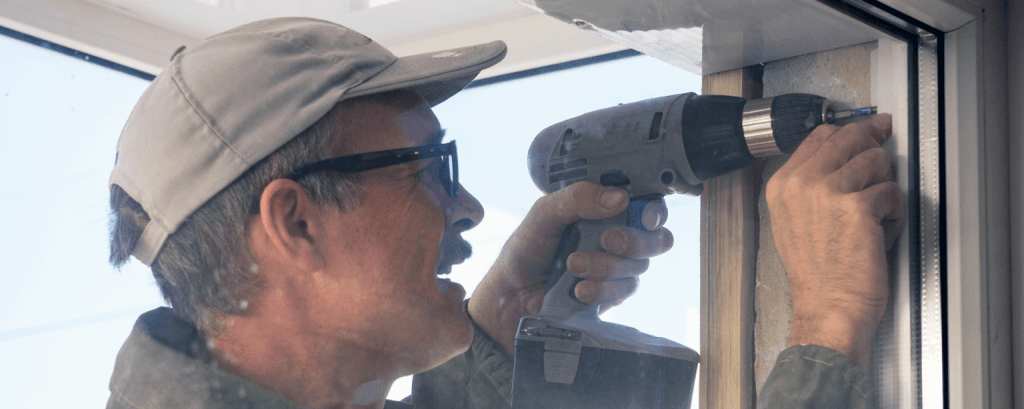

Building/contracting work: Say you helped renovate a client’s kitchen, installing custom cabinets. While putting one of the cabinets up, you accidentally drop the cabinet’s door. The cabinet falls and damages the client’s new hardwood floor.

The client sues, requesting that you pay to repair the damaged floor. General liability insurance could help to cover those costs and any related legal fees.

The average claim against small businesses runs $30,000. Don’t expose yourself — or your business — to that much risk.

True, you don’t have to buy general liability insurance just to do business in Idaho. But opting for that coverage can help protect your exposure to any unforeseen risks.

Idaho Professional Liability Insurance

By design, some businesses, such as advising or consulting clients, have a more direct impact on their clients’ professional and personal lives. If you’re in one of those occupations, professional liability insurance might be the best way to protect yourself against potential risks.

Professional liability insurance is different from general liability insurance. Under general liability insurance, you typically cover yourself against third-party risks like bodily injury and property damage.

With professional liability insurance, you’re looking at claims of negligence or other risks caused by your acts or omissions (i.e. failure to act) in performing your services.

To clarify, let’s look at some examples:

-

You’re a graphic designer. You inadvertently used a third-party trademark to create a professional logo for a client. The owner of that trademark finds out and is going after your client — and your client alleges it was your fault. In that case, you could be on the hook for legal fees and damages. That’s when professional liability insurance can come in handy.

-

You run an accounting firm that handles bookkeeping for large companies. One small error in your work causes all sorts of headaches for one client. If a client sues you, you could face legal fees.

Even if you successfully defend yourself, you could still incur legal fees. This is where the protection of professional liability insurance can protect you and your business.

Of course, many different careers could use the help that professional liability insurance can provide, including:

- Marketing

- Business consulting

- Financial advisors

- Photographers

- Real estate agents

- And more!

If you’re in a service-based business, this is exactly the kind of business insurance you should consider.

Professional liability insurance is not an official requirement of running a business in Idaho.

But that doesn’t mean it’s not a good idea. Particularly if you regularly perform work that exposes you to potential professional liability claims from clients.

Idaho Workers Compensation Insurance

Here’s where Idaho requires you to take action: You need workers compensation insurance if you have any employees in Idaho, with few exceptions.

The state says: “All businesses having employees must carry worker’s compensation insurance, administered by the Idaho Industrial Commission unless specifically exempt.”

That includes companies with “full-time, part-time, seasonal or occasional employees.”

Simply put? If you have employees, you’ll most likely need to cover your company with workers compensation insurance.

