Alaska Business Insurance

Get Insured in Under 10 Minutes + Monthly Payments to Fit Your Budget.

Simply Business is pleased to provide tailored insurance options from:

What do 99% of Alaskan businesses have in common? They’re small businesses.

Entrepreneurs like you enrich your local economy, create jobs, and account for half of the employment in the state. Before you can get to any of that, though, there are a few details to get in order. These include choosing a name, setting up your business structure, getting licensed, and finding business insurance.

If getting Alaska business insurance feels like one of the more daunting steps to starting your business, you’re not alone. Searching through state government websites to find your requirements and make sense of different policies isn’t always easy.

We want to help Alaskan business owners succeed, so we’ve done a lot of the hard work for you. Read on to learn more about the types of Alaska business insurance, which plans you might need, and how to choose the right policy for you.

Alaska Business Insurance: The Basics

First things first — what is business insurance? If you have experience with other insurance, such as for your health, car, or home, then Alaska business insurance isn’t as foreign as you may think.

Like other types of insurance, Alaska business insurance could help you pay for claims in the event of an accident. In a moment, we’ll explore different scenarios where business insurance could help. By paying monthly or annual insurance premiums, you protect your business from potentially career-ending bills. Alaska business insurance coverage could also help you build trust with new clients.

General liability insurance in Alaska

One type of policy to consider is general liability insurance in Alaska. General liability insurance usually covers:

- Third-party property damage, such as to a client or vendor

- Bodily injury to others

- Medical expenses

- Advertising injury

- And more

So who needs this policy? There are no statewide rules for general liability insurance in Alaska, but some businesses have legal coverage requirements. This means that you may or may not need to get insured before taking your first order. Typically, the type of work you do determines whether or not you need insurance.

Here are a few occupations that are legally required to have general liability insurance in Alaska:

- Handymen contractors

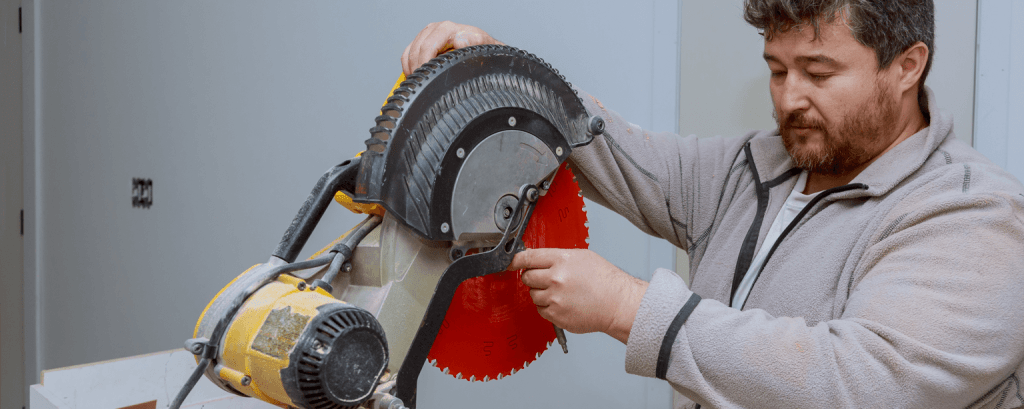

- Specialty contractors, including carpenters, electricians, landscapers, welders, and more

- Mechanical contractors

If you’re a contractor, be sure to check out our guide to getting a contractors license in Alaska.

While most of Alaska’s general liability insurance requirements apply to contractors and related fields, they aren’t the only businesses that can benefit from insurance. Simply Business serves over 80 types of businesses, including barbers, florists, web designers, roofers, and more.

Still not sure what business insurance could do for you? Let’s review a few scenarios where general liability insurance could help.

-

A handyman is cleaning out gutters and steps away to grab a tool. While he isn’t looking, the homeowner’s child trips over the worker’s ladder and breaks their arm. General liability insurance could help the business owner cover the medical bills that the family is suing for.

-

A hairstylist is making a home visit when they accidentally spill hair dye on the client’s couch. It was an honest mistake, but now the homeowner files a $2,000 claim for the ruined sofa. Rather than taking that money from business savings, the hairstylist may be able to use their business insurance policy to help cover costs.

-

A web designer hosts a client in their office when they trip over a cord and breaks their laptop. Not only do they want the web designer to pay for the broken computer, but they’re also demanding reparations for business setbacks for being without the laptop for a few days. General liability insurance in Alaska could cover those costs and keep the web designer moving forward.

Until now, we’ve talked only about what role business insurance can play on your worst days in business. But guess what? Your general liability policy is there for you on the good days, too.

Having a Certificate of Insurance (COI) to prove your coverage can help you grow your business. Show it to potential customers to build trust, set yourself apart from competitors, or stand out on your application for a business loan.

Professional liability insurance in Alaska

General liability insurance comes in handy when accidents occur, resulting in bodily injury or property damage. What about intellectual accidents, though? Professional liability insurance in Alaska can protect your business if someone claims you were negligent or made a mistake while doing work for them.

Generally, professional liability insurance covers:

- Legal defense costs

- Libel and/or slander claims

- Negligence or alleged negligence

- Copyright infringement

- And more

Negligence looks different in each business, and unfortunately, you don’t have to actually do something wrong for an upset client to sue you for messing up. A realtor might get into hot water if they fail to submit an offer on time, and a consultant might face a negligence claim if their advice leads to financial loss.

Your Alaska professional liability insurance requirements depend on your occupation.

Some businesses may need the policy to do business, but the decision is usually up to the owner. Keep in mind that having coverage could help you stand out among competitors in a sea of companies without professional liability insurance.

Other occupations, like acupuncturists, must make it clear to clients if they don’t have coverage. Acupuncturists don’t have to get professional liability insurance in Alaska, but if they forgo it, then clients need to sign off acknowledging that they understand.

Alaska workers compensation insurance

Do you have employees? If you do, you likely need Alaska workers compensation insurance. Having just one part-time employee qualifies you as an employer, no matter your occupation. We’ll review a few exceptions in a later section.

What’s the point of this policy? Workers compensation insurance can help your business cover the costs of lost wages, medical bills, death benefits, and rehabilitation expenses for injured or sick employees. The average cost of a workers comp claim is $41,000, which could hurt your business finances if you aren’t prepared for it.

Other types of Alaska business insurance

The three main types of Alaska business insurance cover a wide range of scenarios. Each business is unique, so you might want to consider additional coverage, including:

-

Commercial auto insurance. All motor vehicles need at least $50,000 in bodily injury coverage and $25,000 for property damage. If you use a vehicle for business, such as a work truck or catering van, check your current auto policy to make sure it covers business activities.

-

Home-based business insurance. Sometimes, a home office can fall between the cracks of business and homeowners insurance coverage. A home-based business insurance policy could cover your space and equipment if they’re damaged or stolen.

-

Surety bond. Some businesses, such as collection agents, need a surety bond. These are agreements between your business, customer, and bond issuer that the insurer will cover damages or unfinished work.

Alaska Workers Compensation: What You Need to Know

As we explored earlier, most businesses with employees need Alaska workers compensation. If you’re a sole proprietor, then you can skip this section for now. Just keep in mind that when it’s time to grow your team that you’ll have some extra insurance requirements to look into.

If you do have employees, you probably need to look for a workers compensation insurance policy. There are only a handful of exceptions as to who qualifies as an insurable employee, including:

- Part-time babysitters

- Part-time agricultural help

- Real estate agents who earn commissions only

- Some taxi drivers

- Sports officials for amateur events

If you want to learn more about the Alaska workers comp claim process, check out this flowchart.

How Much Does Alaska Business Insurance Cost?

Cost is an important factor in nearly all small business decisions, and we understand that business insurance is no different. We can’t give a one-size-fits-all price for every business owner, but that’s actually a good thing.

For instance, a one-person electrical contracting company in Anchorage has different needs than a Fairbanks barbershop about to add its fifth stylist. So why would they have the same Alaska business insurance?

Each insurance quote is customized to your needs today, and then can grow alongside you.

The costs of your insurance typically depend on:

- Your location

- The type of work you do

- Which policies you choose

- The size of your business

Tired of all this ambiguity? Call our licensed insurance agents at 855-559-0286 or fill out a fast online survey to get a customized Alaska business insurance quote in minutes. It’s free and easy to compare quotes between top insurers, so you have nothing to lose.

How Do I Get Alaska Business Insurance?

Learning about Alaska business insurance can feel like a maze of new terms and rules, so let’s recap. Here are the three key policy types to be aware of:

-

General liability insurance in Alaska typically covers medical bills and property damage if your business causes an accident. Some occupations are required by law to have it, while other business owners get to choose for themselves.

-

Professional liability in Alaska could help you pay for legal bills if you need to defend yourself against a negligence claim. Businesses that give advice or offer professional services usually consider this type of policy.

-

Alaska workers compensation insurance is necessary for businesses with one or more employees. There are a few exceptions, but most businesses with employees need this coverage.

Now that you know the basics, here are some extra resources and advice for finding and choosing an insurance policy:

-

Talk to business owners in your area about what insurance policies they have and like, especially if they’re in the same industry as you.

-

Reach out to the licensed insurance agents at Simply Business by calling 855-559-0286 if you have any additional questions.

-

Find advice on common business topics like financing and permits on the Small Business Assistance Center website.

-

Compare multiple insurance quotes across price and coverage to find one you’re comfortable with. You can use our tool!

-

Get free business counseling through the Alaska Small Business Development Center to get your business questions answered by local advisors.

-

Search for your occupation on the list of licensed professions. Typically, you can find insurance requirements on license applications.

-

Check for Alaska business insurance requirements across all the services you provide. This article is a great starting point but shouldn’t be the only resource you use!

A small decision can make a big impact

Running a business is an investment — whether it’s your money, time, or attention. While you might not be legally required to have Alaska business insurance, the decision to get covered could go a long way in protecting your investment.

Having coverage makes you look more reputable and trustworthy, which might be what you need to get your foot in the door with new clients. Then, if an accident does happen, your insurance policy could protect you from draining your business or personal finances to pay for damages or lawsuits.

There’s a lot of good that can come out of getting insurance coverage, and it all starts with comparing quotes. It takes only a few minutes to get information tailored to you via our online quote tool, or have a chat with one of our insurance agents at 855-559-0286.

Businesses We Insure

- Architect Insurance

- Attorney Insurance

- Digital Marketing Insurance

- Dj Insurance

- Draftsman Insurance

- E-commerce Insurance

- Education Consultant Insurance

- Engineering Insurance

- Financial Planner Insurance

- Home Inspector Insurance

- Insurance For Insurance Agents

- Interior Design Insurance

- Insurance It Consulting

Other Businesses We Insure

- Land Surveyor Insurance

- Lawyer Insurance

- Life Coach Insurance

- Management Consultant Insurance

- Mortgage Broker Insurance

- Photographers Insurance

- Insurance For Private Tutors

- Project Manager Insurance

- Real Estate Agent Insurance

- Social Work Insurance

- Tax Preparer Insurance

- Travel Agent Insurance

- Videographer Insurance

This content is intended to be used for informational purposes only. It is not intended to provide legal, tax, accounting, investment, or any other form of professional advice.