But we should still explain the basic function of this insurance. Workers compensation insurance helps protect employees. If they have an accident at work or get sick on the job, they can file a workers compensation claim.

You can learn more about Idaho workers compensation insurance in the section below.

Other Types of Idaho Business Insurance

Those are some of the most important types of business insurance in Idaho. But it doesn’t mean they’re the only types you should consider.

Let’s take a look at other popular Idaho business insurance options:

-

Commercial auto insurance. As with many states, if you use a vehicle for commercial purposes, you will likely need commercial auto insurance in Idaho.

-

Home-based business insurance. A homeowner’s policy may not cover certain risks if you run a business out of your home. And with teleworking on the rise in Idaho, now’s the time to consider adding home-based business insurance coverage.

Idaho Workers Compensation: What You Need to Know

So far, we’ve reviewed the basics. But what is it about workers compensation insurance that makes it so important for your business?

The idea is simple. When a workers compensation claim is filed, employees can have recourse for paying their medical bills, rehabilitation, time off, and potentially other needs.

Workers compensation insurance can help protect against those claims. It especially helps protect your company if you have a large number of employees. What if an accident affects multiple workers at once?

Workers compensation insurance may help protect you, allowing the business to keep running while your employees get the care they need.

According to the Department of Labor, over 3,000 workers filed for workers compensation in 2020. The total amounts paid out? Nearly $250,000,000.

Beyond the legality issues, you simply can’t afford to put your business at that kind of risk.

Independent contractors in Idaho should keep in mind that the workers compensation insurance requirement may not extend to them. But if your business has anyone classified as an employee, you’ll have to have workers compensation insurance.

How Much Does Idaho Business Insurance Cost?

Every company is different. With different risks come different annual or monthly insurance premiums.

The good news is that although the average claim against small businesses is $30,000, protecting yourself from that kind of risk is usually much more affordable.

How Do I Get Idaho Business Insurance?

It’s tough to know what insurance should cost you. How do you know when you’re paying too much? Or that you’re buying too little coverage?

Here are some steps to help cut through the confusion.

-

Examine your risks. Do you run a home-based business? Your homeowner’s policy may not be enough. Do you have employees? You must carry workers compensation insurance in Idaho. Examine all of your risks and write them down to understand what kind of coverage you need.

-

Ask around. If you have any friends or acquaintances with similar insurance needs, ask them about their coverage.

-

Get quotes. The more quotes you can get, the better informed you’ll be. You’ll also have a solid reference point for what prices look like. Simply Business helps you compare insurance quotes for free.

-

Budget. Look at different options, such as paying annually versus monthly premiums, to find out what best fits in your budget.

Finally, simplify the process by checking out our FREE tool for business insurance quotes. Or if you want to speak with someone with unique questions, call a Simply Business licensed insurance agent at 855-608-1362.

Making Idaho Business Insurance Work for You

You’re a business owner, which means you’re no stranger to taking risks. But you know that taking unnecessary risks isn’t good. So it’s important to know what insurance coverage you need as you grow your business.

With a growing business, the risks you take on can grow as well. So your insurance coverage should rise to the challenge. Take the next steps today and get a business insurance quote to help make sure that it does.

Businesses We Insure

- Architect Insurance

- Attorney Insurance

- Digital Marketing Insurance

- Dj Insurance

- Draftsman Insurance

- E-commerce Insurance

- Education Consultant Insurance

- Engineering Insurance

- Financial Planner Insurance

- Home Inspector Insurance

- Insurance For Insurance Agents

- Interior Design Insurance

- Insurance It Consulting

Other Businesses We Insure

- Land Surveyor Insurance

- Lawyer Insurance

- Life Coach Insurance

- Management Consultant Insurance

- Mortgage Broker Insurance

- Photographers Insurance

- Insurance For Private Tutors

- Project Manager Insurance

- Real Estate Agent Insurance

- Social Work Insurance

- Tax Preparer Insurance

- Travel Agent Insurance

- Videographer Insurance

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.